Green Pine Capital Partners

-

DATABASE (840)

-

ARTICLES (556)

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Co-founder of Duodianyun

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Co-founder of Mobvoi

Zhu graduated from Stanford University in 2012 with a master’s in Mechanical Engineering. That same year, he returned to China and co-founded Mobvoi. In 2014, Zhu left Mobvoi to work at IDG Capital Partners as the firm’s first Entrepreneur-In-Residence. A year later, he joined VC firm FreeS Fund, where he now serves as vice president.

Zhu graduated from Stanford University in 2012 with a master’s in Mechanical Engineering. That same year, he returned to China and co-founded Mobvoi. In 2014, Zhu left Mobvoi to work at IDG Capital Partners as the firm’s first Entrepreneur-In-Residence. A year later, he joined VC firm FreeS Fund, where he now serves as vice president.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Acton Capital Partners is a Munich-based VC that focuses on late-stage investments. The firm invests primarily in the sectors of fintech, marketing and e-commerce and has invested over €350m across the three industries. It has backed prominent companies such as Toronto-based Chef’s Plate and online homemade crafts marketplace Etsy.

Acton Capital Partners is a Munich-based VC that focuses on late-stage investments. The firm invests primarily in the sectors of fintech, marketing and e-commerce and has invested over €350m across the three industries. It has backed prominent companies such as Toronto-based Chef’s Plate and online homemade crafts marketplace Etsy.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

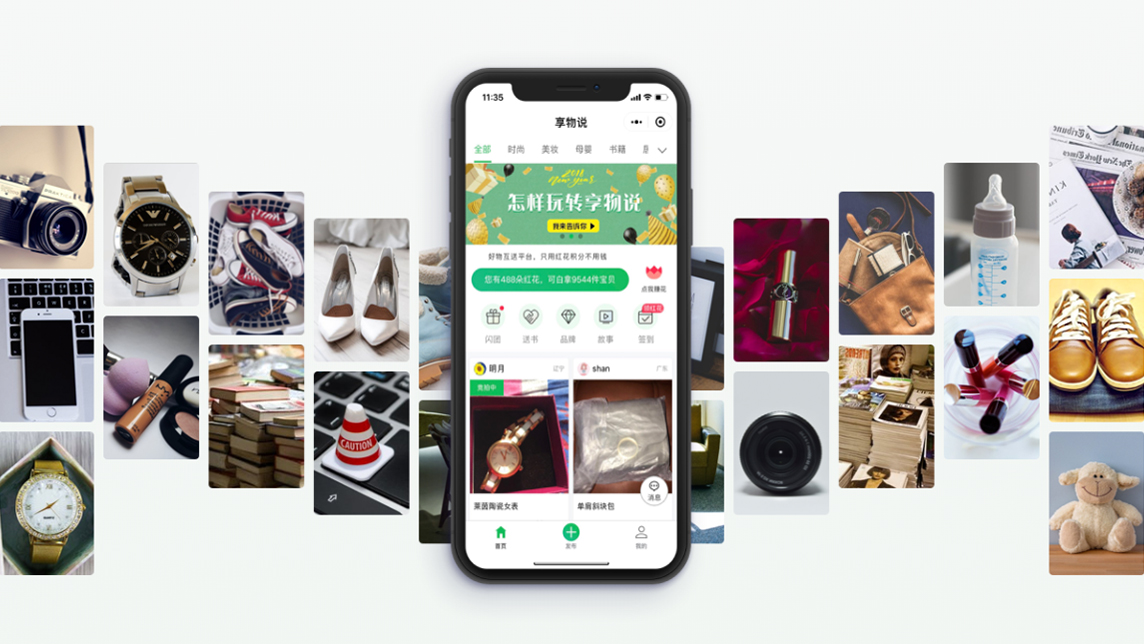

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Faromatics' ChickenBoy robot brings smart analytics to poultry farming

The makers of the AI-based robot for managing large-scale poultry farming are seeking up to €4m in a second round funding as they launch their invention in Europe

Sorry, we couldn’t find any matches for“Green Pine Capital Partners”.