Green Pine Capital Partners

-

DATABASE (840)

-

ARTICLES (556)

Intudo Ventures is an Indonesia-focused venture capital firm. It invests in companies led by returning Southeast Asian entrepreneurs who had studied or worked outside the region for a significant amount of time.

Intudo Ventures is an Indonesia-focused venture capital firm. It invests in companies led by returning Southeast Asian entrepreneurs who had studied or worked outside the region for a significant amount of time.

LINE Ventures is the venture capital arm of LINE Corporation, a mobile app and internet services company based in Japan. LINE Corp is, in turn, a subsidiary of the Korean internet conglomerate NAVER.

LINE Ventures is the venture capital arm of LINE Corporation, a mobile app and internet services company based in Japan. LINE Corp is, in turn, a subsidiary of the Korean internet conglomerate NAVER.

Based in Jakarta, Indonesia, GnB Accelerator is a part of Fenox Venture Capital. With access to Fenox’s international network of investors, entrepreneurs and advisors, GnB Accelerator supports early stage startups in diverse industries.

Based in Jakarta, Indonesia, GnB Accelerator is a part of Fenox Venture Capital. With access to Fenox’s international network of investors, entrepreneurs and advisors, GnB Accelerator supports early stage startups in diverse industries.

Founder of Xiongxin Capital, Wang Guanxiong used to work in Alibaba, Wanda, 360 and Linekong. He is one of the top 10 We Media and a KOL in tech business in China.

Founder of Xiongxin Capital, Wang Guanxiong used to work in Alibaba, Wanda, 360 and Linekong. He is one of the top 10 We Media and a KOL in tech business in China.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

Founded in 2009 by ex-banker Yan Li (currently its managing director), Eastern Bell focuses on logistics & supply chain and O2O e-commerce companies.

Founded in 2009 by ex-banker Yan Li (currently its managing director), Eastern Bell focuses on logistics & supply chain and O2O e-commerce companies.

Northern Light Venture Capital

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

China Softbank Capital (SBCVC)

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Taihecap (formerly TH Capital)

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

Abac Nest was founded in Barcelona in 2017 by the team behind Abac Capital, and supported by a network of industry experts and investors. Abac Nest mainly invests in early-stage investments.

Abac Nest was founded in Barcelona in 2017 by the team behind Abac Capital, and supported by a network of industry experts and investors. Abac Nest mainly invests in early-stage investments.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2011 by Wang Xiao, a member of the Baidu founding team, Unity Ventures is a venture capital firm in China that focuses on early-stage companies in the internet and mobile internet sectors.

Founded in 2011 by Wang Xiao, a member of the Baidu founding team, Unity Ventures is a venture capital firm in China that focuses on early-stage companies in the internet and mobile internet sectors.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Switch Automation: On-demand, data-driven building management

The Denver-based company kicked off operations in Singapore last year, intends to use the city-state as a spring board to expand in the Asia Pacific

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

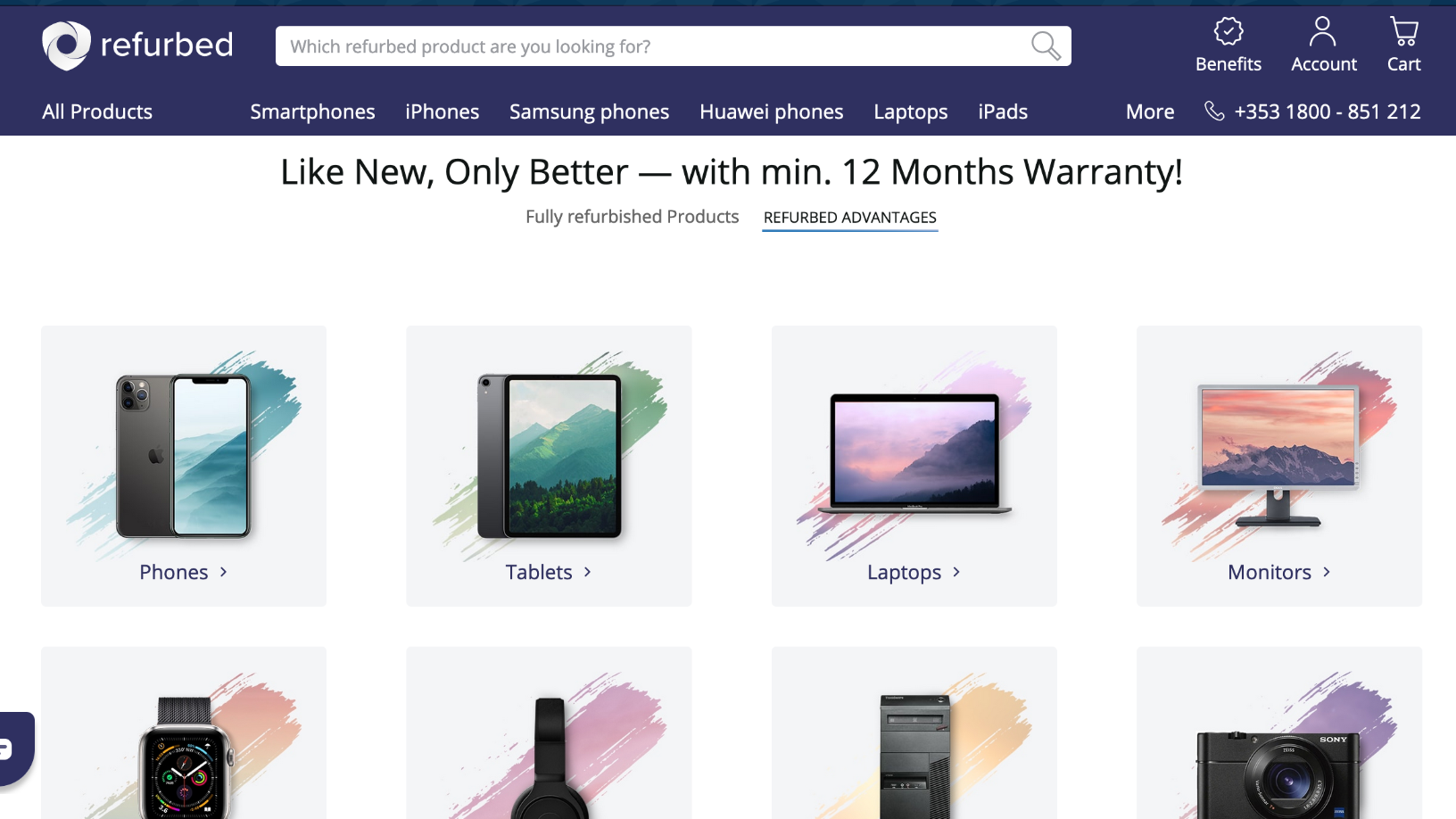

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Sorry, we couldn’t find any matches for“Green Pine Capital Partners”.