Google Cloud

-

DATABASE (178)

-

ARTICLES (198)

GGV Capital manages $3.8 billion across eight funds, making multi-stage investments in companies from mobile internet, hardware, cloud technology and SaaS sectors. Among them, 27 GGV-invested companies have completed IPOs in the last 10 years. Its portfolio features a wide range of companies, such as Alibaba, AirBnb, Qunar, YY, Didi, Soundcloud, slack, Youku Tudou and more. Founded in 2000, the firm deploys a single team operating in both China and the US.

GGV Capital manages $3.8 billion across eight funds, making multi-stage investments in companies from mobile internet, hardware, cloud technology and SaaS sectors. Among them, 27 GGV-invested companies have completed IPOs in the last 10 years. Its portfolio features a wide range of companies, such as Alibaba, AirBnb, Qunar, YY, Didi, Soundcloud, slack, Youku Tudou and more. Founded in 2000, the firm deploys a single team operating in both China and the US.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Co-founder and CEO of Line Health

Coding since he was 15, Diogo Ortega worked as a freelance software developer while reading a business degree at the University of London. He had previously studied Audiovisual and Multimedia Technologies at the Polytechnic Institute of Lisbon.Ortega worked for six years at TAP Air Portugal until 2014 when he co-founded Line Health as CEO. He was the CEO. The healthtech was dissolved in 2018 and he eventually moved to the US to work for WW (formerly Weight Watchers) as a product manager. Currently based in San Francisco, he is working as a product manager at Google.

Coding since he was 15, Diogo Ortega worked as a freelance software developer while reading a business degree at the University of London. He had previously studied Audiovisual and Multimedia Technologies at the Polytechnic Institute of Lisbon.Ortega worked for six years at TAP Air Portugal until 2014 when he co-founded Line Health as CEO. He was the CEO. The healthtech was dissolved in 2018 and he eventually moved to the US to work for WW (formerly Weight Watchers) as a product manager. Currently based in San Francisco, he is working as a product manager at Google.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

CTO and Co-founder of Squirrel AI

CTO and co-founder of Squirrel AI, Fan Xing obtained his bachelor’s and master’s degrees in computer science from Northwestern Polytechnical University in Xi’an, China, between 1999 and 2006. After graduating, he worked at several Internet companies as a software engineer and architect. He was CTO and R&D Director of IMO Cloud Office from 2012–2015, a senior researcher and platform technology manager at ShanDa Interactive Entertainment from 2010–2012, a server manager at 51.com from 2008–2010 and a senior engineer at Tencent from 2006–2008. He joined Squirrel AI in 2015.

CTO and co-founder of Squirrel AI, Fan Xing obtained his bachelor’s and master’s degrees in computer science from Northwestern Polytechnical University in Xi’an, China, between 1999 and 2006. After graduating, he worked at several Internet companies as a software engineer and architect. He was CTO and R&D Director of IMO Cloud Office from 2012–2015, a senior researcher and platform technology manager at ShanDa Interactive Entertainment from 2010–2012, a server manager at 51.com from 2008–2010 and a senior engineer at Tencent from 2006–2008. He joined Squirrel AI in 2015.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Founded in 1999 by Jack Ma, Alibaba was initially an online B2B platform for small businesses in China. Today it is one of the world’s largest internet companies. Alibaba provides internet infrastructure and marketing platforms for businesses and brands globally to connect with their consumers. Its core businesses include e-commerce, cloud computing, and digital media and entertainment, as it increasingly identifies itself as a data company, rather than as an e-retailer. It is also engaged in building ecosystems of logistics and local services through its invested companies.

Founded in 1999 by Jack Ma, Alibaba was initially an online B2B platform for small businesses in China. Today it is one of the world’s largest internet companies. Alibaba provides internet infrastructure and marketing platforms for businesses and brands globally to connect with their consumers. Its core businesses include e-commerce, cloud computing, and digital media and entertainment, as it increasingly identifies itself as a data company, rather than as an e-retailer. It is also engaged in building ecosystems of logistics and local services through its invested companies.

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Coding edtech platform Dicoding fulfills market demand for tech professionals

Dicoding wants to remedy the shortfall in Indonesian tech professionals and prepare them for the global industry

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

Edpuzzle waives fees for video learning platform during coronavirus pandemic

Spanish edtech startup Edpuzzle lets teachers create engaging remote-learning tools from easily accessible online videos

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

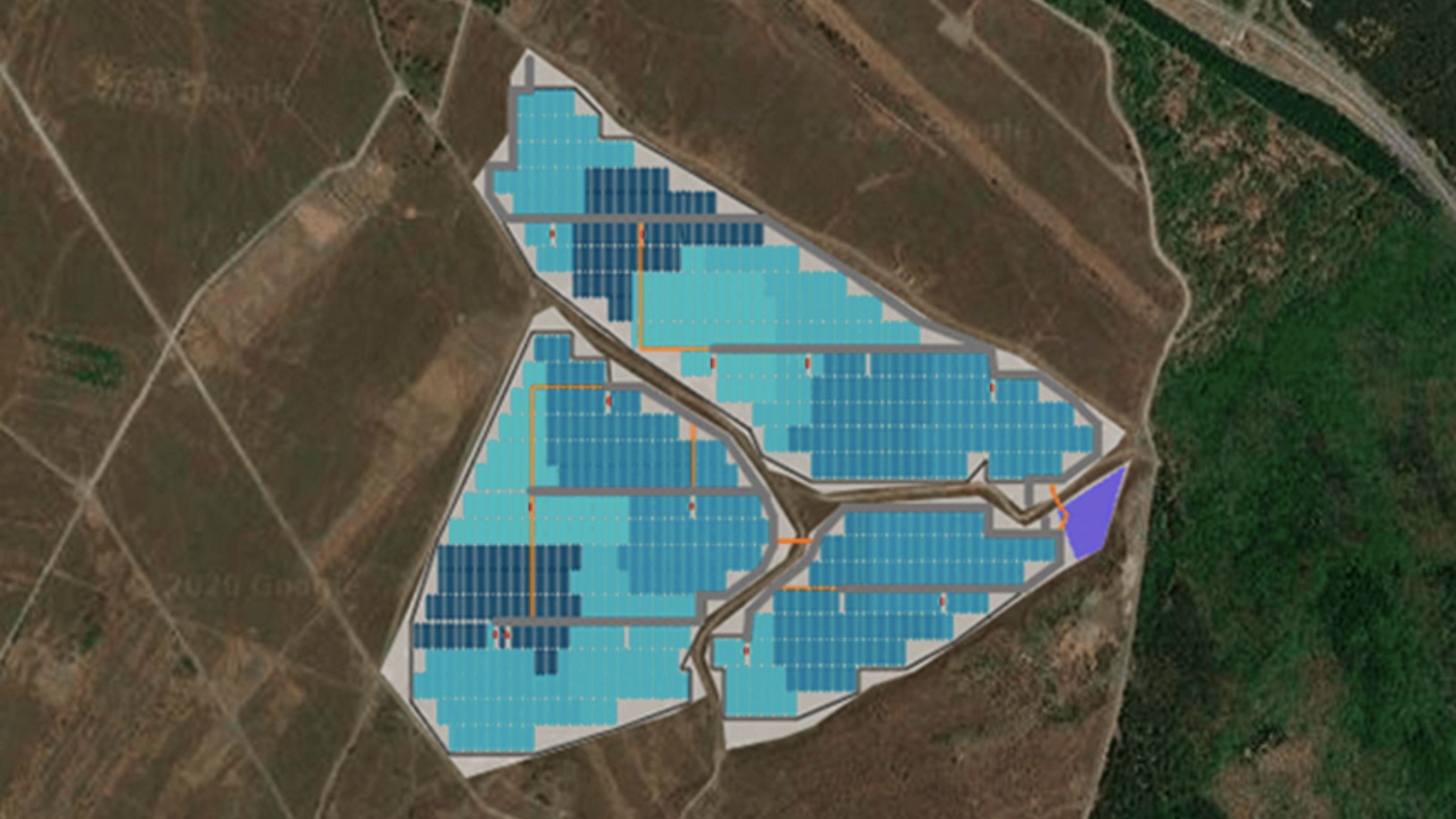

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

How Sea Water Analytics is using IoT to help keep beaches safe in Covid-19 era

Sea Water Analytics checks water quality, overcrowding, even jelly fish threats in Spanish beaches

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

NoMorePass: Free app for safe, easy password retrieval across platforms

NoMorePass is a password storage solution that employs military-grade encryption to guard against hackers and data leaks, rendering cloud-based password managers obsolete

Will Shanghai's new tech board be home to China’s next BAT?

As China’s new Nasdaq-style board speeds to welcome its first IPOs, here’s a look at what’s changed for Chinese tech firms listing in the mainland, and if it could be pivotal in the emerging tech cold war

Sorry, we couldn’t find any matches for“Google Cloud”.