Good Startup

-

DATABASE (574)

-

ARTICLES (725)

Co-founder, Partner of FarmCloud

Miguel Carvalho is a Portuguese entrepreneur and co-founder of FarmCloud, where he is partner and advisor. Since 2010, he has also been a partner at hosting platform startup CloudNode and at web development firm Multiweb since 1999.

Miguel Carvalho is a Portuguese entrepreneur and co-founder of FarmCloud, where he is partner and advisor. Since 2010, he has also been a partner at hosting platform startup CloudNode and at web development firm Multiweb since 1999.

Co-founder of Wallapop

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Co-founder and COO of Line Health

Former journalist Sofia Simões de Almeida graduated from New University of Lisbon with degrees in Law and Communication Sciences. In 2010, she became a founding member and editor at Lead Magazine. After working at Human Resources Portugal in Lisbon, she founded HR startup "Make it Happy" in 2012 that was incubated at Startup Lisboa.In 2014, she co-founded Line Health and worked at the healthtech as COO until the company was closed down in 2018. Currently based in Berlin, she is now the head of Feed Rocket, an online marketing tool launched by Visual Meta Business Labs.

Former journalist Sofia Simões de Almeida graduated from New University of Lisbon with degrees in Law and Communication Sciences. In 2010, she became a founding member and editor at Lead Magazine. After working at Human Resources Portugal in Lisbon, she founded HR startup "Make it Happy" in 2012 that was incubated at Startup Lisboa.In 2014, she co-founded Line Health and worked at the healthtech as COO until the company was closed down in 2018. Currently based in Berlin, she is now the head of Feed Rocket, an online marketing tool launched by Visual Meta Business Labs.

CMO and co-founder of Biel Glasses

Since 2017, Constanza Lucero has been the co-founder and Chief Medical Officer at Biel Glasses, a medtech startup offering relief to people with low vision. She is the mother of Biel, who was born with low vision and the impetus for the startup. She also works at Badalona Hospital as a Specialist in Internal Medicine in its Accidents and Emergencies Department. Prior to this, she worked for nine years at Barcelona's Hospital Clinic as a Specialist in Infectious Diseases, HIV and Internal Medicine. Lucero holds a Doctorate of Medicine from the University of Barcelona as well as a master's in Clinical Research from the same institution.

Since 2017, Constanza Lucero has been the co-founder and Chief Medical Officer at Biel Glasses, a medtech startup offering relief to people with low vision. She is the mother of Biel, who was born with low vision and the impetus for the startup. She also works at Badalona Hospital as a Specialist in Internal Medicine in its Accidents and Emergencies Department. Prior to this, she worked for nine years at Barcelona's Hospital Clinic as a Specialist in Infectious Diseases, HIV and Internal Medicine. Lucero holds a Doctorate of Medicine from the University of Barcelona as well as a master's in Clinical Research from the same institution.

Co-founder and Vice-President of Operations of Tiaoguoshi

Xiao Hongtao is one of China’s first public relations managers, with 10+ years of experience. She was a brand director at Baihe.com, a matchmaking website. Tiaoguoshi is her third startup. Born in the 1970s, Xiao is married to fellow Tiaoguoshi co-founder Yu Jinhua.

Xiao Hongtao is one of China’s first public relations managers, with 10+ years of experience. She was a brand director at Baihe.com, a matchmaking website. Tiaoguoshi is her third startup. Born in the 1970s, Xiao is married to fellow Tiaoguoshi co-founder Yu Jinhua.

Co-founder and CEO of PopBox Asia

Adrian Lim is PopBox Asia’s co-founder and CEO, establishing the smart locker startup in 2015. Between 2001 and 2003, Lim worked as an engineer at Lucent Technologies (which merged with Alcatel). He was later a director at the TAK Group, a multinational property conglomerate. He is also an advisor to Block71, the startup incubator run by the National University of Singapore.Lim holds a bachelor’s in Mechanical Engineering from the Imperial College of London, as well as a master’s in the same field from the University of Michigan, USA.

Adrian Lim is PopBox Asia’s co-founder and CEO, establishing the smart locker startup in 2015. Between 2001 and 2003, Lim worked as an engineer at Lucent Technologies (which merged with Alcatel). He was later a director at the TAK Group, a multinational property conglomerate. He is also an advisor to Block71, the startup incubator run by the National University of Singapore.Lim holds a bachelor’s in Mechanical Engineering from the Imperial College of London, as well as a master’s in the same field from the University of Michigan, USA.

Founder and CEO of Get.AI

Liu Yongxiang (Jeff) is a serial entrepreneur who had started several ventures prior to Get.AI. He was the founder and CEO of Hero Start, which aims to connect college graduates and students with established companies for internships or mentorships. Liu later initiated Startup Salad Eastern China, an international startup community that organizes hackathons to let people explore, trial and develop their ideas through their own startups within 52 hours or over one weekend. Participants are free to form their own teams. In 2018, he founded Get.AI and has served as CEO since.

Liu Yongxiang (Jeff) is a serial entrepreneur who had started several ventures prior to Get.AI. He was the founder and CEO of Hero Start, which aims to connect college graduates and students with established companies for internships or mentorships. Liu later initiated Startup Salad Eastern China, an international startup community that organizes hackathons to let people explore, trial and develop their ideas through their own startups within 52 hours or over one weekend. Participants are free to form their own teams. In 2018, he founded Get.AI and has served as CEO since.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

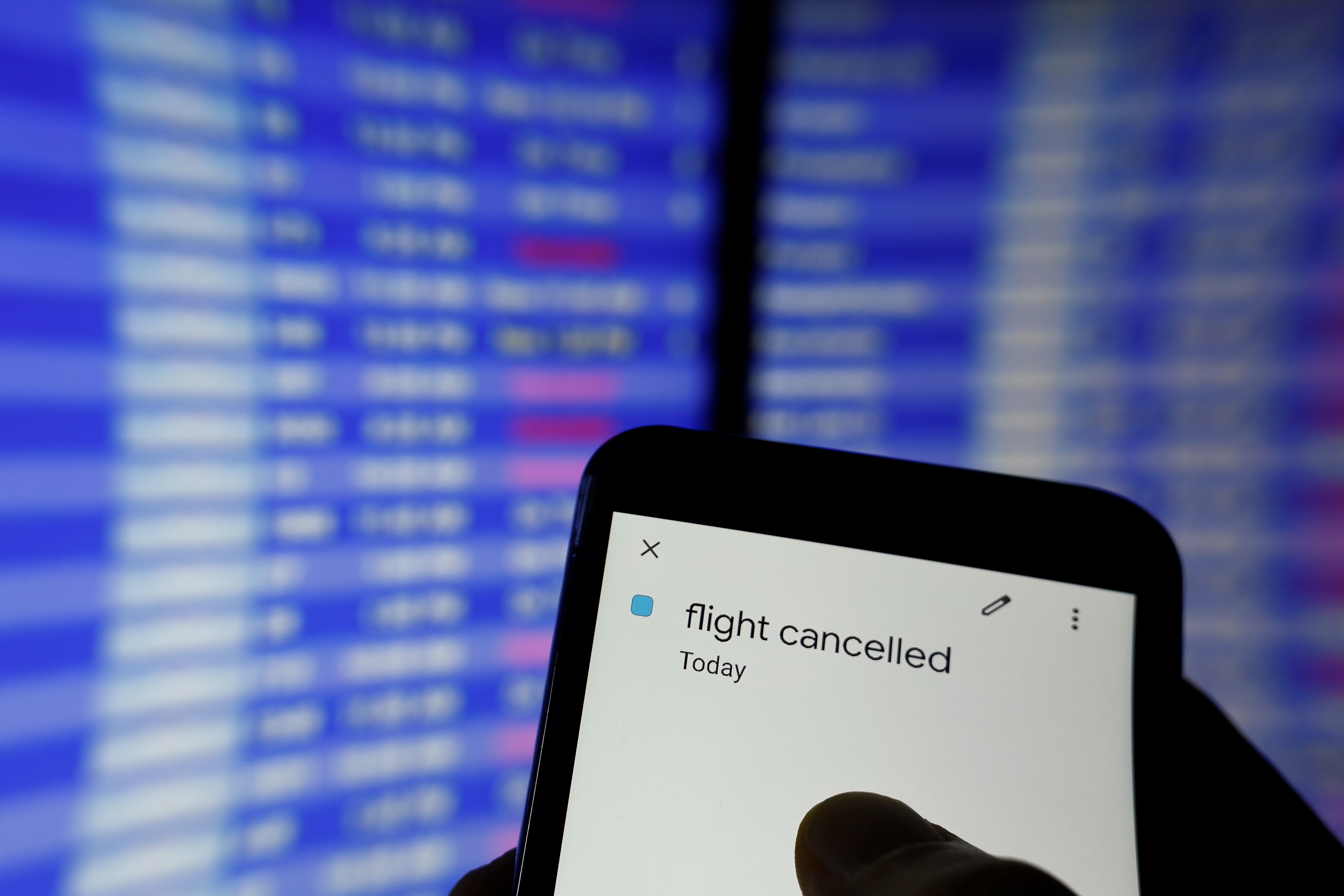

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

This startup aims to be the DocuSign of China

Having captured a third of a largely untapped domestic e-contracting market, Shangshangqian looks to gain a greater foothold at home and abroad

Chinese startup offers fully-automated, environmentally-friendly car washes

Yigongli's car wash machines can wash a car in three mins for as low as RMB 10, while using two-thirds less water

Will this one-year-old startup revolutionize traditional industries?

Targeting retail and tourism first, Aibee aims to help traditional businesses keep up with their online counterparts using its all-in-one AI solutions

Roadstar.ai: A promising autonomous driving startup wrecked by infighting

No side benefits from the disputes, whether it is the founding team, investors or the employees

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Sorry, we couldn’t find any matches for“Good Startup”.