Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Goldman Sachs Asset Management

Established in 1988, Goldman Sachs Asset Management (GSAM) initially specialized in fixed income separate account management for pension funds and institutions. Today, it has grown into one of the world's leading investment managers. As the primary investment arm of Goldman Sachs, it provides investment and advisory services to institutions, financial advisors and individuals through its 33 offices worldwide. As of March 2021, it has overseen over $2tn in assets across the world.

Established in 1988, Goldman Sachs Asset Management (GSAM) initially specialized in fixed income separate account management for pension funds and institutions. Today, it has grown into one of the world's leading investment managers. As the primary investment arm of Goldman Sachs, it provides investment and advisory services to institutions, financial advisors and individuals through its 33 offices worldwide. As of March 2021, it has overseen over $2tn in assets across the world.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Longtime internet businessman Eka Ginting is the founder and CEO of Indo.com, one of Indonesia’s first travel booking websites. Eka is also a commissioner of PT Rimba Raya Conservation, a company focused on forest restoration in Borneo.In recent years he has been involved in the burgeoning startup scene, becoming a mentor at Founders Institute and a board member in a few Indonesian startups. One of these startups is DanaDidik, a crowdfunding website for student loans.

Longtime internet businessman Eka Ginting is the founder and CEO of Indo.com, one of Indonesia’s first travel booking websites. Eka is also a commissioner of PT Rimba Raya Conservation, a company focused on forest restoration in Borneo.In recent years he has been involved in the burgeoning startup scene, becoming a mentor at Founders Institute and a board member in a few Indonesian startups. One of these startups is DanaDidik, a crowdfunding website for student loans.

Eduardo Saverin is a Brazilian tech entrepreneur and angel investor who is most famous for co-founding Facebook. A skilled investor, he reportedly made US$300,000 from trading while he was a Harvard undergraduate. He was also a co-founder and partner at B Capital Group that invested in logistics startup Ninja Van. In 2015, he invested in Indonesian e-commerce site Bilna and joined another funding round when Bilna merged with Moxy to form Orami.

Eduardo Saverin is a Brazilian tech entrepreneur and angel investor who is most famous for co-founding Facebook. A skilled investor, he reportedly made US$300,000 from trading while he was a Harvard undergraduate. He was also a co-founder and partner at B Capital Group that invested in logistics startup Ninja Van. In 2015, he invested in Indonesian e-commerce site Bilna and joined another funding round when Bilna merged with Moxy to form Orami.

Shenzhen Qianhai Xingwang Investment Co Ltd

Shenzhen Qianhai Xingwang Investment Co Ltd (Xingwang Investment) was founded in June 2015. The company is headquartered in Shenzhen and has offices in Beijing and Shanghai. Xingwang Investment has RMB 5 billion under management. It has established an investment fund with Ximalaya FM, China's largest audio sharing platform, to finance startups in the pay-for-knowledge sector.

Shenzhen Qianhai Xingwang Investment Co Ltd (Xingwang Investment) was founded in June 2015. The company is headquartered in Shenzhen and has offices in Beijing and Shanghai. Xingwang Investment has RMB 5 billion under management. It has established an investment fund with Ximalaya FM, China's largest audio sharing platform, to finance startups in the pay-for-knowledge sector.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

Established in 2018, Robot Union is a pan-European robotics association that is funded by the European Union. It is an EU initiative under the Horizon 2020 program for investment in research and innovation across sectors and countries. Through various competitions, robotics startups can win equity-free awards of up to €223,000 each. Robot Union selected its first batch of 20 startups in September 2018.

Established in 2018, Robot Union is a pan-European robotics association that is funded by the European Union. It is an EU initiative under the Horizon 2020 program for investment in research and innovation across sectors and countries. Through various competitions, robotics startups can win equity-free awards of up to €223,000 each. Robot Union selected its first batch of 20 startups in September 2018.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

Adrian Suherman has over 19 years of management experience, including senior executive roles. He was the vice president of Indonesian telco Telkomsel and was also the CEO of aCommerce. Adrian was previously a software engineer for Sun Microsystems and had also worked at Sherikon Inc, Oracle, AT Kearney and LivingSocial.He is currently the CEO of Lippo Group’s digital branch and fintech firm OVO, as well as a commissioner of Lippo Group’s e-tailer MatahariMall.

Adrian Suherman has over 19 years of management experience, including senior executive roles. He was the vice president of Indonesian telco Telkomsel and was also the CEO of aCommerce. Adrian was previously a software engineer for Sun Microsystems and had also worked at Sherikon Inc, Oracle, AT Kearney and LivingSocial.He is currently the CEO of Lippo Group’s digital branch and fintech firm OVO, as well as a commissioner of Lippo Group’s e-tailer MatahariMall.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

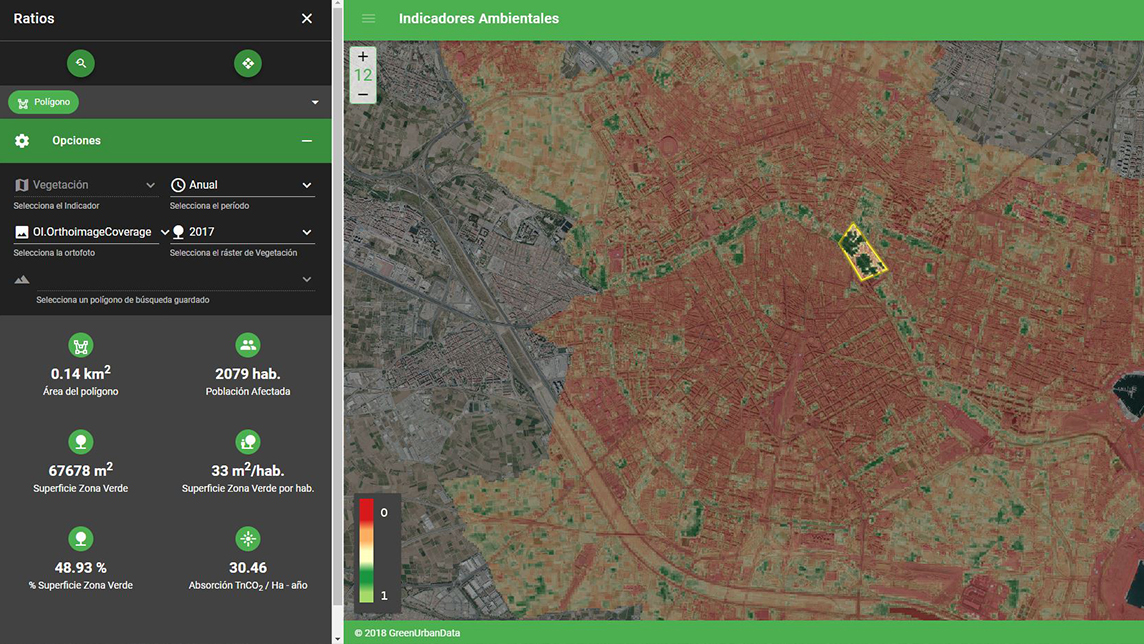

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Sorry, we couldn’t find any matches for“Green for Growth”.