Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Suzhou Industrial Park Bioventure Investment Management Limited (Bioventure) was established in September 2013. It has invested in 50 companies and manages RMB2bn worth of total assets. Bioventure invests mostly in the life sciences and bio-pharmaceutical industries, seeking early-stage startups with high growth potential. Bioventure provides post-investment support and services including funding, business operations and management.

Suzhou Industrial Park Bioventure Investment Management Limited (Bioventure) was established in September 2013. It has invested in 50 companies and manages RMB2bn worth of total assets. Bioventure invests mostly in the life sciences and bio-pharmaceutical industries, seeking early-stage startups with high growth potential. Bioventure provides post-investment support and services including funding, business operations and management.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

As part of Vertex Ventures Holdings, a member of Temasek Holdings and Singapore's oldest and largest venture capital firm, Vertex Ventures China focuses on investment in high-growth internet and technology startups across mainland China. Vertex Ventures Holdings has a capital of US$600 million. It also has offices in Singapore, the US and Israel; and investments in these regions as well as Asia.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Woodford Patient Capital Trust

The Woodford Patient Capital Trust is part of the larger group Woodford Funds. The company is based in Oxford and was formed in 2014, headed by veteran fund manager Neil Woodford. The Patient Capital Trust focuses on early- and early-growth-stage companies, with target returns of more than 10% yearly. The bulk of their portfolio comprises healthcare companies.

The Woodford Patient Capital Trust is part of the larger group Woodford Funds. The company is based in Oxford and was formed in 2014, headed by veteran fund manager Neil Woodford. The Patient Capital Trust focuses on early- and early-growth-stage companies, with target returns of more than 10% yearly. The bulk of their portfolio comprises healthcare companies.

Shenzhen-based Tiantu Capital manages over RMB 6 billion, spread across six RMB-denominated funds and one USD-denominated fund. The 30-plus-strong team also has offices in Shanghai and Beijing. It focuses on growth-stage consumer goods companies, particularly in the Series C round of financing. In 2015, it financed 22 startups, with total funding amounting to RMB 2.5 billion. Tiantu Capital was founded in 2002.

Shenzhen-based Tiantu Capital manages over RMB 6 billion, spread across six RMB-denominated funds and one USD-denominated fund. The 30-plus-strong team also has offices in Shanghai and Beijing. It focuses on growth-stage consumer goods companies, particularly in the Series C round of financing. In 2015, it financed 22 startups, with total funding amounting to RMB 2.5 billion. Tiantu Capital was founded in 2002.

Fides Capital is a private investment group aimed at tech-based B2B startups with scalable business models and products or services already in the market.Fides Capital is part of a larger group Perennius, comprising investment professionals with a focus on financial products, real estate and high growth companies. Success stories funded include Masmovil that has grown into the fourth largest telephone operator in Spain.

Fides Capital is a private investment group aimed at tech-based B2B startups with scalable business models and products or services already in the market.Fides Capital is part of a larger group Perennius, comprising investment professionals with a focus on financial products, real estate and high growth companies. Success stories funded include Masmovil that has grown into the fourth largest telephone operator in Spain.

Founded in 2013, Gaorong Capital is based in Beijing, with an additional office in Hong Kong. It invests primarily in early-stage and growth-stage startups in the TMT sector. Gaorong Capital’s backers include successful entrepreneurs and former investors in other world-class funds. It runs four US$ investment funds, three RMB investment funds and manages around RMB 11 billion.

Founded in 2013, Gaorong Capital is based in Beijing, with an additional office in Hong Kong. It invests primarily in early-stage and growth-stage startups in the TMT sector. Gaorong Capital’s backers include successful entrepreneurs and former investors in other world-class funds. It runs four US$ investment funds, three RMB investment funds and manages around RMB 11 billion.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

Enlightened Hospitality Investments (EHI)

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

With about $2 billion under management, this VC fund invests primarily in early- and growth-stage global companies with substantial businesses in China, namely in the semiconductor, Internet, wireless, new media and cleantech sectors. GSR Ventures has backed Didi, Ele.me, among others, and was involved in the $2.8 billion purchase of an 80% stake in Philips's LED components and automotive business. It has offices in Beijing, Hong Kong and Silicon Valley.

With about $2 billion under management, this VC fund invests primarily in early- and growth-stage global companies with substantial businesses in China, namely in the semiconductor, Internet, wireless, new media and cleantech sectors. GSR Ventures has backed Didi, Ele.me, among others, and was involved in the $2.8 billion purchase of an 80% stake in Philips's LED components and automotive business. It has offices in Beijing, Hong Kong and Silicon Valley.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Seed Capital Bizkaia is a division the Department of Economic and Territorial Development of Bizkaia province. Created in 1991, the seed capital investment fund supports the growth of small businesses with established operations in Spain's Bizkaia region. The firm invests in startups from different business sectors in the form of participatory loans or by contributing up to €300,000, with share participation of up to 45%.

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

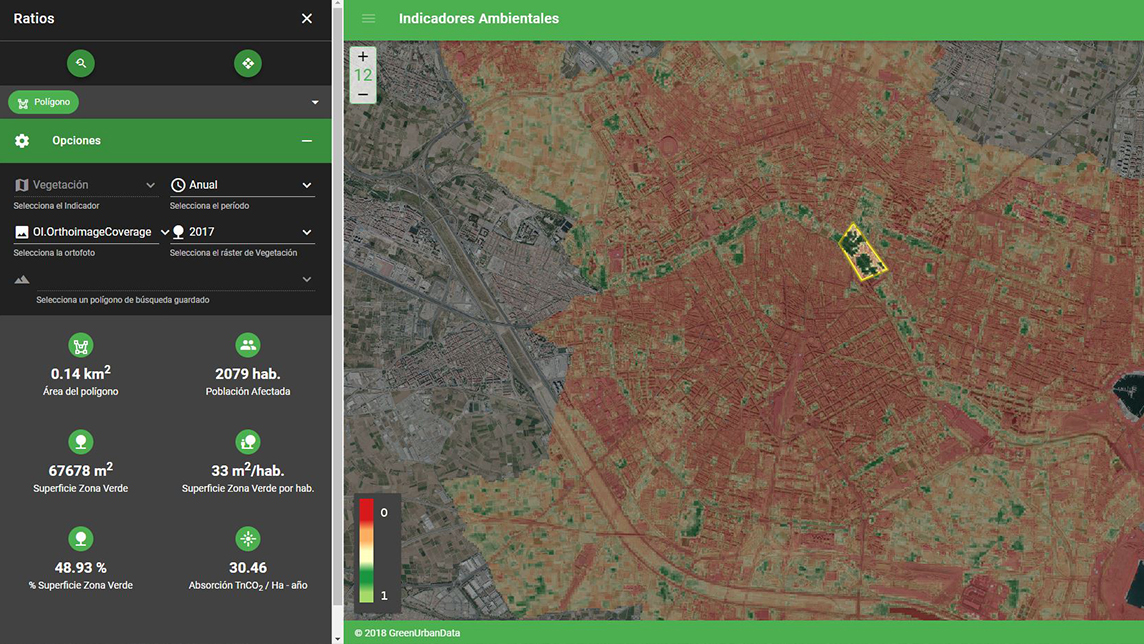

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Sorry, we couldn’t find any matches for“Green for Growth”.