Greenwoods Investment

-

DATABASE (717)

-

ARTICLES (367)

Founded in 2010, Greenwoods Investment has invested in over 60 startups, with three RMB-denominated PE funds and two USD PE funds under management.

Founded in 2010, Greenwoods Investment has invested in over 60 startups, with three RMB-denominated PE funds and two USD PE funds under management.

Focused on helping young professionals learn to manage their finances, Halofina is a mobile app that gives users investment recommendations and portfolio tracking.

Focused on helping young professionals learn to manage their finances, Halofina is a mobile app that gives users investment recommendations and portfolio tracking.

Bareksa’s low-cost trading platform targets Indonesia’s masses, offering an expanding range of innovative investment products, supported by strong distribution and financial services partners.

Bareksa’s low-cost trading platform targets Indonesia’s masses, offering an expanding range of innovative investment products, supported by strong distribution and financial services partners.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Pioneering crowdfunding company lets individuals invest as little as €500 in renewable energy projects, previously open only to energy companies and financial entities.

Pioneering crowdfunding company lets individuals invest as little as €500 in renewable energy projects, previously open only to energy companies and financial entities.

Tigris Investment is a South Korean private equity firm.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Goldstone Investment was founded in 2007. It is a branch company of CITIC Securities.

Goldstone Investment was founded in 2007. It is a branch company of CITIC Securities.

SDP Investment was founded in 2017 by Chi Miao, former Warburg Pincus head of real estate for Asia. It is a real estate investment management firm focusing on acquisition of prime properties in Tier 1 cities in China. The firm also invests in real estate-related areas including logistics, data center and cloud service.

SDP Investment was founded in 2017 by Chi Miao, former Warburg Pincus head of real estate for Asia. It is a real estate investment management firm focusing on acquisition of prime properties in Tier 1 cities in China. The firm also invests in real estate-related areas including logistics, data center and cloud service.

Headquartered in Hangzhou, Qianran Investment was founded in December 2014. It invests mainly in artificial intelligence, entertainment and art sectors.

Headquartered in Hangzhou, Qianran Investment was founded in December 2014. It invests mainly in artificial intelligence, entertainment and art sectors.

Shangwan Investment was founded in February 2011 in Shenzhen, a major city in southeastern China.

Shangwan Investment was founded in February 2011 in Shenzhen, a major city in southeastern China.

Zhan Investment was founded in 2015 in Guangzhou.

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Treasury: Bringing gold savings to millennials

Gold savings online platform Treasury targets a younger demographic with its playful and contemporary branding

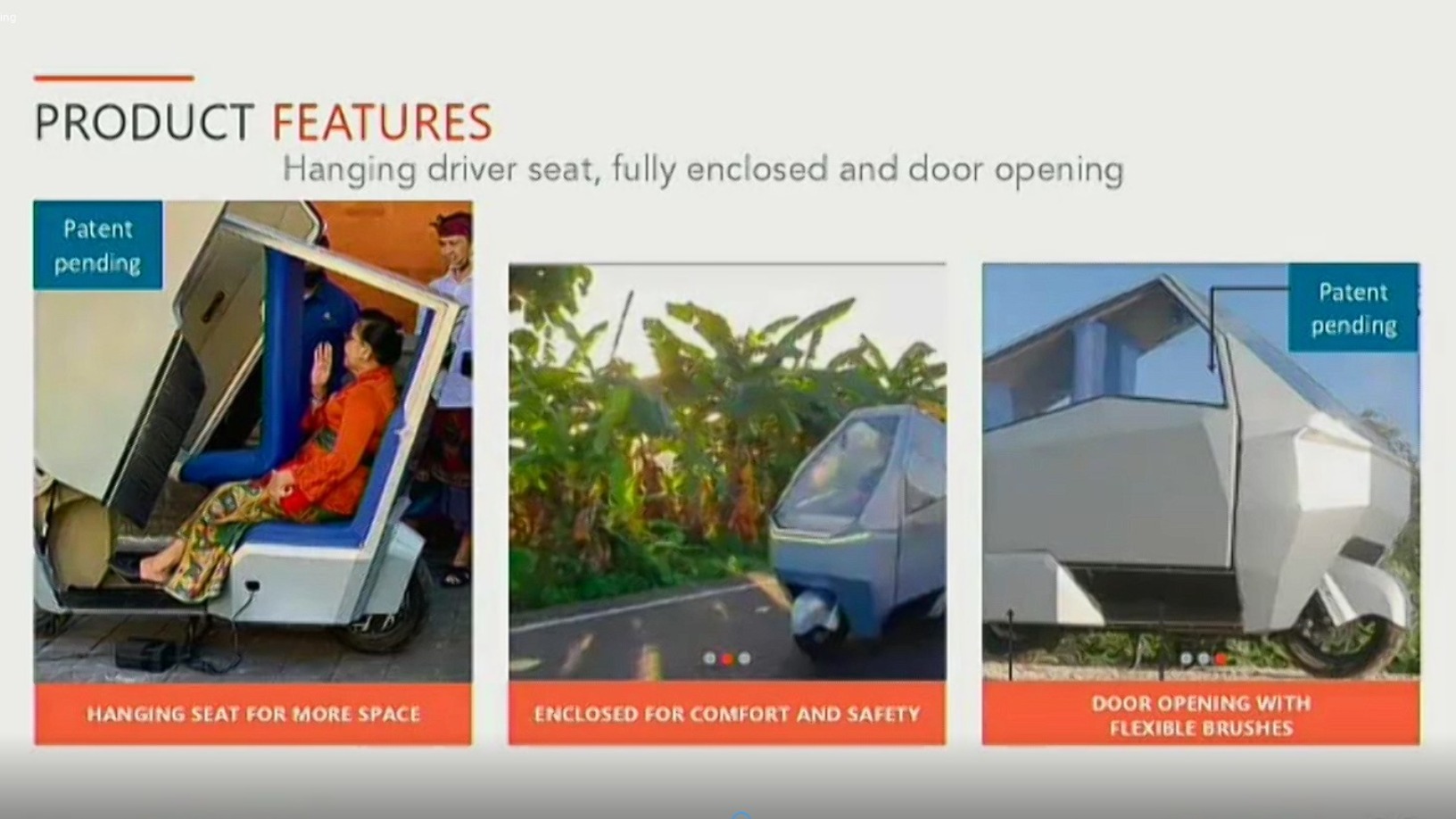

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

China bets on road-vehicle coordination for the mass adoption of autonomous driving cars by 2025

Money pours in as China pushes sector to be the next growth engine, and both self-driving startups and their investors are optimistic about their commercialization attempts

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Lesielle: Award-winning personalized cosmetics that adapt to changing skincare needs

This Spanish AI-powered device combines with a mobile app to track the daily condition of your skin and tailor-make cosmetics for each customer

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Sorry, we couldn’t find any matches for“Greenwoods Investment”.