Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Qingdao Haier Venture Capital is the investment arm of China-based electronics manufacturer Haier Group. The Haier SAIF fund was established in September 2014, in partnership with private equity firm SAIF Partners and other investors. The RMB 320m investment fund is managed by SAIF Partners. The fund mainly invests smart home product developers and related sectors like AI, IoT and big data. As of December 2017, it has invested in 16 startups.

Qingdao Haier Venture Capital is the investment arm of China-based electronics manufacturer Haier Group. The Haier SAIF fund was established in September 2014, in partnership with private equity firm SAIF Partners and other investors. The RMB 320m investment fund is managed by SAIF Partners. The fund mainly invests smart home product developers and related sectors like AI, IoT and big data. As of December 2017, it has invested in 16 startups.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Co-founder of AEInnova

José Antonio Molina Rodríguez is a co-founder of AEInnova and was responsible for the development of its first thermoelectric mechanical technology. He has designed more than 100 different machines and mechanical components for multiple industrial applications, including several plants for the manufacture of gypsum plaster. Antonio received the maximum score in a first year program using the finite element method (FEM) for calculations. He also won the PIMEC award for business innovation and internationalization strategy for Catalan SMEs in 2006. He graduated in Mechanics and Technical, Industrial Engineering from the Polytechnic University of Catalonia.

José Antonio Molina Rodríguez is a co-founder of AEInnova and was responsible for the development of its first thermoelectric mechanical technology. He has designed more than 100 different machines and mechanical components for multiple industrial applications, including several plants for the manufacture of gypsum plaster. Antonio received the maximum score in a first year program using the finite element method (FEM) for calculations. He also won the PIMEC award for business innovation and internationalization strategy for Catalan SMEs in 2006. He graduated in Mechanics and Technical, Industrial Engineering from the Polytechnic University of Catalonia.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

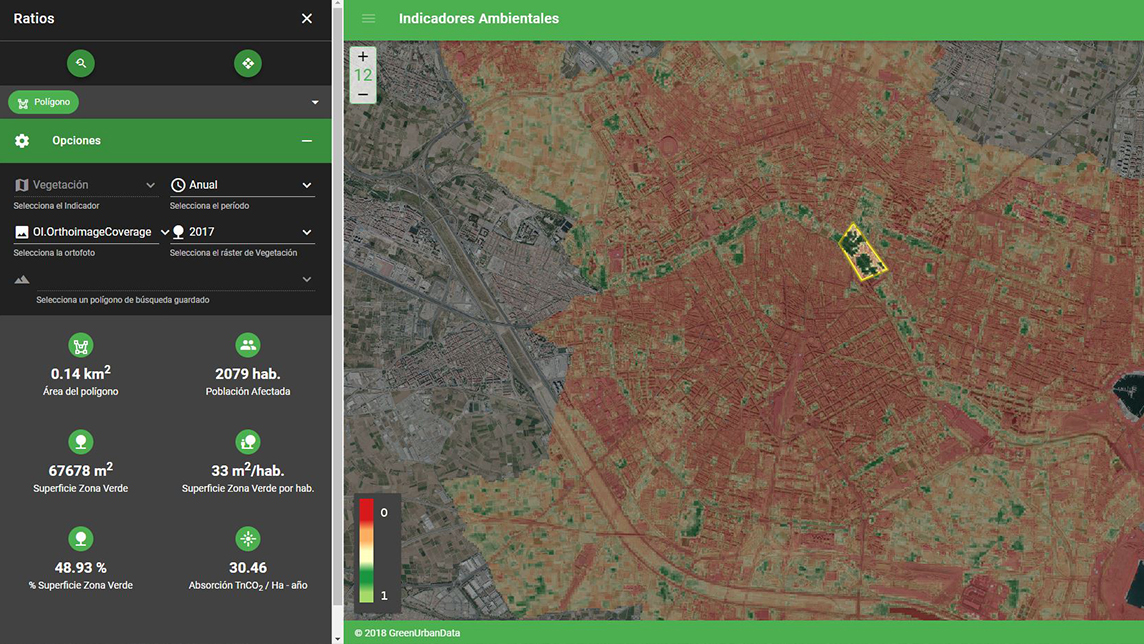

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Sorry, we couldn’t find any matches for“Green for Growth”.