Good Seed Ventures

-

DATABASE (500)

-

ARTICLES (489)

Founder and CEO of SCOOP, Founder of EV Hive

East Ventures co-founder Willson Cuaca graduated from Bina Nusantara University with a bachelor’s degree in Computer Science. He worked at Singapore-based Red Sentry, a cyber security and network performance optimization company. In 2010 he co-founded East Ventures, a seed-early stage venture capital firm. That same year, he also co-founded Apps Foundry, a mobile company that developed the e-reader app SCOOP, among other things.

East Ventures co-founder Willson Cuaca graduated from Bina Nusantara University with a bachelor’s degree in Computer Science. He worked at Singapore-based Red Sentry, a cyber security and network performance optimization company. In 2010 he co-founded East Ventures, a seed-early stage venture capital firm. That same year, he also co-founded Apps Foundry, a mobile company that developed the e-reader app SCOOP, among other things.

Formerly the Suzhou Venture Group (which was reconstructed from the former venture capital entity China-Singapore Suzhou Industrial Park Ventures), state investment firm Oriza Holdings manages about RMB 29.7 billion. As of 1Q2016, its investments comprised 253 seed/early-stage companies, 81 growth-stage entities and 48 mature ones.

Formerly the Suzhou Venture Group (which was reconstructed from the former venture capital entity China-Singapore Suzhou Industrial Park Ventures), state investment firm Oriza Holdings manages about RMB 29.7 billion. As of 1Q2016, its investments comprised 253 seed/early-stage companies, 81 growth-stage entities and 48 mature ones.

Founder and CEO of Wendy's Choice

Former editor-in-chief at Trends Media Group (publisher of Harper’s Bazaar, Cosmopolitan, Trends Home in China), where she was the publisher and editor-in-chief of “Good Housekeeper” and “Good Housekeeping” for eight years. Wen Jie graduated from the Beijing Institute of Fashion Technology and Kent State University (media studies), USA.

Former editor-in-chief at Trends Media Group (publisher of Harper’s Bazaar, Cosmopolitan, Trends Home in China), where she was the publisher and editor-in-chief of “Good Housekeeper” and “Good Housekeeping” for eight years. Wen Jie graduated from the Beijing Institute of Fashion Technology and Kent State University (media studies), USA.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Co-Founder and COO of Zuoyehezi (Homework Box)

Baidu’s former manager, in strategic cooperation; following years of working in secondary education. Good friend of Liu’s for many years.

Baidu’s former manager, in strategic cooperation; following years of working in secondary education. Good friend of Liu’s for many years.

Rising Ventures is a Portuguese seed/early-stage VC firm founded in 2014. Its current portfolio consists of startups that provide B2B tech solutions.

Rising Ventures is a Portuguese seed/early-stage VC firm founded in 2014. Its current portfolio consists of startups that provide B2B tech solutions.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Design to Improve Life Fund (The INDEX Project)

The Index Project, known by its motto “Design to Improve Life”, is a Copenhagen-based non-profit organization under the patronage of the Crown Prince and Princess of Denmark and supported by the Danish Ministry of Business and Growth.Founded in 2002, The Index Project organizes the biennial Index Award, one of the world's biggest design award. A diverse range of designs are selected through each Index Award cycle. It also backs projects with good causes through investment vehicle, Design to Improve Life Fund that has stakes in 11 solutions, ranging from seed to Series B+.

The Index Project, known by its motto “Design to Improve Life”, is a Copenhagen-based non-profit organization under the patronage of the Crown Prince and Princess of Denmark and supported by the Danish Ministry of Business and Growth.Founded in 2002, The Index Project organizes the biennial Index Award, one of the world's biggest design award. A diverse range of designs are selected through each Index Award cycle. It also backs projects with good causes through investment vehicle, Design to Improve Life Fund that has stakes in 11 solutions, ranging from seed to Series B+.

CRCM Ventures is a unit of US- and HK-listed ChinaRock Capital Management. Headquartered in San Francisco with branch offices in Palo Alto, Beijing and Hong Kong, CRCM Ventures invests in seed and early-stage Silicon Valley and China technology startups, with more than 20 years of experience in public and private investing.

CRCM Ventures is a unit of US- and HK-listed ChinaRock Capital Management. Headquartered in San Francisco with branch offices in Palo Alto, Beijing and Hong Kong, CRCM Ventures invests in seed and early-stage Silicon Valley and China technology startups, with more than 20 years of experience in public and private investing.

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

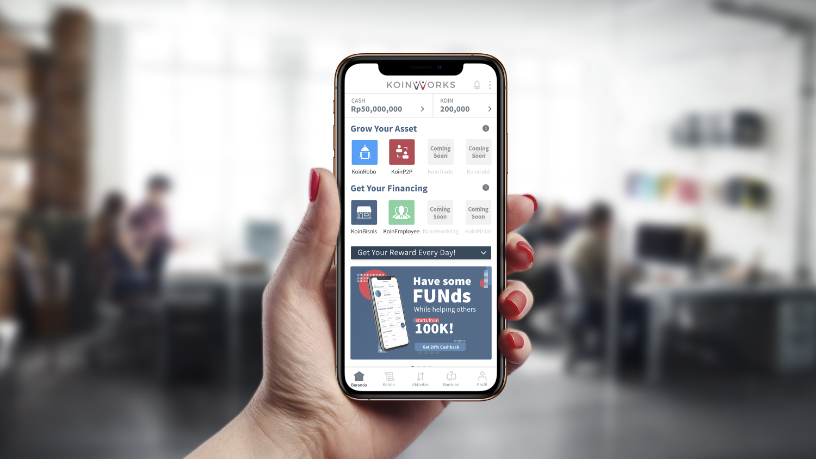

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

RecyGlo, Myanmar's first circular economy waste management system, targets regional growth

Turning trash into cash, Yangon-based recycling pioneer RecyGlo wants to extend its zero-waste circular economy model to the rest of Southeast Asia

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Doinn: Impeccable housekeeping for lucrative holiday rentals

With its tech tools, better working conditions and 5-star ratings, the Portuguese startup now wants to expand to Southeast Asia and get Series A funding

The charm of Jike: From search engine to popular social network

App's success shows enthusiasm for a personalized, community-based content and search platform, emulated even by Tencent

The death of Wazypark: A tale of too much money, and no business model

It was an investors’ and media darling. But the story of Wazypark got bitter in 2017, when management disputes and ballooning losses culminated in the startup’s final days

Nodeflux: Automating computer vision analysis for the smart cities of tomorrow

Indonesia's first facial recognition tech company aims to become a central player in Jakarta's smart city push

Sorry, we couldn’t find any matches for“Good Seed Ventures”.