Google for Startups Residency

-

DATABASE (996)

-

ARTICLES (811)

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

BraveGeneration is a Portuguese investment vehicle founded in 2015 for projects arising from the television series Shark Tank Portugal. South African entrepreneur Tim Vieira acts as its principal investor and mentor. The holding currently funds around 30 startups, both in tech and in other sectors. Consumers Trust is the first company it has invested in not to have appeared on the television show.

BraveGeneration is a Portuguese investment vehicle founded in 2015 for projects arising from the television series Shark Tank Portugal. South African entrepreneur Tim Vieira acts as its principal investor and mentor. The holding currently funds around 30 startups, both in tech and in other sectors. Consumers Trust is the first company it has invested in not to have appeared on the television show.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

CEO and founder of Diamond Foundry

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

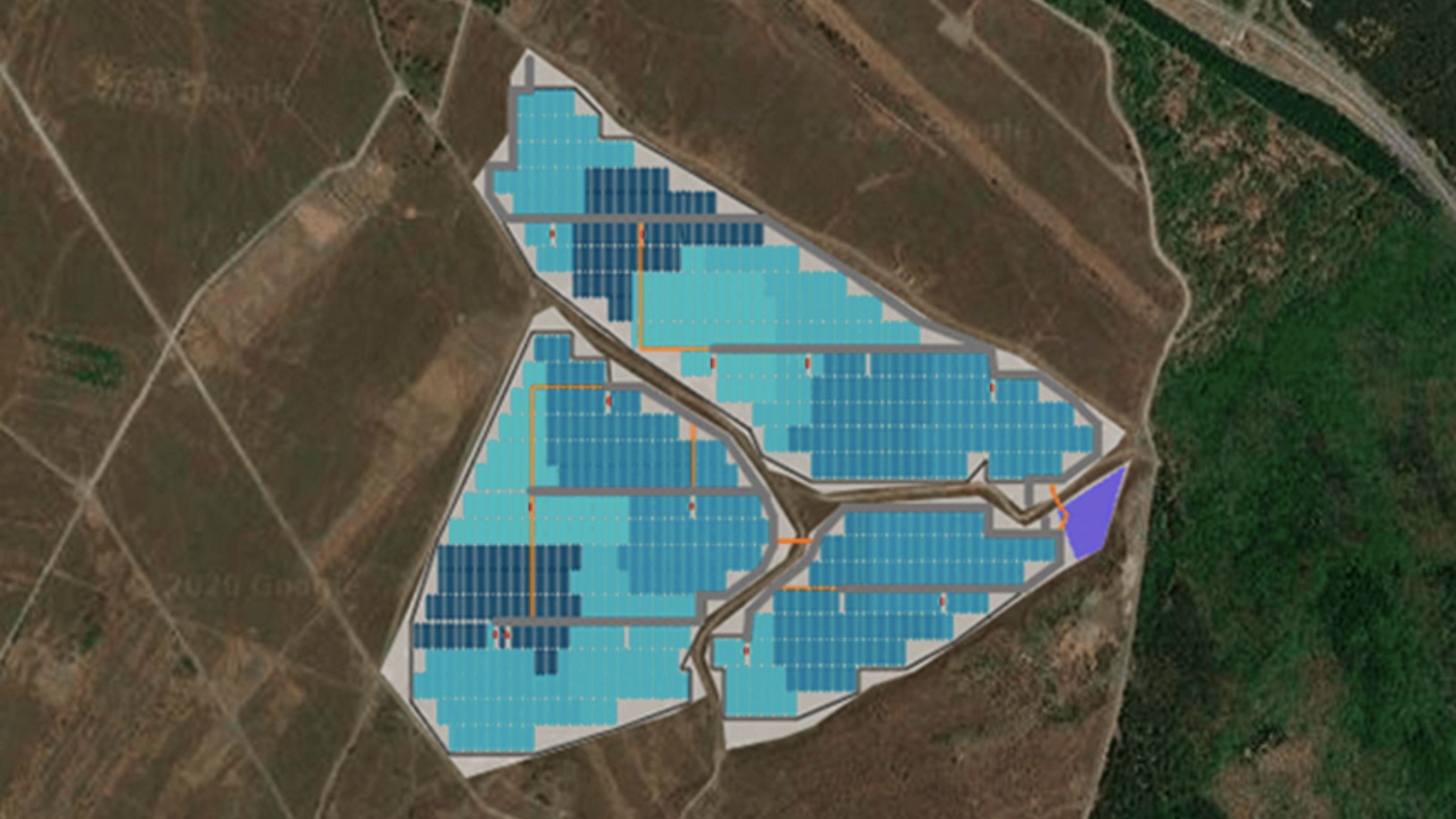

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

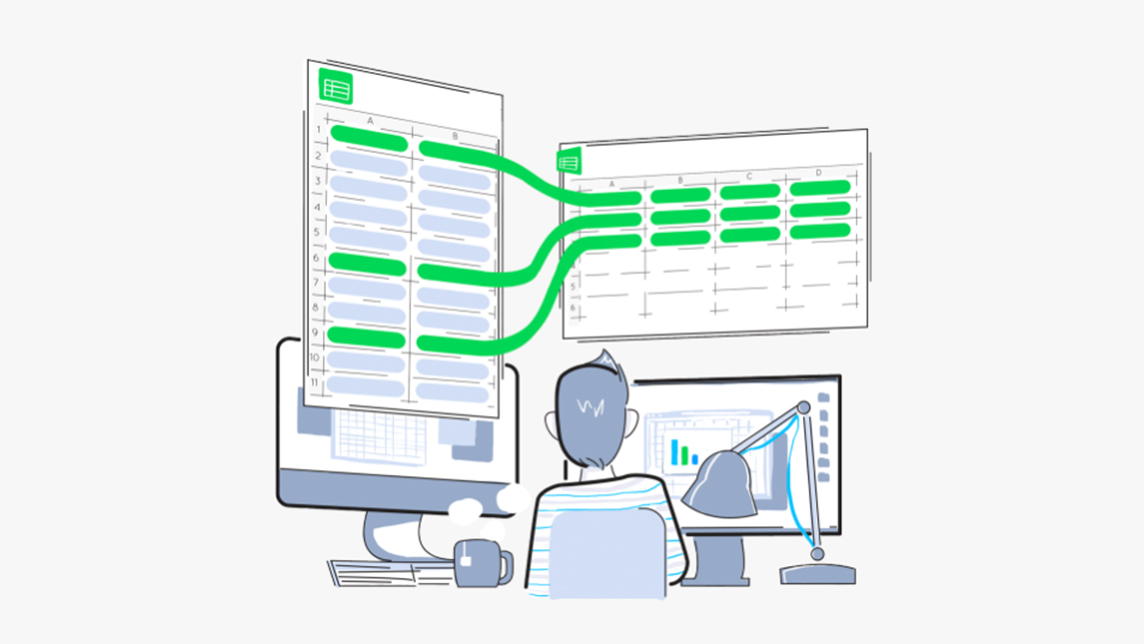

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Sorry, we couldn’t find any matches for“Google for Startups Residency”.