Google for Startups Residency

-

DATABASE (996)

-

ARTICLES (811)

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Marieta del Rivero is a successful female entrepreneur with over 25 years of experience in leading companies in the world of information and communications technology, mobility and digital services. She graduated from the IESE Business School and has an executive degree in Digital Business Strategy from Columbia University.Currently, the president of the International Women´s Forum Spain, she is also the president of Seeliger and Conde media group. Del Rivero is also an independent non-executive director at Cellnex Telecom, the main European infrastructure operator for wireless communication and Gestamp, an international group that manufactures metal automotive components.

Marieta del Rivero is a successful female entrepreneur with over 25 years of experience in leading companies in the world of information and communications technology, mobility and digital services. She graduated from the IESE Business School and has an executive degree in Digital Business Strategy from Columbia University.Currently, the president of the International Women´s Forum Spain, she is also the president of Seeliger and Conde media group. Del Rivero is also an independent non-executive director at Cellnex Telecom, the main European infrastructure operator for wireless communication and Gestamp, an international group that manufactures metal automotive components.

Orkla ASA is an Oslo-based supplier of branded consumer products to major markets in the Nordic and Baltic regions and Central Europe. Selected product categories are also available in India, known as MTR Foods brand. Popular brands include Felix, Toro, Panda and Abba.Originally founded in 1654, Orkla is one of Norway’s oldest business conglomerates and became public-listed on the Oslo Stock Exchange (ORKLY) in 1929. Orkla Foods accounts for 39% of the group’s operating revenues. Two other subsidiaries, Orkla Care and Orkla Food Ingredients generate about 43% of the group’s operating revenues. The Orkla Confectionery & Snacks division contributes about 15%.

Orkla ASA is an Oslo-based supplier of branded consumer products to major markets in the Nordic and Baltic regions and Central Europe. Selected product categories are also available in India, known as MTR Foods brand. Popular brands include Felix, Toro, Panda and Abba.Originally founded in 1654, Orkla is one of Norway’s oldest business conglomerates and became public-listed on the Oslo Stock Exchange (ORKLY) in 1929. Orkla Foods accounts for 39% of the group’s operating revenues. Two other subsidiaries, Orkla Care and Orkla Food Ingredients generate about 43% of the group’s operating revenues. The Orkla Confectionery & Snacks division contributes about 15%.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Scott Banister is a prolific Silicon Valley-based angel investor. From 2000–2007, he was CTO and co-founder at IronPort, an enterprise email routing and anti-spam solutions provider that was acquired by Cisco Systems for $830m. He has invested in more than 100 companies to date and managed numerous exits, including Uber. His most recent undisclosed amounts of investments include participating in the $150m investment round of US investment analytics firm Forge Global in May 2021, as well as the April 2021 $35m funding round of US video streaming server Plex.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Former CBDO and Co-founder of Psious

Daniel Roig graduated in Electrical and Electronic Engineering in 2006 and worked as an editor at Digital-text for over five years. In 2012, he co-founded GrowInPallet after completing an MBA. He won the first prize in a competition presenting an app to treat mental illness like phobias. The project led him to co-found Psious in 2014, taking on the role of CBDO. Roig was been responsible for the expansion and innovation strategy of Psious, leading the business development unit until April 2017 when he left the company.Based in Barcelona, he is now the sales manager at Supertronic SA. He had previously worked for Supertronic for two years until 2007 while still at university. He had also worked as webmaster for Redfactory SL for five years prior to joining Supertronic in 2005.

Daniel Roig graduated in Electrical and Electronic Engineering in 2006 and worked as an editor at Digital-text for over five years. In 2012, he co-founded GrowInPallet after completing an MBA. He won the first prize in a competition presenting an app to treat mental illness like phobias. The project led him to co-found Psious in 2014, taking on the role of CBDO. Roig was been responsible for the expansion and innovation strategy of Psious, leading the business development unit until April 2017 when he left the company.Based in Barcelona, he is now the sales manager at Supertronic SA. He had previously worked for Supertronic for two years until 2007 while still at university. He had also worked as webmaster for Redfactory SL for five years prior to joining Supertronic in 2005.

Co-founder and CMO of Keyfare

Wan Xuan has worked on investment and branding consulting for many years. After co-founding Keyfare, he leads the marketing and sales for the startup as its CMO.

Wan Xuan has worked on investment and branding consulting for many years. After co-founding Keyfare, he leads the marketing and sales for the startup as its CMO.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

Spiral Ventures (IMJ Investment Partners)

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

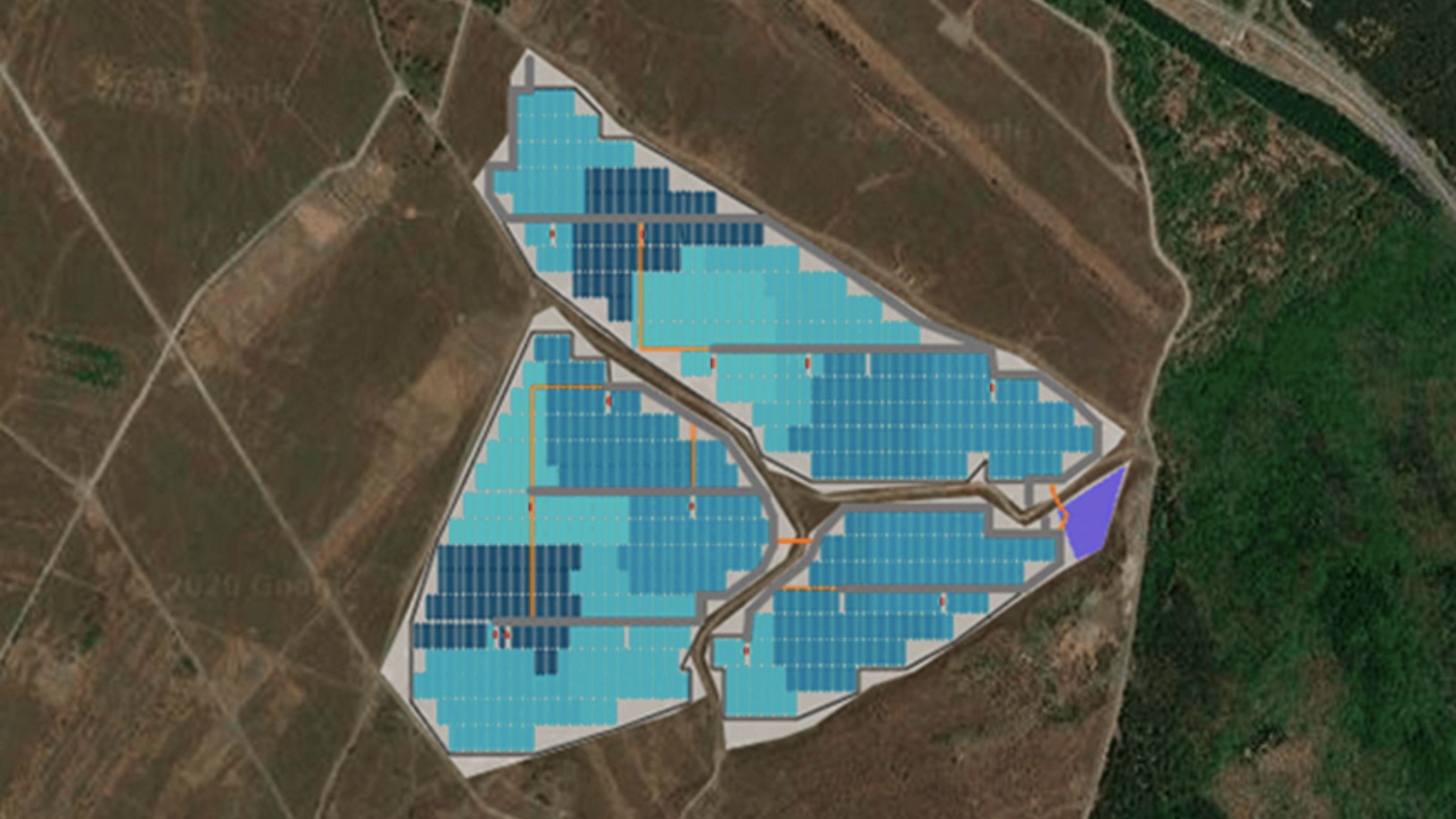

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

What Indonesia’s election could mean for startups and investors

Industry players voice their hopes, concerns and expectations as the April presidential election nears

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Sorry, we couldn’t find any matches for“Google for Startups Residency”.