Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Founded in 1985, Draper Associates is primarily a seed-stage venture capital firm with an international portfolio focusing on fintech, healthcare, education, government tech, manufacturing and consumer technology. It has made successful exits from major tech players like Baidu, Skype, Twitch (the video game streaming website) and Tesla. Draper Associates invests and supports startups for the long haul to create innovative solutions and new technologies in diverse industries.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

MediaTek Inc. is a Taiwanese fabless semiconductor company. Its chips are widely used in smartphones and tablet computers sold by Xiaomi, Huawei, Meizu, Lenovo, etc. MediaTek Inc. was founded in 1997, and its headquarters are in Hsinchu, Taiwan. In 2018, the company announced it would invest mainly in 5G network and AI for the next five years.

MediaTek Inc. is a Taiwanese fabless semiconductor company. Its chips are widely used in smartphones and tablet computers sold by Xiaomi, Huawei, Meizu, Lenovo, etc. MediaTek Inc. was founded in 1997, and its headquarters are in Hsinchu, Taiwan. In 2018, the company announced it would invest mainly in 5G network and AI for the next five years.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

WuXi AppTec is a Chinese company that specializes in the outsourcing of R&D in the pharmaceuticals, biotechnology and medical devices sectors. Listed on the Hong Kong Stock Exchange, WuXi AppTec has invested in drug development and healthcare firms globally. Its portfolio includes Insilico Medicine, which is developing an AI platform for drug development, brain disease research firm Verge Genomics and Indonesian healthcare platform Halodoc.

WuXi AppTec is a Chinese company that specializes in the outsourcing of R&D in the pharmaceuticals, biotechnology and medical devices sectors. Listed on the Hong Kong Stock Exchange, WuXi AppTec has invested in drug development and healthcare firms globally. Its portfolio includes Insilico Medicine, which is developing an AI platform for drug development, brain disease research firm Verge Genomics and Indonesian healthcare platform Halodoc.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

Dayli Partners is a VC company in South Korea that specializes in biotech and healthcare investments. It is a partner of Korea's TIPS (Tech Incubator Program for Startups) initiative, which aims to find the best startups in the country and help them develop their potential. As of December 2019, it has an AUM total of $170.7m and aims to manage $350m in assets by the end of 2020.

Dayli Partners is a VC company in South Korea that specializes in biotech and healthcare investments. It is a partner of Korea's TIPS (Tech Incubator Program for Startups) initiative, which aims to find the best startups in the country and help them develop their potential. As of December 2019, it has an AUM total of $170.7m and aims to manage $350m in assets by the end of 2020.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

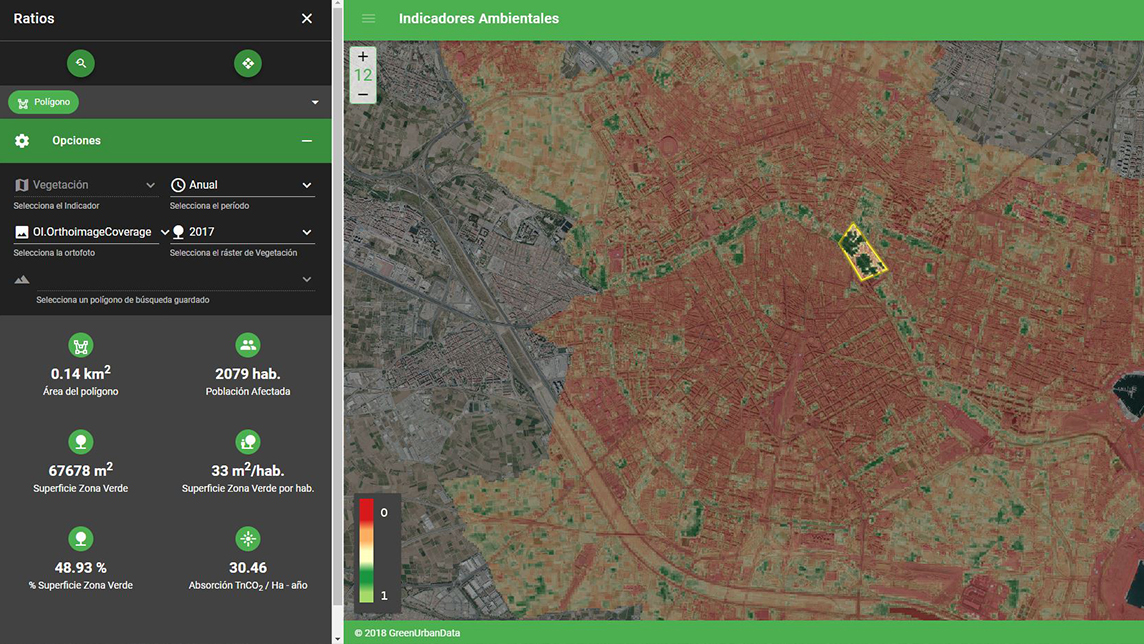

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Sorry, we couldn’t find any matches for“Green for Growth”.