Good Startup

-

DATABASE (574)

-

ARTICLES (725)

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Bånt AB is the investment vehicle of Karl Sverker Forsén based in Luleå, a coastal city in Swedish Lapland. In May 2020, the Swedish family office invested in a Gothenburg startup Mycorena, a biotech that produces mycoproteins through fermentation. The fungi-based protein can be used as an alt-protein ingredient instead of traditional plant-based food components.

Bånt AB is the investment vehicle of Karl Sverker Forsén based in Luleå, a coastal city in Swedish Lapland. In May 2020, the Swedish family office invested in a Gothenburg startup Mycorena, a biotech that produces mycoproteins through fermentation. The fungi-based protein can be used as an alt-protein ingredient instead of traditional plant-based food components.

CTO and co-founder of Diamond Foundry

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Co-founder, CTO of Virtuleap

Hossein Jalali is the Iranian CTO and co-founder of Virtuleap, a Portugal-based cognition training and assessment VR startup, where he has worked since 2018. He was also simultaneously co-founder at Lisbon-based fitness search and discovery startup Flexpass, which was acquired by Urban Sports in 2018.He was previously co-founder at Dubai-based gaming startup Gameguise, the publishing arm of Edoramedia. Before this, Jalali spent six years as Head of Online at Dubai-based satellite TV company Al Aan. He holds an MBA in Business and Finance from the American University of Sharjah in the United Arab Emirates and a bachelor’s in Computer Engineering from Azad University in Tehran, Iran.

Hossein Jalali is the Iranian CTO and co-founder of Virtuleap, a Portugal-based cognition training and assessment VR startup, where he has worked since 2018. He was also simultaneously co-founder at Lisbon-based fitness search and discovery startup Flexpass, which was acquired by Urban Sports in 2018.He was previously co-founder at Dubai-based gaming startup Gameguise, the publishing arm of Edoramedia. Before this, Jalali spent six years as Head of Online at Dubai-based satellite TV company Al Aan. He holds an MBA in Business and Finance from the American University of Sharjah in the United Arab Emirates and a bachelor’s in Computer Engineering from Azad University in Tehran, Iran.

CEO and founder of Kuaikan (formerly Kuaikan Comic)

Chen gained several million fans on Weibo (Chinese Twitter) from the comics she wrote about her and her boyfriend. She sold hundreds of thousands of comic books while she was still in college. After graduation, Chen founded Kuaikan Comic in 2014. The artist-turned-entrepreneur turned the startup into one of the top mobile comic platforms in China within three years. The startup changed its name to Kuaikan in August 2021

Chen gained several million fans on Weibo (Chinese Twitter) from the comics she wrote about her and her boyfriend. She sold hundreds of thousands of comic books while she was still in college. After graduation, Chen founded Kuaikan Comic in 2014. The artist-turned-entrepreneur turned the startup into one of the top mobile comic platforms in China within three years. The startup changed its name to Kuaikan in August 2021

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

Founded in 1972 by Sudono Salim, aka Liem Sioe Liong, the Salim Group is now headed by his son Anthoni Salim. The Salim Group is one of Indonesia's biggest diversified conglomerates, with business interests in real estate, banking, automotive, telecommunications and F&B. Flagship brands include Bank BCA, Bogasari (wheat flour manufacturer) and Indofood, one of the world's largest producer of instant noodles. The Salim Group is a partner of NUS Enterprise, the startup incubator wing of the National University of Singapore.

Founded in 1972 by Sudono Salim, aka Liem Sioe Liong, the Salim Group is now headed by his son Anthoni Salim. The Salim Group is one of Indonesia's biggest diversified conglomerates, with business interests in real estate, banking, automotive, telecommunications and F&B. Flagship brands include Bank BCA, Bogasari (wheat flour manufacturer) and Indofood, one of the world's largest producer of instant noodles. The Salim Group is a partner of NUS Enterprise, the startup incubator wing of the National University of Singapore.

CAS Star was established in September 2013 in Xi’an by several VC firms and the Xi’an Institute of Optics and Precision Mechanics of Chinese Academy of Sciences. The high-tech startup incubator has also set up a RMB 5.2bn Xike Angel fund to specialize in the commercialization of the high-tech research projects. To date, Xike Angel has a portfolio of more than 230 startups with a total value of RMB 20bn.

CAS Star was established in September 2013 in Xi’an by several VC firms and the Xi’an Institute of Optics and Precision Mechanics of Chinese Academy of Sciences. The high-tech startup incubator has also set up a RMB 5.2bn Xike Angel fund to specialize in the commercialization of the high-tech research projects. To date, Xike Angel has a portfolio of more than 230 startups with a total value of RMB 20bn.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

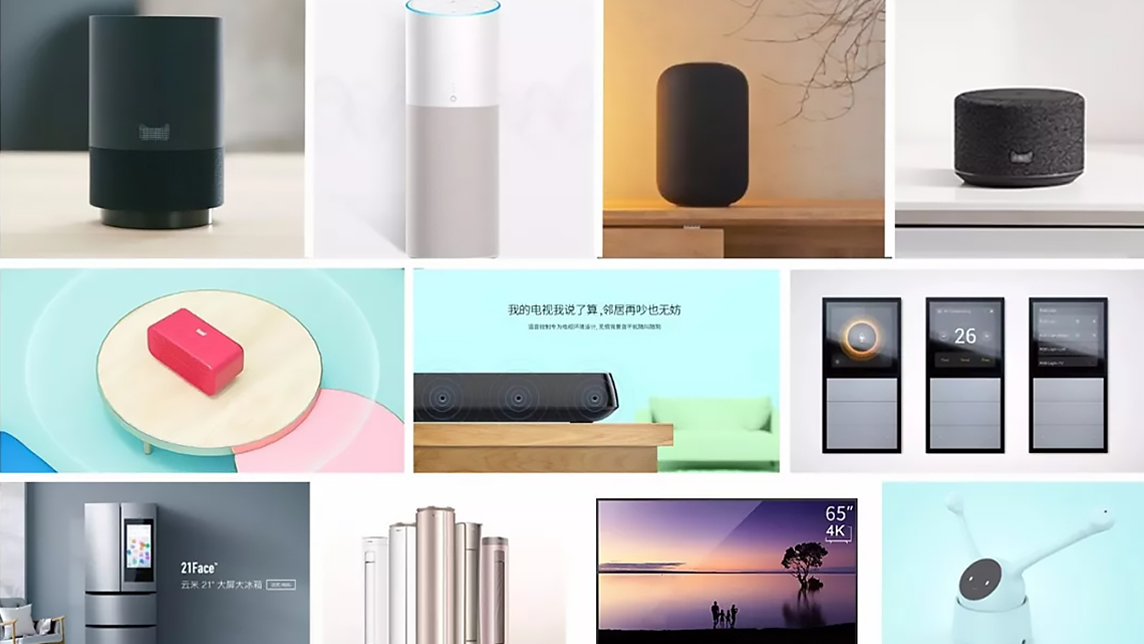

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

This startup aims to be the DocuSign of China

Having captured a third of a largely untapped domestic e-contracting market, Shangshangqian looks to gain a greater foothold at home and abroad

Chinese startup offers fully-automated, environmentally-friendly car washes

Yigongli's car wash machines can wash a car in three mins for as low as RMB 10, while using two-thirds less water

Will this one-year-old startup revolutionize traditional industries?

Targeting retail and tourism first, Aibee aims to help traditional businesses keep up with their online counterparts using its all-in-one AI solutions

Roadstar.ai: A promising autonomous driving startup wrecked by infighting

No side benefits from the disputes, whether it is the founding team, investors or the employees

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Sorry, we couldn’t find any matches for“Good Startup”.