Google for Startups Residency

-

DATABASE (996)

-

ARTICLES (811)

Headquartered in Shenzhen, Gemboom.com was founded in 2016. It invests mainly in early-stage startups in the high tech, industry upgrade and consumption upgrade sectors.

Headquartered in Shenzhen, Gemboom.com was founded in 2016. It invests mainly in early-stage startups in the high tech, industry upgrade and consumption upgrade sectors.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

STI Financial Group is a Hong Kong-based investment firm. It specializes in hedge fund and private equity investments, managing the assets of clients through various investment instruments and structured products. The company also runs services to help clients set up trust funds for their heirs or family members.

STI Financial Group is a Hong Kong-based investment firm. It specializes in hedge fund and private equity investments, managing the assets of clients through various investment instruments and structured products. The company also runs services to help clients set up trust funds for their heirs or family members.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

Established in 2015, Isomer Capital is a London-based VC that mainly invests in European technology startups from pre-seed to Series B rounds. It invests across multiple sectors and currently has 30 startups in its portfolio, including prominent companies Deliveroo and Codacy. Isomer has managed two exits to date: Codeship and Accelerated Dynamics. Its most recent investments include the seed round of quantum ML technology GTN and the Series A round of Proxiclick, a cloud-based tourism management system.

José Neves is best known as the CEO and co-founder of fashion unicorn Farfetch, one of Portugal's most successful startups to date. London-based Neves is also a non-executive director at the British Fashion Council. He has set up his own foundation to spend two-thirds of Farfetch's profits on innovation projects. As an angel investor, he has so far invested in two startups: Portuguese fintech StudentFinance and fashion platform asap54.com where he is also an advisor.

José Neves is best known as the CEO and co-founder of fashion unicorn Farfetch, one of Portugal's most successful startups to date. London-based Neves is also a non-executive director at the British Fashion Council. He has set up his own foundation to spend two-thirds of Farfetch's profits on innovation projects. As an angel investor, he has so far invested in two startups: Portuguese fintech StudentFinance and fashion platform asap54.com where he is also an advisor.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Batavia Incubator was founded as a joint venture between Rebright Partners, a Japanese incubator, and the Indonesian financial group, Corfina Group. The firm focuses on investing in Indonesian startups.

Batavia Incubator was founded as a joint venture between Rebright Partners, a Japanese incubator, and the Indonesian financial group, Corfina Group. The firm focuses on investing in Indonesian startups.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Ximalaya FM is China’s largest audio sharing and service platform with 450m subscribed users. It has invested in several startups in the culture and entertainment sectors.

Ximalaya FM is China’s largest audio sharing and service platform with 450m subscribed users. It has invested in several startups in the culture and entertainment sectors.

Angel Investment Network Indonesia (ANGIN)

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

Alex Benzer is the co-founder of online video community Vidme and the co-creator of Curate LA and Represent LA. Previously, he co-founded SocialEngine and Fanmix. Benzer received his bachelor’s degree in Entrepreneurship from University of Redlands. As an undergraduate, he won the Wall Street Journal Student Achievement Award for Entrepreneurship.

Alex Benzer is the co-founder of online video community Vidme and the co-creator of Curate LA and Represent LA. Previously, he co-founded SocialEngine and Fanmix. Benzer received his bachelor’s degree in Entrepreneurship from University of Redlands. As an undergraduate, he won the Wall Street Journal Student Achievement Award for Entrepreneurship.

UCommune is a Chinese coworking space operator, best known for its UrWork brand. As of November 2018, it has raised over US$650 million and has most recently completed series D funding. UCommune has also invested in Chinese companies Danke Apartment and Huodongxing, as well as Indonesian coworking space operator Rework (now GoWork).

UCommune is a Chinese coworking space operator, best known for its UrWork brand. As of November 2018, it has raised over US$650 million and has most recently completed series D funding. UCommune has also invested in Chinese companies Danke Apartment and Huodongxing, as well as Indonesian coworking space operator Rework (now GoWork).

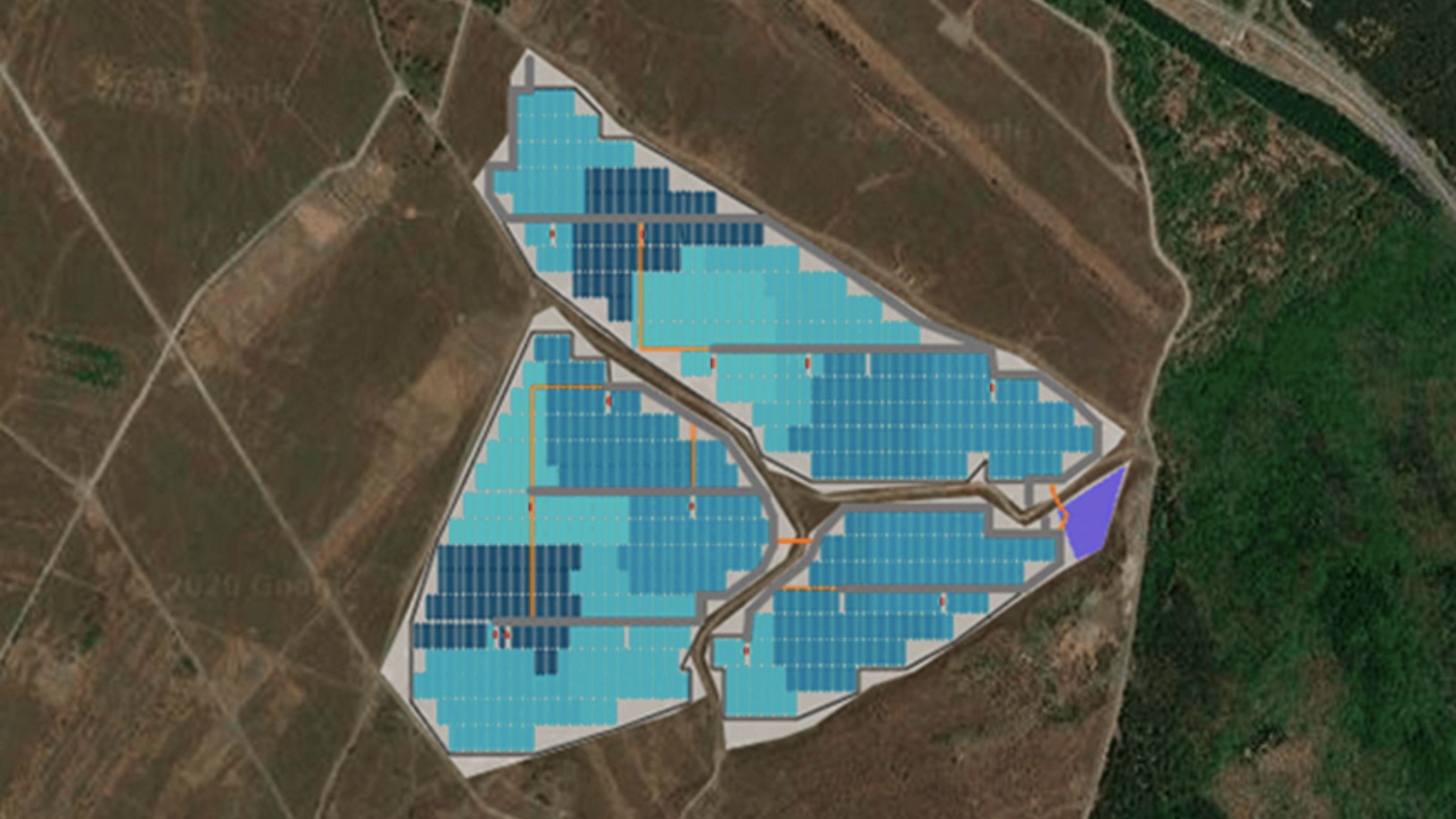

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

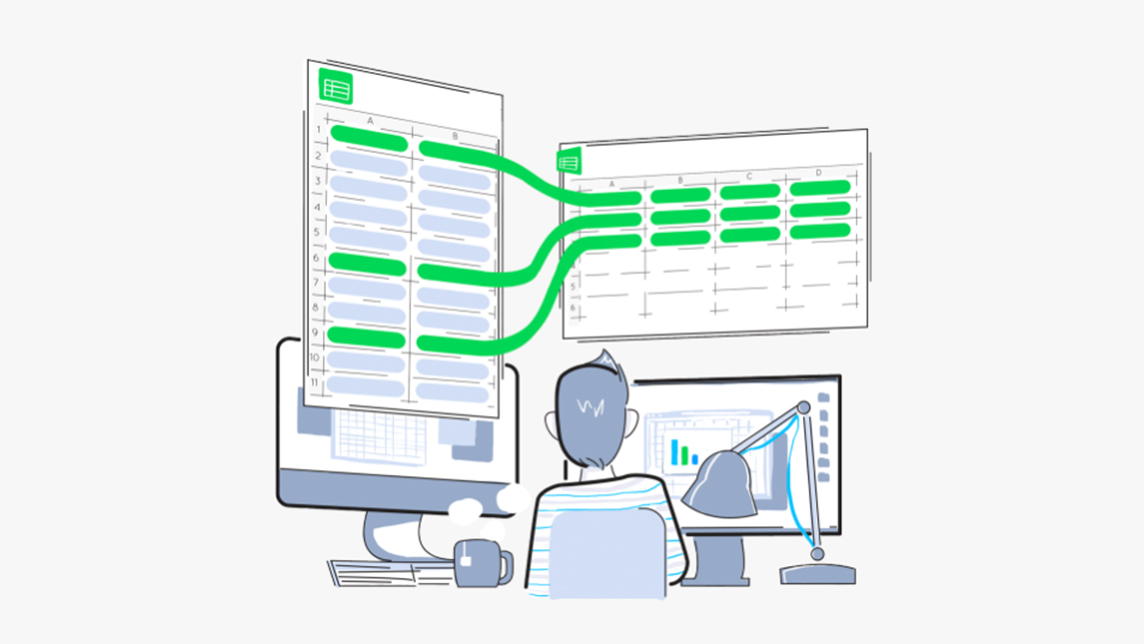

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Sorry, we couldn’t find any matches for“Google for Startups Residency”.