Google Demo Day Asia

-

DATABASE (253)

-

ARTICLES (467)

Founded in 1998 by Larry Page and Sergey Brin, Google started out as a web search engine. It then grew into a provider of various web services (e.g., email, web publishing) and subsequently became one of the world’s biggest tech companies, standing alongside Apple, Microsoft and Amazon. As an investor, Google is notably one of the earliest investors in Chinese internet giants Baidu and Meituan-Dianping.

Founded in 1998 by Larry Page and Sergey Brin, Google started out as a web search engine. It then grew into a provider of various web services (e.g., email, web publishing) and subsequently became one of the world’s biggest tech companies, standing alongside Apple, Microsoft and Amazon. As an investor, Google is notably one of the earliest investors in Chinese internet giants Baidu and Meituan-Dianping.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Pick up ecommerce deliveries at your convenience with PopBox Asia’s smart lockers in Indonesia and Malaysia.

Pick up ecommerce deliveries at your convenience with PopBox Asia’s smart lockers in Indonesia and Malaysia.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Founder and CEO of Babytree

With a degree in electrical engineering from Tsinghua University, a master’s in sociology from Columbia and an MBA from Georgetown University, Wang is the former chief marketing officer of Google Asia. He has also worked at McKinsey & Co., P&G, and Yahoo.

With a degree in electrical engineering from Tsinghua University, a master’s in sociology from Columbia and an MBA from Georgetown University, Wang is the former chief marketing officer of Google Asia. He has also worked at McKinsey & Co., P&G, and Yahoo.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

CEO and co-founder of TurtleTree Labs

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Co-founder of Jide Technology (Remix)

Ex-Googler David Ko (Gao Heng) holds a BS in Computer Engineering from Washington University. After graduation, he joined two startups in succession of which the latter was acquired by Google. He joined Google US and was appointed to the Shanghai Office in 2011 where he served as staff software engineer. In his eight years at Google, he worked on a number of projects, including WebCrawler, Google Finance, Google Suggest, cloud input method, AdWords.

Ex-Googler David Ko (Gao Heng) holds a BS in Computer Engineering from Washington University. After graduation, he joined two startups in succession of which the latter was acquired by Google. He joined Google US and was appointed to the Shanghai Office in 2011 where he served as staff software engineer. In his eight years at Google, he worked on a number of projects, including WebCrawler, Google Finance, Google Suggest, cloud input method, AdWords.

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Oscillum: The intelligent label to reduce food waste

The Spanish biotech startup has developed sensors embedded in biodegradable plastic labels to monitor “product freshness” beyond expiration dates, helping consumers to avoid food waste and save money

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

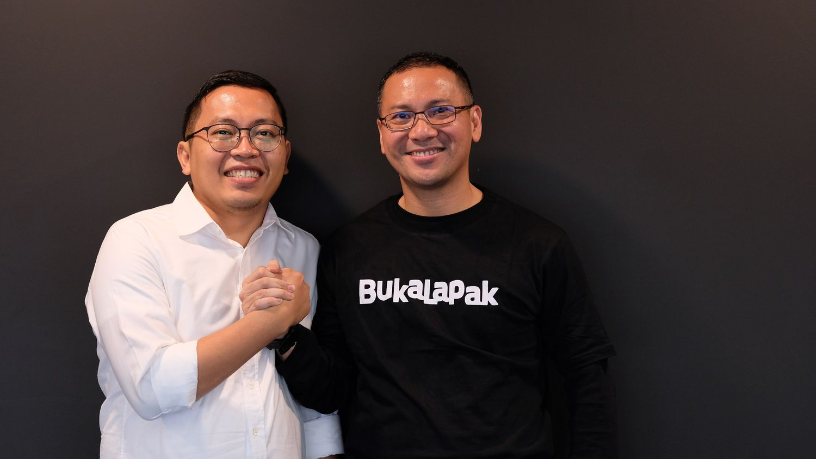

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Chat SDK startup Qiscus raising Series A, targets greater Southeast Asian presence

With clients like Bukalapak and Halodoc, the in-app chat specialist looks to expand its market beyond Indonesia

Neil Shen: The super unicorn hunter

His bet on ByteDance, the startup that gave the world TikTok, helped Neil Shen top this year's Forbes Midas List. But for Shen, even in that deal he once made the wrong call

Aurora Tech AI: Helping new parents sleep at night, and not on the job

When employees become new parents, the challenges they face can lead to sleep deprivation and a loss of productivity at work. Aurora Tech AI says it has a solution

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

Indonesia transport ministry to regulate ride-hailing app discounts

Despite criticism from riders and drivers, the ministry will cooperate with business competition supervisor to curb excessive discounts and prevent price wars

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

Kantox: Value for corporates, headache for banks

Moving beyond its initial remit of currency exchange, Europe's fourth-fastest growing fintech Kantox has garnered awards and financial sector hostility as it differentiates itself in a crowded marketplace

Allen Zhang: Father of WeChat and its string of innovations

Get to know the man behind the app in every Chinese user's smartphone

Sorry, we couldn’t find any matches for“Google Demo Day Asia”.