Google for Startups Residency

-

DATABASE (996)

-

ARTICLES (811)

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Healthbox is a Chicago-based medtech accelerator that was established in 2010 with a global focus. To date, it has invested in more than 90 startups, mostly in seed rounds of up to $100,000 per startup. The firm has seen three exits so far. Since 2014, Healthbox has also been offering consultancy services.

Healthbox is a Chicago-based medtech accelerator that was established in 2010 with a global focus. To date, it has invested in more than 90 startups, mostly in seed rounds of up to $100,000 per startup. The firm has seen three exits so far. Since 2014, Healthbox has also been offering consultancy services.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

XY Capital was co-founded in Hangzhou in April 2018 by former Alibaba CEO Lu Zhaoxi and Tang Yun, a former government official in Hangzhou with a PhD in Computer Science from Tsinghua University. The company set up an RMB investment fund in June 2018 and invests mainly in early-stage tech startups.

XY Capital was co-founded in Hangzhou in April 2018 by former Alibaba CEO Lu Zhaoxi and Tang Yun, a former government official in Hangzhou with a PhD in Computer Science from Tsinghua University. The company set up an RMB investment fund in June 2018 and invests mainly in early-stage tech startups.

Shanghai Zhangjiang Science & Technology Investment Corporation (ZJ STIC) was founded in 2005. The company has invested in almost 100 startups. ZJ STIC has also launched the RMB 1 billion Zhangjiang Sino-Century Venture Capital Fund, which invests primarily in the sectors of advanced manufacturing, energy conservation, environmental protection, etc.

Shanghai Zhangjiang Science & Technology Investment Corporation (ZJ STIC) was founded in 2005. The company has invested in almost 100 startups. ZJ STIC has also launched the RMB 1 billion Zhangjiang Sino-Century Venture Capital Fund, which invests primarily in the sectors of advanced manufacturing, energy conservation, environmental protection, etc.

Red Avenue Foundation was founded by Zhang Ning, chairwoman of Red Avenue New Materials Group, in 2002. It focuses on various areas, including student assistance, disaster relief and environmental protection. It mainly invests in startups that offer the highest social return on investment (SROI).

Red Avenue Foundation was founded by Zhang Ning, chairwoman of Red Avenue New Materials Group, in 2002. It focuses on various areas, including student assistance, disaster relief and environmental protection. It mainly invests in startups that offer the highest social return on investment (SROI).

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

Xia Zuoquan (b. 1963) co-founded BYD in 1996, which makes cars as well as batteries for electric vehicles. BYD is about 10% owned by Warren Buffett's Berkshire Hathaway. Xia founded Zhengxuan Capital in 2004, an investment firm having over RMB 10 billion in assets under management. Zhengxuan Capital has invested in more than 30 companies in gene sequencing, robotics, smart hardware, chip design, supply chain finance and talent assessment sectors. Xia was placed no. 256 in the 2015 Forbes China Rich List, with an estimated net worth US$1.2 billion.

Xia Zuoquan (b. 1963) co-founded BYD in 1996, which makes cars as well as batteries for electric vehicles. BYD is about 10% owned by Warren Buffett's Berkshire Hathaway. Xia founded Zhengxuan Capital in 2004, an investment firm having over RMB 10 billion in assets under management. Zhengxuan Capital has invested in more than 30 companies in gene sequencing, robotics, smart hardware, chip design, supply chain finance and talent assessment sectors. Xia was placed no. 256 in the 2015 Forbes China Rich List, with an estimated net worth US$1.2 billion.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

Founded in 2011, the knowledge capital fund is an initiative from the InKemia IUCT Group to focus on innovation and the licensing of patents in the biotech sectors. InKemia supports the life science industry through R&D grant programs, technical consultancy and training. It specializes in areas such as chemical synthesis, biotech, bio-catalysis, quality control and EU releases of new products. InKemia also supports local entrepreneurs through the Manuel Arroyo Award for Young Entrepreneurs with the aim to promote local cooperative economic development.

Founded in 2011, the knowledge capital fund is an initiative from the InKemia IUCT Group to focus on innovation and the licensing of patents in the biotech sectors. InKemia supports the life science industry through R&D grant programs, technical consultancy and training. It specializes in areas such as chemical synthesis, biotech, bio-catalysis, quality control and EU releases of new products. InKemia also supports local entrepreneurs through the Manuel Arroyo Award for Young Entrepreneurs with the aim to promote local cooperative economic development.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

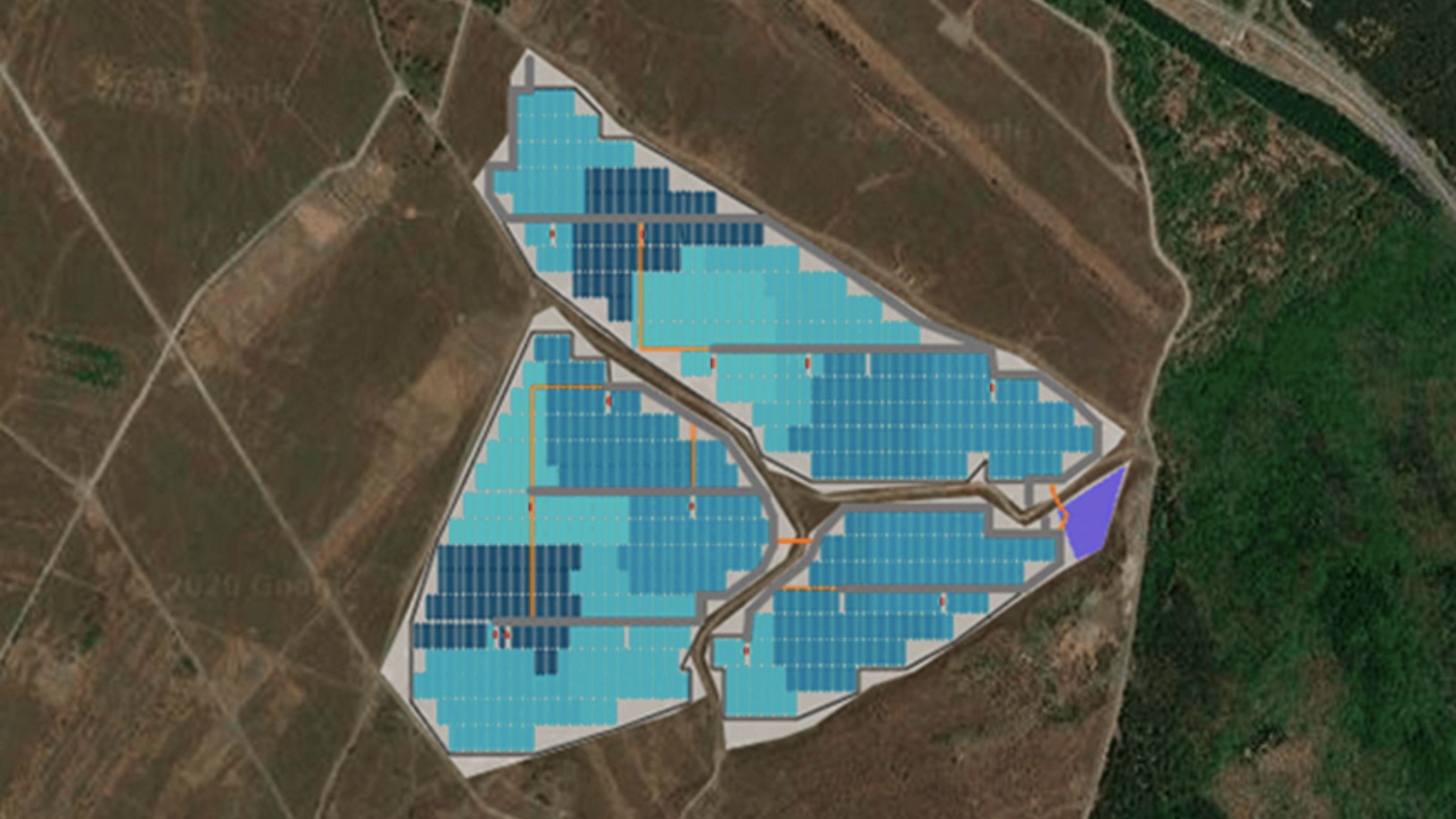

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Sorry, we couldn’t find any matches for“Google for Startups Residency”.