Google for Startups Residency

-

DATABASE (996)

-

ARTICLES (811)

Established by Chinese Academy of Sciences Holdings Co., Ltd., and several other conglomerates in 2011, Cash Capital invests mainly in high-tech startups in the IoT, intelligent manufacturing, mobile internet, big data, artificial intelligence, fintech, healthcare, medical equipment and pharmaceutical sectors. The firm manages assets of more than RMB 10 billion and has invested in nearly 100 companies.

Established by Chinese Academy of Sciences Holdings Co., Ltd., and several other conglomerates in 2011, Cash Capital invests mainly in high-tech startups in the IoT, intelligent manufacturing, mobile internet, big data, artificial intelligence, fintech, healthcare, medical equipment and pharmaceutical sectors. The firm manages assets of more than RMB 10 billion and has invested in nearly 100 companies.

Established in 2015, EQT Ventures is a Stockholm-based investor that describes itself as "half VC, half startup." It has invested in more than 50 companies, acting as lead investor in almost two-thirds of its investments, to date, of a total investment fund of €566m. EQT Ventures invests across sectors locally and globally and has successfully managed the exits of two Scandinavian startups.

Established in 2015, EQT Ventures is a Stockholm-based investor that describes itself as "half VC, half startup." It has invested in more than 50 companies, acting as lead investor in almost two-thirds of its investments, to date, of a total investment fund of €566m. EQT Ventures invests across sectors locally and globally and has successfully managed the exits of two Scandinavian startups.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Founded by Feng Bo, who left China for San Francisco at aged 18 and returning in 1994, as one of technology-focused boutique investment bank Robertson Stephens' first bankers in China. Feng set up Ceyuan Ventures in 2004, focusing on early-stage IT and emerging growth firms in China. Notable investments include Jiayuan, Qihoo 360, Dianping and Meitu. Feng Bo is the brother of Feng Tao, another leading investor, and founder and head of NewMargin Ventures.

Founded by Feng Bo, who left China for San Francisco at aged 18 and returning in 1994, as one of technology-focused boutique investment bank Robertson Stephens' first bankers in China. Feng set up Ceyuan Ventures in 2004, focusing on early-stage IT and emerging growth firms in China. Notable investments include Jiayuan, Qihoo 360, Dianping and Meitu. Feng Bo is the brother of Feng Tao, another leading investor, and founder and head of NewMargin Ventures.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Hadi Wenas joined the Lippo Group in 2015 as the current CEO of Lippo’s e-commerce site MatahariMall. A graduate in Mechanical Engineering and Computer Science, Hadi was able to work as an applications engineer at Oracle while reading a master’s degree in Computer Science at Stanford University in the US. He returned to Indonesia and worked at McKinsey in Jakarta for six years before jumping into the tech scene as a co-founder and managing director of Zalora Indonesia. After exiting Zalora in 2013, he became the CEO of tech firm aCommerce until June 2015.

Hadi Wenas joined the Lippo Group in 2015 as the current CEO of Lippo’s e-commerce site MatahariMall. A graduate in Mechanical Engineering and Computer Science, Hadi was able to work as an applications engineer at Oracle while reading a master’s degree in Computer Science at Stanford University in the US. He returned to Indonesia and worked at McKinsey in Jakarta for six years before jumping into the tech scene as a co-founder and managing director of Zalora Indonesia. After exiting Zalora in 2013, he became the CEO of tech firm aCommerce until June 2015.

DFS168.com is a B2C e-commerce platform for agricultural materials. DFS168.com sells to major agricultural provinces in China such as Jiangxi, Heibei and Anhui. Upon noticing Chinese farmers' lack of agricultural expertise and technical knowledge, the team at DFS168.com came up with the idea of building an agricultural education platform. However, the company decided not to launch the business itself, worried farmers might misinterpret the platform as simply a means to sell more products. Instead, founder Yan Zitong co-founded Tiantian Xuenong, an independent company, with Zhao Guang, and DFS168.com assumed the role of angel investor.

DFS168.com is a B2C e-commerce platform for agricultural materials. DFS168.com sells to major agricultural provinces in China such as Jiangxi, Heibei and Anhui. Upon noticing Chinese farmers' lack of agricultural expertise and technical knowledge, the team at DFS168.com came up with the idea of building an agricultural education platform. However, the company decided not to launch the business itself, worried farmers might misinterpret the platform as simply a means to sell more products. Instead, founder Yan Zitong co-founded Tiantian Xuenong, an independent company, with Zhao Guang, and DFS168.com assumed the role of angel investor.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Ontario Teachers' Pension Plan

Founded by the Ontario government and Ontario Teachers' Federation in 1990, Ontario Teachers' Pension Plan is Canada's largest single-profession pension plan. Headquartered in Toronto, Ontario Teachers' also has investment offices in London, Singapore and Hong Kong. With C$204.7bn worth of assets under its management, Ontario Teachers' is responsible for the pensions of 329,000 working and retired teachers in Ontario. Its diverse global portfolio of assets generates a total-fund net return of 9.5% annually. A new investment department, Teachers’ Innovation Platform, was set up in 2019 to invest in late-stage ventures that deliver disruptive technologies.

Founded by the Ontario government and Ontario Teachers' Federation in 1990, Ontario Teachers' Pension Plan is Canada's largest single-profession pension plan. Headquartered in Toronto, Ontario Teachers' also has investment offices in London, Singapore and Hong Kong. With C$204.7bn worth of assets under its management, Ontario Teachers' is responsible for the pensions of 329,000 working and retired teachers in Ontario. Its diverse global portfolio of assets generates a total-fund net return of 9.5% annually. A new investment department, Teachers’ Innovation Platform, was set up in 2019 to invest in late-stage ventures that deliver disruptive technologies.

This private Portuguese healthcare group was established in 2000 and based in Lisbon. It made its first investment in a startup in 2019 when it led the €600,000 seed round of medtech UpHill, a SaaS for healthcare professionals to keep up-to-speed on the latest clinical treatments and protocols using AI. The group’s Hospital da Luz was one of UpHill’s first customers.

This private Portuguese healthcare group was established in 2000 and based in Lisbon. It made its first investment in a startup in 2019 when it led the €600,000 seed round of medtech UpHill, a SaaS for healthcare professionals to keep up-to-speed on the latest clinical treatments and protocols using AI. The group’s Hospital da Luz was one of UpHill’s first customers.

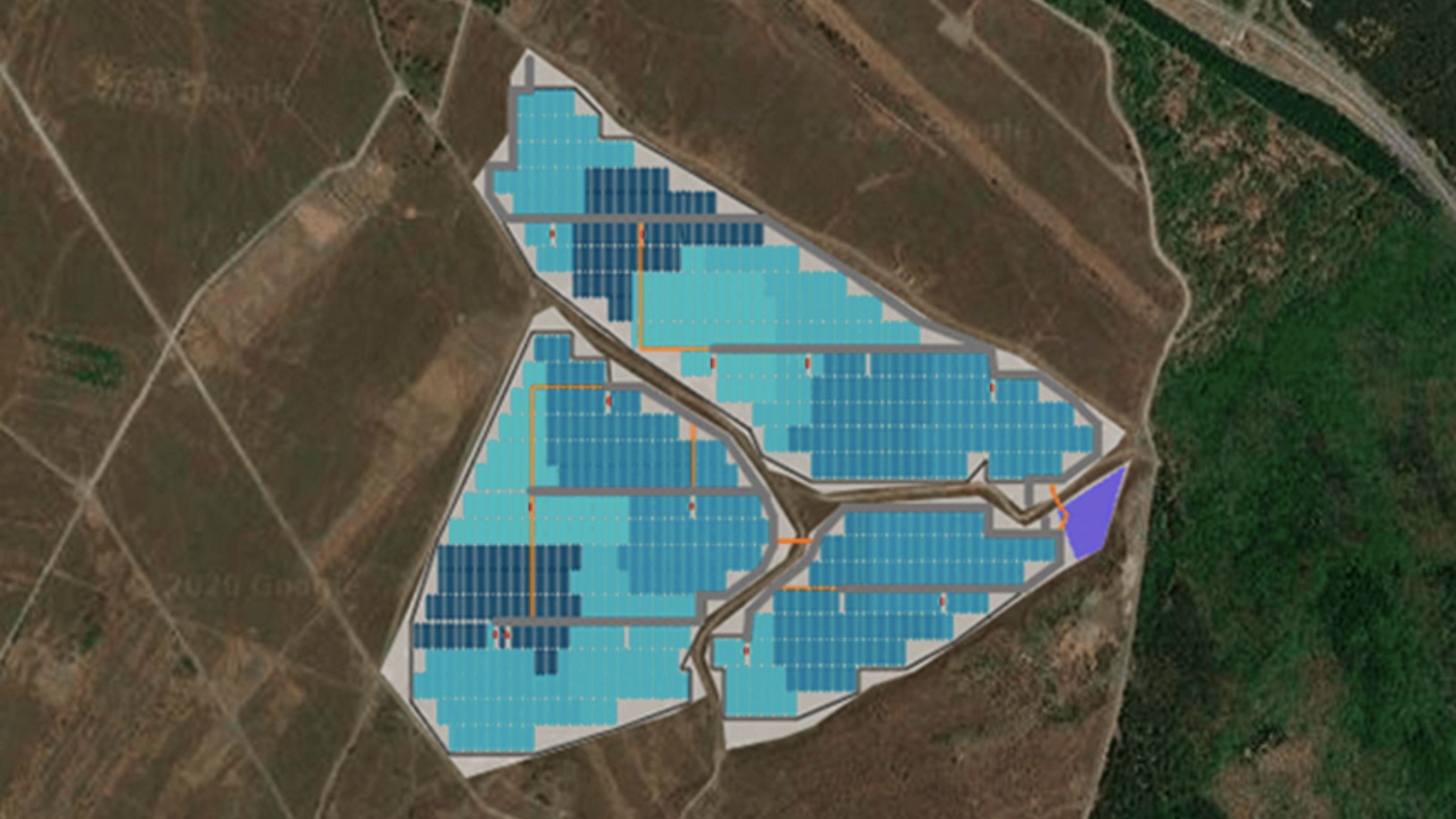

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Sorry, we couldn’t find any matches for“Google for Startups Residency”.