Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Founded in June 2015, Horizon Robotics is an AI solutions provider. Devices carrying its AI systems have been widely applied in smart driving, smart city and smart retail scenarios. Horizon developed China’s first embedded AI processors for computer vision tasks: the Sunrise 1.0 Processor, which is used in smart cameras, and the Journey 1.0 Processor, which is used in autonomous vehicles.

Founded in June 2015, Horizon Robotics is an AI solutions provider. Devices carrying its AI systems have been widely applied in smart driving, smart city and smart retail scenarios. Horizon developed China’s first embedded AI processors for computer vision tasks: the Sunrise 1.0 Processor, which is used in smart cameras, and the Journey 1.0 Processor, which is used in autonomous vehicles.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

Founded in 2007 by Soichiro Swimmy Minami, BizReach is a Tokyo-based recruitment firm that operates a full service headhunting and talent search platform. Its hallmark feature is an AI-powered software for shortlisting job applicants. Outside of Japan, the company also has a presence in Singapore and Kuala Lumpur, Malaysia. BizReach raised funding through a Series A round in 2016.

Founded in 2007 by Soichiro Swimmy Minami, BizReach is a Tokyo-based recruitment firm that operates a full service headhunting and talent search platform. Its hallmark feature is an AI-powered software for shortlisting job applicants. Outside of Japan, the company also has a presence in Singapore and Kuala Lumpur, Malaysia. BizReach raised funding through a Series A round in 2016.

Founded in April 1993, Nvidia Corp is a California-based designer and producer of graphics processing units (GPUs) and system chips (SoCs) for the professional gaming, mobile computing and automotive markets. Its technology is widely used on laptops, workstations, mobile devices and PCs. As an investor, it has invested in more than a dozen AI-related startups worldwide since 2017.

Founded in April 1993, Nvidia Corp is a California-based designer and producer of graphics processing units (GPUs) and system chips (SoCs) for the professional gaming, mobile computing and automotive markets. Its technology is widely used on laptops, workstations, mobile devices and PCs. As an investor, it has invested in more than a dozen AI-related startups worldwide since 2017.

REDangels is a Portuguese angel investor enterprise that specializes in pre-seed and seed investments in Portuguese and European startups across various sectors. There are 56 business angels working for REDangels which currently has 26 startups in its portfolio. It most recent investments include the seed rounds of sound design CGI software company Sound Particles and digital identity lifestyle manager Loqr.

REDangels is a Portuguese angel investor enterprise that specializes in pre-seed and seed investments in Portuguese and European startups across various sectors. There are 56 business angels working for REDangels which currently has 26 startups in its portfolio. It most recent investments include the seed rounds of sound design CGI software company Sound Particles and digital identity lifestyle manager Loqr.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

BraveGeneration is a Portuguese investment vehicle founded in 2015 for projects arising from the television series Shark Tank Portugal. South African entrepreneur Tim Vieira acts as its principal investor and mentor. The holding currently funds around 30 startups, both in tech and in other sectors. Consumers Trust is the first company it has invested in not to have appeared on the television show.

BraveGeneration is a Portuguese investment vehicle founded in 2015 for projects arising from the television series Shark Tank Portugal. South African entrepreneur Tim Vieira acts as its principal investor and mentor. The holding currently funds around 30 startups, both in tech and in other sectors. Consumers Trust is the first company it has invested in not to have appeared on the television show.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Formerly known as Tsinghua University Science Park (TusPark) Development Center founded in August 1994, Tus-Holdings was incorporated in 2000. The company takes full responsibility for developing, constructing, operating and managing TusPark.Tus-Holdings is the controlling shareholder, or shareholder, of over 800 listed and non-listed enterprises. The total assets under its management amount to nearly RMB 200bn.

Formerly known as Tsinghua University Science Park (TusPark) Development Center founded in August 1994, Tus-Holdings was incorporated in 2000. The company takes full responsibility for developing, constructing, operating and managing TusPark.Tus-Holdings is the controlling shareholder, or shareholder, of over 800 listed and non-listed enterprises. The total assets under its management amount to nearly RMB 200bn.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

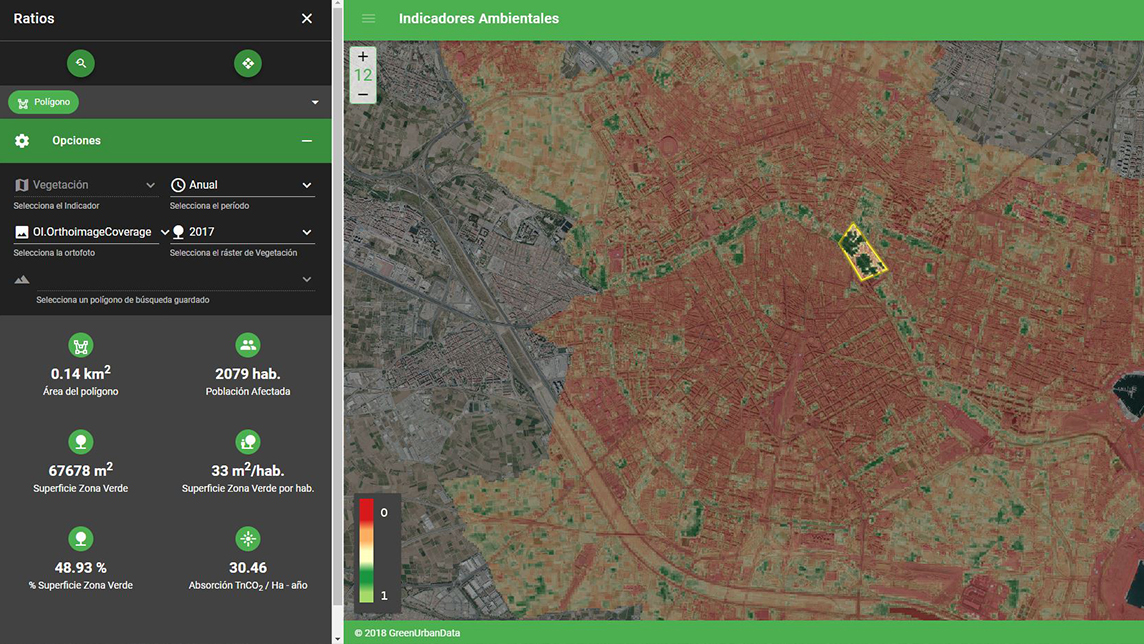

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Sorry, we couldn’t find any matches for“Green for Growth”.