Green for Growth

-

DATABASE (997)

-

ARTICLES (811)

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Former co-founder of Qiscus

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Co-founder of Narasi TV

Dahlia Citra Buana is a veteran in the journalistic and broadcasting world. After graduating from Universitas Gadjah Mada, Indonesia with a bachelor's degree in Politics, she began her career as a radio host and journalist in 2002, working for KBR68H and Green Radio Jakarta. In 2008 she joined Metro TV, eventually becoming the producer of Mata Najwa, a talk show hosted by well-known anchor Najwa Shihab. Together with Najwa, she established the omni-channel media network Narasi TV in 2017. Dahlia officially left Metro TV in 2018.

Dahlia Citra Buana is a veteran in the journalistic and broadcasting world. After graduating from Universitas Gadjah Mada, Indonesia with a bachelor's degree in Politics, she began her career as a radio host and journalist in 2002, working for KBR68H and Green Radio Jakarta. In 2008 she joined Metro TV, eventually becoming the producer of Mata Najwa, a talk show hosted by well-known anchor Najwa Shihab. Together with Najwa, she established the omni-channel media network Narasi TV in 2017. Dahlia officially left Metro TV in 2018.

COO of NutraSign

Rosa López-Monis is a well-known nutrition, food safety and health specialist in southern Spain. She also holds a master's in Nutrition and Dietetics and a master's in Clinical Analysis. She has published health and nutrition books like Green Detox. Since 2007, the molecular biologist and microscopist has been running her own e-commerce site for Health, Wellness and Fitness Más que Dietas. She joined NutraSign as COO in 2018, applying her food safety knowledge to the company's traceability processes and digital applications.

Rosa López-Monis is a well-known nutrition, food safety and health specialist in southern Spain. She also holds a master's in Nutrition and Dietetics and a master's in Clinical Analysis. She has published health and nutrition books like Green Detox. Since 2007, the molecular biologist and microscopist has been running her own e-commerce site for Health, Wellness and Fitness Más que Dietas. She joined NutraSign as COO in 2018, applying her food safety knowledge to the company's traceability processes and digital applications.

Co-founder of Jimaisong

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

Shanshui Investment (Born For Maker Fund)

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

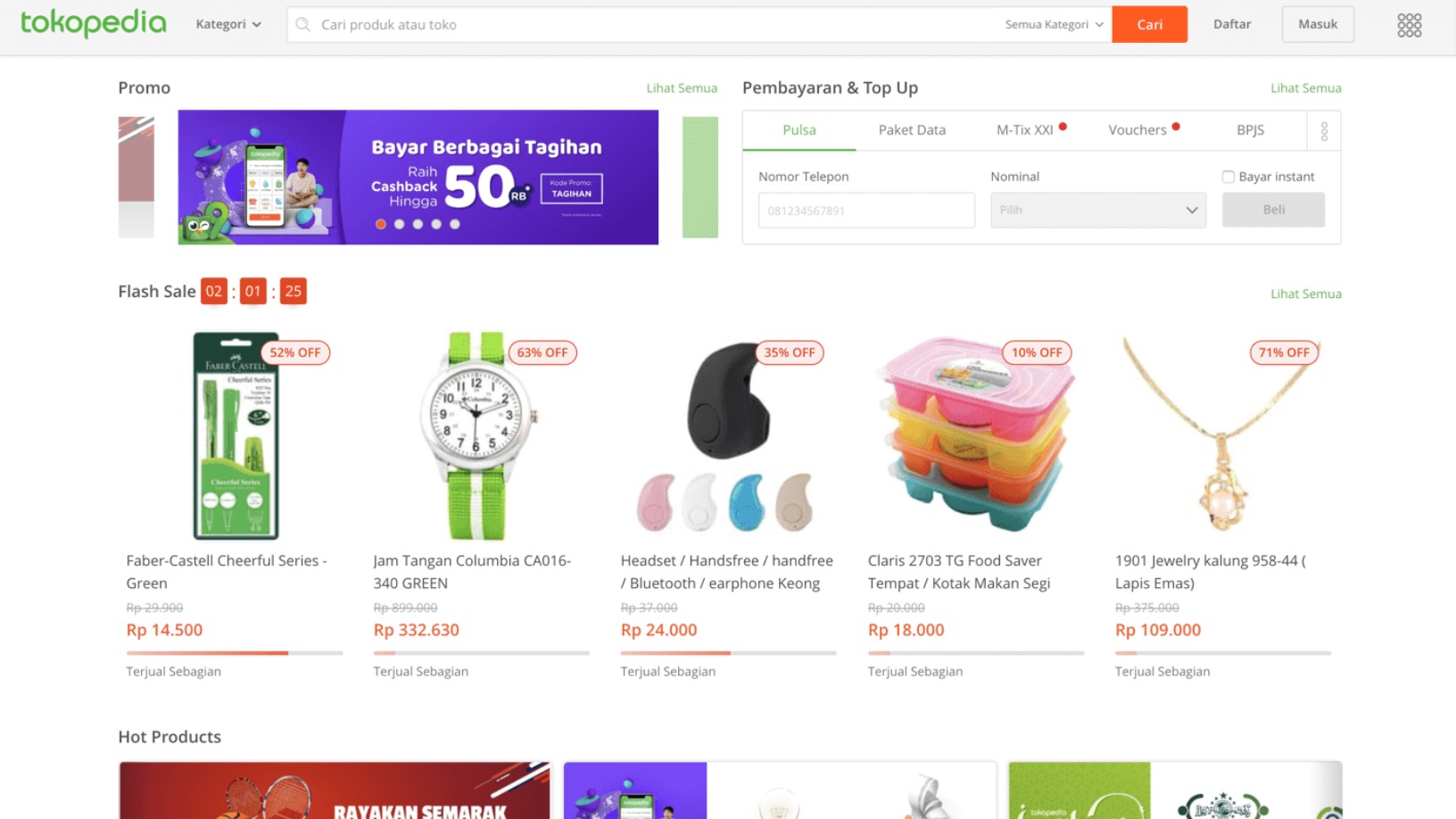

Tokopedia gets hacked, 91m customer records for sale on the dark web

Tokopedia is investigating the breach, and users should change their passwords as soon as possible

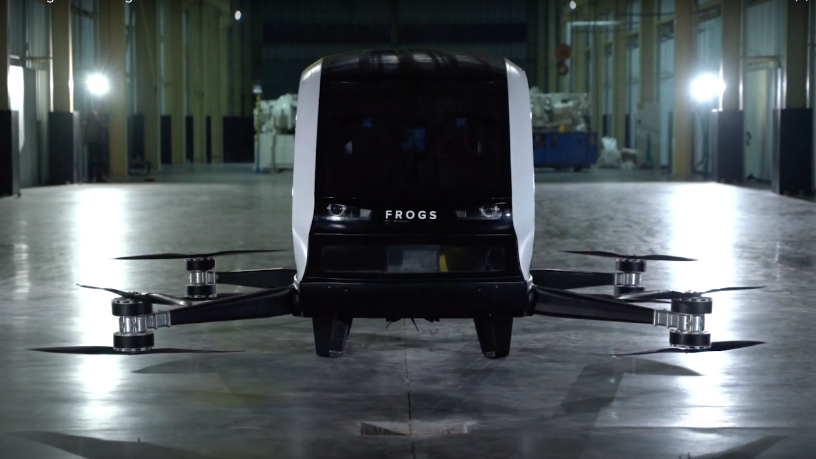

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

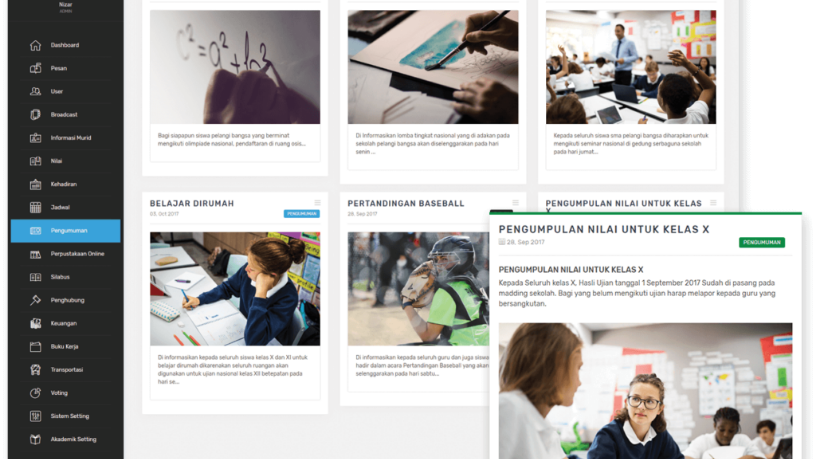

Simak: An integrated edtech platform for Indonesian schools, parents, teachers and students

By connecting all players via its communication and information app, Simak hopes to modernize the Indonesian education system and make it more efficient

P2P lender Investree collaborates with eFishery to provide loans for aquaculture SMEs

Access to quick financing would be a welcome relief to fish farmers, whose incomes have been battered by Covid-19, but can’t get bank loans

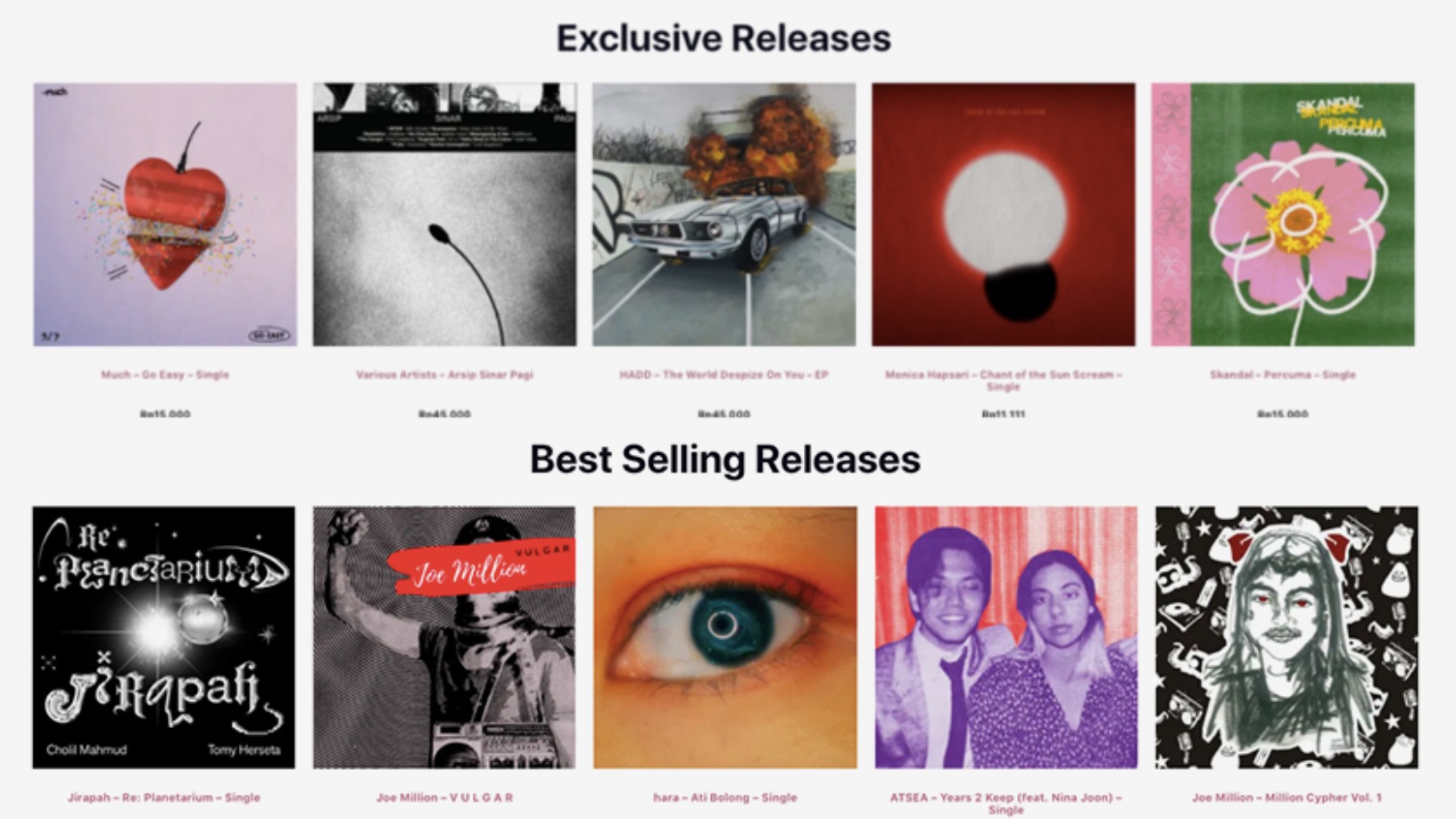

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

HigoSense launching advanced mobile device for self-triage and diagnosis, boosting telemedicine

The Polish medtech has developed a five-in-one diagnostic device for throat, ear, heart checks and more, with diagnosis in four minutes and compatible with diagnostic equipment

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Sorry, we couldn’t find any matches for“Green for Growth”.