Green for Growth

DATABASE (997)

ARTICLES (811)

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Former co-founder of Qiscus

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

Co-founder of Narasi TV

Dahlia Citra Buana is a veteran in the journalistic and broadcasting world. After graduating from Universitas Gadjah Mada, Indonesia with a bachelor's degree in Politics, she began her career as a radio host and journalist in 2002, working for KBR68H and Green Radio Jakarta. In 2008 she joined Metro TV, eventually becoming the producer of Mata Najwa, a talk show hosted by well-known anchor Najwa Shihab. Together with Najwa, she established the omni-channel media network Narasi TV in 2017. Dahlia officially left Metro TV in 2018.

Dahlia Citra Buana is a veteran in the journalistic and broadcasting world. After graduating from Universitas Gadjah Mada, Indonesia with a bachelor's degree in Politics, she began her career as a radio host and journalist in 2002, working for KBR68H and Green Radio Jakarta. In 2008 she joined Metro TV, eventually becoming the producer of Mata Najwa, a talk show hosted by well-known anchor Najwa Shihab. Together with Najwa, she established the omni-channel media network Narasi TV in 2017. Dahlia officially left Metro TV in 2018.

COO of NutraSign

Rosa López-Monis is a well-known nutrition, food safety and health specialist in southern Spain. She also holds a master's in Nutrition and Dietetics and a master's in Clinical Analysis. She has published health and nutrition books like Green Detox. Since 2007, the molecular biologist and microscopist has been running her own e-commerce site for Health, Wellness and Fitness Más que Dietas. She joined NutraSign as COO in 2018, applying her food safety knowledge to the company's traceability processes and digital applications.

Rosa López-Monis is a well-known nutrition, food safety and health specialist in southern Spain. She also holds a master's in Nutrition and Dietetics and a master's in Clinical Analysis. She has published health and nutrition books like Green Detox. Since 2007, the molecular biologist and microscopist has been running her own e-commerce site for Health, Wellness and Fitness Más que Dietas. She joined NutraSign as COO in 2018, applying her food safety knowledge to the company's traceability processes and digital applications.

Co-founder of Jimaisong

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

Shanshui Investment (Born For Maker Fund)

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Huidu Environmental: Creating a circular economy to ease online retail's parcel waste woes

China's billion-dollar courier industry finds much-needed solution in Huidu's eco-friendly, low-cost boxes and smart recycling system

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

This e-retailer uses influencers to sell niche brand cosmetics in high-growth markets

Huajuan Mall is a popular makeup e-mall for young women in smaller Chinese cities, turning little-known local brands into big hits

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

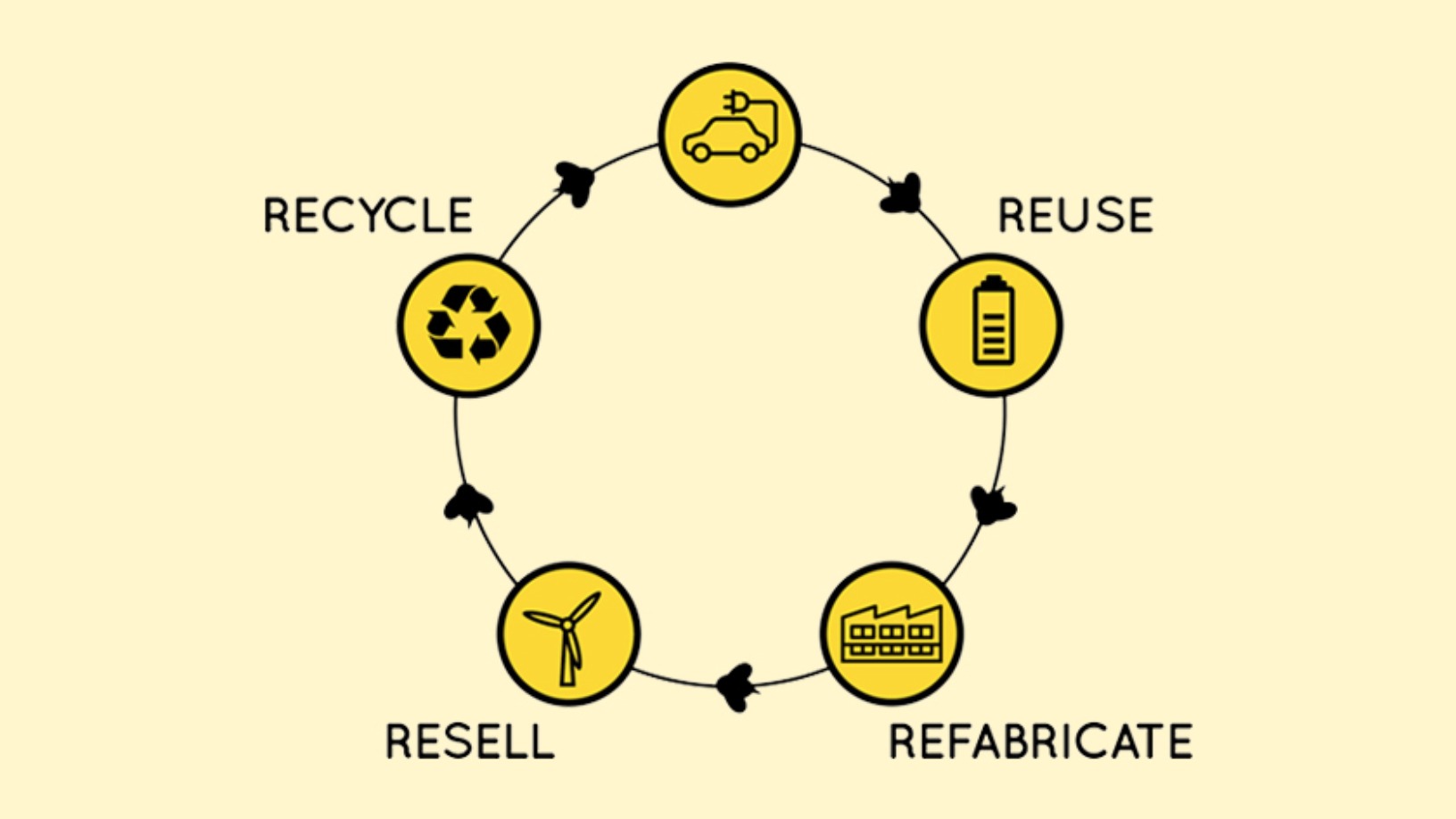

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

CoRTP: Building sustainable supply chains with returnable packaging

The Shanghai-based startup’s award-winning returnable transit packaging reduced carbon emissions in 2020 by 250,000 tons, and the figure is estimated to reach 8m by 2030

Sorry, we couldn’t find any matches for“Green for Growth”.