Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Scottish Enterprise, a public arm of the Scottish Government, facilitates investments and economic growth of businesses in the eastern, central, and southern areas of Scotland. Led by Chairman Bob Keiller, Scottish Enterprise fulfills the objectives of the Scottish Government. It employs 1,100 staff across 14 offices in the UK and 33 overseas.Founded in 1975 as the Scottish Development Agency (SDA), it changed into Scottish Enterprise in 1991. Its operative structure was initially formed by Local Enterprise Companies (LECs) with boards led by local entrepreneurs. Since 2000, former limited companies have become wholly-owned subsidiaries of the Scottish Enterprise.Based on its performance report for 2017–2018, Scottish Enterprise has helped portfolio companies with £315m in R&D funds and secured capital investment of £215m.

Scottish Enterprise, a public arm of the Scottish Government, facilitates investments and economic growth of businesses in the eastern, central, and southern areas of Scotland. Led by Chairman Bob Keiller, Scottish Enterprise fulfills the objectives of the Scottish Government. It employs 1,100 staff across 14 offices in the UK and 33 overseas.Founded in 1975 as the Scottish Development Agency (SDA), it changed into Scottish Enterprise in 1991. Its operative structure was initially formed by Local Enterprise Companies (LECs) with boards led by local entrepreneurs. Since 2000, former limited companies have become wholly-owned subsidiaries of the Scottish Enterprise.Based on its performance report for 2017–2018, Scottish Enterprise has helped portfolio companies with £315m in R&D funds and secured capital investment of £215m.

US-based Sovereign's Capital is a private equity and venture capital firm specializing in early growth-stage companies in emerging markets. The company typically invests between US$250,000 and US$2 million.

US-based Sovereign's Capital is a private equity and venture capital firm specializing in early growth-stage companies in emerging markets. The company typically invests between US$250,000 and US$2 million.

Part of the Zero2IPO VC/PE group, Zero2IPO Ventures was founded in 2011. It co-invests and/or co-leads investment in high-growth Chinese firms in all stages.

Part of the Zero2IPO VC/PE group, Zero2IPO Ventures was founded in 2011. It co-invests and/or co-leads investment in high-growth Chinese firms in all stages.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Delong Capital was founded by entrepreneur Ding Liguo. It has branches in Beijing, Hong Kong and Singapore and assets under management worth nearly RMB 10 billion. Delong Capital invests mainly in early- or growth-stage startups from the high-end manufacturing, healthcare, new materials/new energy, artificial intelligence and big data sectors.

Delong Capital was founded by entrepreneur Ding Liguo. It has branches in Beijing, Hong Kong and Singapore and assets under management worth nearly RMB 10 billion. Delong Capital invests mainly in early- or growth-stage startups from the high-end manufacturing, healthcare, new materials/new energy, artificial intelligence and big data sectors.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Founded in 2017, Oceanpine Capital focuses on investment opportunities in the TMT, consumption upgrade, advanced manufacturing, and healthcare sectors. Oceanpine Capital mainly invest in private companies with rapid growth, but also look at some opportunities in public companies. HQ in Hong Kong with offices in Beijing and San Francisco.

Founded in 2017, Oceanpine Capital focuses on investment opportunities in the TMT, consumption upgrade, advanced manufacturing, and healthcare sectors. Oceanpine Capital mainly invest in private companies with rapid growth, but also look at some opportunities in public companies. HQ in Hong Kong with offices in Beijing and San Francisco.

Established in 2013, Danhua Capital is one of the most influential venture capital funds in Silicon Valley. Founded by Chinese Americans, Danhua Capital invests primarily in early-stage and growth-stage startups with disruptive technologies or business models.Founder Zhang Shoucheng is a well-known physicist and a tenured professor at Stanford University.

Established in 2013, Danhua Capital is one of the most influential venture capital funds in Silicon Valley. Founded by Chinese Americans, Danhua Capital invests primarily in early-stage and growth-stage startups with disruptive technologies or business models.Founder Zhang Shoucheng is a well-known physicist and a tenured professor at Stanford University.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 1993, as part of the Consortium of Vigo Free Trade Zone, the firm invests in startups from the Spanish autonomous region of Galicia throughout the seed, growth and acquisition stages. Vigo normally takes minority stakes of 5–40%. It also provides loans and participates in leveraged acquisitions, including management buy-outs, buy-ins or a mixture of both.

Founded in 1993, as part of the Consortium of Vigo Free Trade Zone, the firm invests in startups from the Spanish autonomous region of Galicia throughout the seed, growth and acquisition stages. Vigo normally takes minority stakes of 5–40%. It also provides loans and participates in leveraged acquisitions, including management buy-outs, buy-ins or a mixture of both.

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

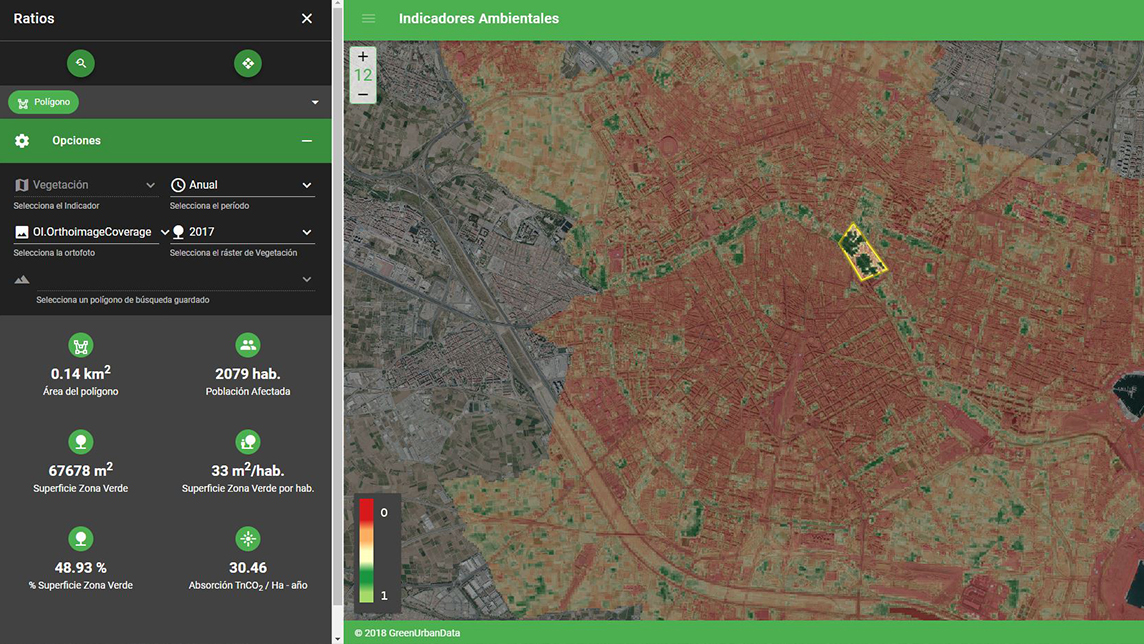

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Sorry, we couldn’t find any matches for“Green for Growth”.