Grow Asia

-

DATABASE (182)

-

ARTICLES (391)

CEO and founder of Swan Daojia (formerly 58 Daojia)

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

DX Ventures is the Berlin-based investment vehicle of on-demand app unicorn Delivery Hero. The VC currently has 12 startups in its portfolio including EU rival Glovo. It also invests in social commerce and on-demand delivery startups in Latin America like Facily and Rappi.Investments in September 2021 include participation in the $43m Series B round of British food-sharing app OLIO and $5m Series A funding round for Toku, a Singapore-based startup and Asia Pacific’s dedicated cloud communications provider. It also invested in Leipzig-based sustainable foodtech, the nu company, that produces vegan chocolates and organic proteins.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Chow Tai Fook Jewellery Group Limited

Hong Kong-based Chow Tai Fook Jewellery Group Limited was founded as a jewelry store in Guangzhou in 1929. Listed on the Stock Exchange of Hong Kong in December 2011, it is one of the world's largest jewelry companies, with total assets of around US$8 billion. The Group owns several jewelry brands, including Chow Tai Fook, Chow Tai Fook T MARK, Hearts On Fire, MONOLOGUE and SOINLOVE, and operates a retail network in East Asia and the US. The Group invests in other firms through its VMS Legend Investment Fund, which has funded companies from fields such as fintech, hardware, healthcare, streaming media and cloud.

Hong Kong-based Chow Tai Fook Jewellery Group Limited was founded as a jewelry store in Guangzhou in 1929. Listed on the Stock Exchange of Hong Kong in December 2011, it is one of the world's largest jewelry companies, with total assets of around US$8 billion. The Group owns several jewelry brands, including Chow Tai Fook, Chow Tai Fook T MARK, Hearts On Fire, MONOLOGUE and SOINLOVE, and operates a retail network in East Asia and the US. The Group invests in other firms through its VMS Legend Investment Fund, which has funded companies from fields such as fintech, hardware, healthcare, streaming media and cloud.

Evolution Media China (EMC) was founded in Beijing by Evolution Media Partners, the investment arm of American talent and sports agency Creative Artists Agency and Evolution Media Capital, in early 2016. EMC currently manages a total of US$350 million in assets. The firm invests primary in startups with potential from the Asia-Pacific region, with a focus on China, in sectors such as media, entertainment, sports, advertising and lifestyle.

Evolution Media China (EMC) was founded in Beijing by Evolution Media Partners, the investment arm of American talent and sports agency Creative Artists Agency and Evolution Media Capital, in early 2016. EMC currently manages a total of US$350 million in assets. The firm invests primary in startups with potential from the Asia-Pacific region, with a focus on China, in sectors such as media, entertainment, sports, advertising and lifestyle.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

TreeFrog Therapeutics: Mimicking how stem cells grow in the human body

The French biotech’s proprietory technology to cultivate pluripotent stem cells in a 3D environment can be scaled to mass-produce high-quality cells to treat diseases such as Parkinson’s

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Singrow to start selling Singapore-grown strawberries in March, plans $15m Series A this year

Singrow also plans to offer locally grown produce across Southeast Asia, starting with strawberries farmed in energy-efficient greenhouses

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

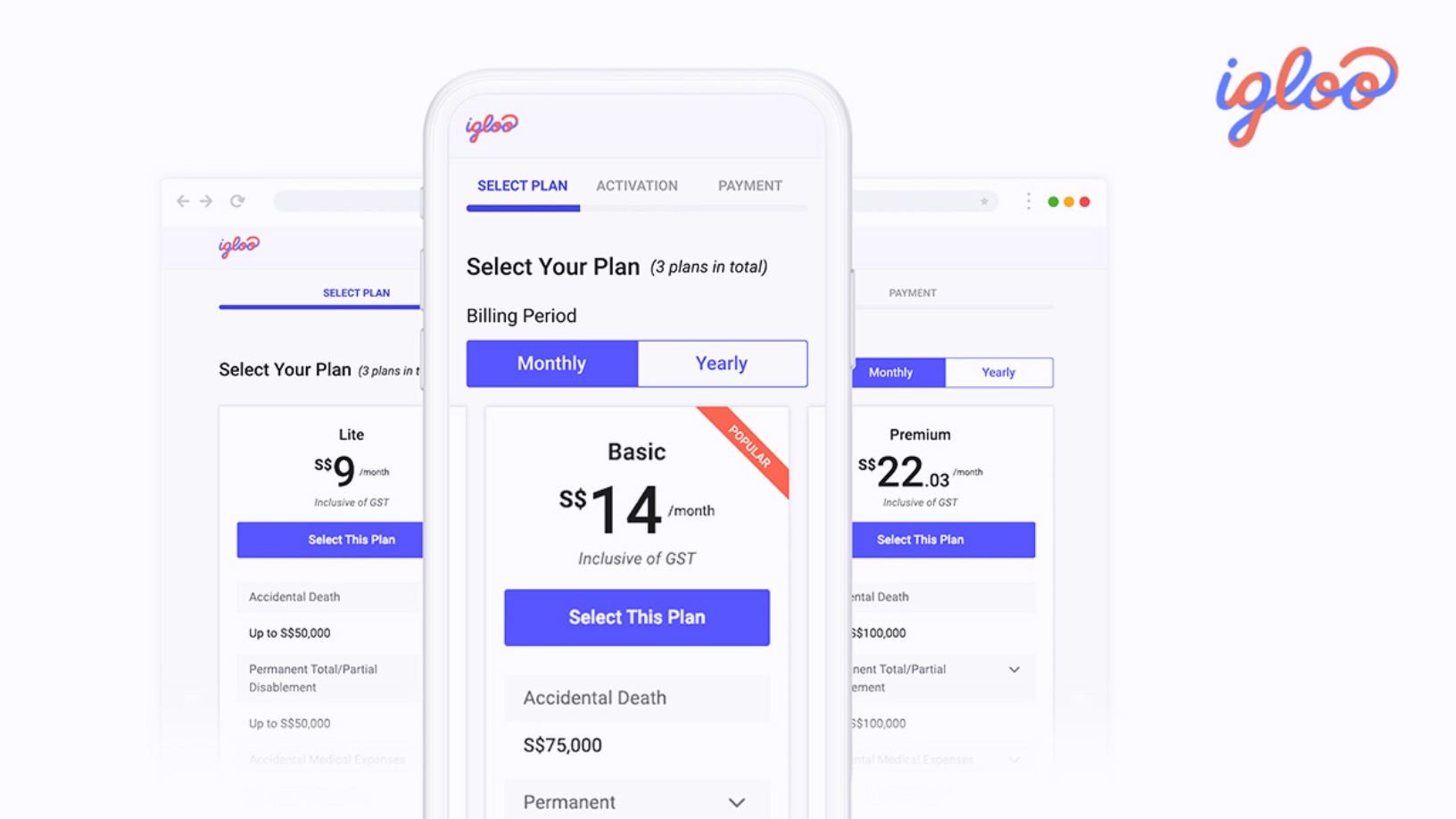

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

From Porto to Phnom Penh: Last2Ticket expands to Asia

Their first stop is Cambodia, where tourism-related ticketing is big business yet underserved by technology. Emilía Simões, founder and CEO of the Portuguese e-ticketing startup, tells us more

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Sorry, we couldn’t find any matches for“Grow Asia”.