Health food

-

DATABASE (307)

-

ARTICLES (378)

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Co-founder, CEO of Mediktor

In 2009, Cristian Pascual became a business angel at Let's Bonus and Audience Media in Spain. He also became a business angel at Antai Venture Builder in 2012 and joined as board member in 2018. The co-founder and CEO of Mediktor is also the president of Barcelona Health Hub.The engineering graduate has an MBA from ESADE Business School. In 1996, he became a board member of Greens Power Products, the distributor for Honda power products in Spain. Pascual spent 18 years working at his family's business Europastry that also invested in Let's Bonus.

In 2009, Cristian Pascual became a business angel at Let's Bonus and Audience Media in Spain. He also became a business angel at Antai Venture Builder in 2012 and joined as board member in 2018. The co-founder and CEO of Mediktor is also the president of Barcelona Health Hub.The engineering graduate has an MBA from ESADE Business School. In 1996, he became a board member of Greens Power Products, the distributor for Honda power products in Spain. Pascual spent 18 years working at his family's business Europastry that also invested in Let's Bonus.

Co-founder of Meatable

Mark Kotter is the Austrian co-founder at Dutch cell-based meat startup Meatable, the first to use pluripotent stem cells and claim a highly scalable culture technology, which was developed by Kotter prior to founding the startup in 2018. He is also founder at his biotech startup, bit.bio, which is based in Cambridge, UK, since 2016, where he applies his cellular technological innovation to human stem cell research and has raised investments totaling $42m. His main full-time position is at the University of Cambridge, where he has worked since 2009. He has spent more than five years as a clinician-scientist in stem cell research and was previously a lecturer in neurosurgery. Kotter also lectures at Paris Descartes University and is a team leader at the UK’s National Institute for Health Research’s Brain Injury MedTech Co-operative. He also founded Myelopathy.org to raise awareness of cervical myelopathy. His past positions were as a research group leader at the Max Planck Institute for Experimental Medicine for one year, and for two years spent at the Medical University of Vienna. Kotter holds two doctorates; one in philosophy from the University of Cambridge and the other in medicine from the University of Graz in Austria. Kotter also holds a master’s in philosophy from the University of Cambridge.

Mark Kotter is the Austrian co-founder at Dutch cell-based meat startup Meatable, the first to use pluripotent stem cells and claim a highly scalable culture technology, which was developed by Kotter prior to founding the startup in 2018. He is also founder at his biotech startup, bit.bio, which is based in Cambridge, UK, since 2016, where he applies his cellular technological innovation to human stem cell research and has raised investments totaling $42m. His main full-time position is at the University of Cambridge, where he has worked since 2009. He has spent more than five years as a clinician-scientist in stem cell research and was previously a lecturer in neurosurgery. Kotter also lectures at Paris Descartes University and is a team leader at the UK’s National Institute for Health Research’s Brain Injury MedTech Co-operative. He also founded Myelopathy.org to raise awareness of cervical myelopathy. His past positions were as a research group leader at the Max Planck Institute for Experimental Medicine for one year, and for two years spent at the Medical University of Vienna. Kotter holds two doctorates; one in philosophy from the University of Cambridge and the other in medicine from the University of Graz in Austria. Kotter also holds a master’s in philosophy from the University of Cambridge.

Co-founder, CCO of Cocuus

Patxi Larumbe is the Spanish CCO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Larumbe founded and directed eight other companies, the majority, like Cocuus, also based in Pamplona, Navarre. During his extensive entrepreneurial career, Larumbe had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Before Cocuus, he was a director at his building materials distribution company, On Clima, for two years, which was preceded by a two-year stint heading up Tohama, an IoT tech developer for Somfy products. Prior to that, he was commercial director for 20 years at building services company Terradisa and also founded its Catalonia offices.From 2000–2013, Larumbe was the founder and board member at Acustica Arquitectonica, an acoustic architectural design company and from 1995–2005, he had the same responsibilities at his hospitality company, Ostatu Zaharra. Other companies he founded were were Render (1990–96), Netcorp Factory (1996–2000) and No Solo Futbol ("Not Just Soccer") (2000–2004). Larumbe studied electronics at first degree level in Pamplona.

Patxi Larumbe is the Spanish CCO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Larumbe founded and directed eight other companies, the majority, like Cocuus, also based in Pamplona, Navarre. During his extensive entrepreneurial career, Larumbe had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Before Cocuus, he was a director at his building materials distribution company, On Clima, for two years, which was preceded by a two-year stint heading up Tohama, an IoT tech developer for Somfy products. Prior to that, he was commercial director for 20 years at building services company Terradisa and also founded its Catalonia offices.From 2000–2013, Larumbe was the founder and board member at Acustica Arquitectonica, an acoustic architectural design company and from 1995–2005, he had the same responsibilities at his hospitality company, Ostatu Zaharra. Other companies he founded were were Render (1990–96), Netcorp Factory (1996–2000) and No Solo Futbol ("Not Just Soccer") (2000–2004). Larumbe studied electronics at first degree level in Pamplona.

Co-founder, COO of Cocuus

Daniel Rico Aldaz is the Spanish COO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Rico founded an industrial design company, Rico Ingenio, which was established in 2009, where he continues to be a founding partner.His last full-time position before Cocuus was at systems automation company Kaizen for less than a year, where he headed up the technical office. Prior to that, Rico briefly led the computer-to-plate (CTP) and quality control departments at printers Estellaprint. For 15 years, until 2016, Rico was founder at his own industrial design company El Seis Y El Cuatro.Rico’s varied career has also seen him as head designer of children's parks and gyms at Mader Play, as an IT teacher at a worker’s foundation and as both a graphic and an artistic designer in two communication agencies and a lighting company. During his career, Rico has had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Rico did not attend university. He studied music and design at high school.

Daniel Rico Aldaz is the Spanish COO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Rico founded an industrial design company, Rico Ingenio, which was established in 2009, where he continues to be a founding partner.His last full-time position before Cocuus was at systems automation company Kaizen for less than a year, where he headed up the technical office. Prior to that, Rico briefly led the computer-to-plate (CTP) and quality control departments at printers Estellaprint. For 15 years, until 2016, Rico was founder at his own industrial design company El Seis Y El Cuatro.Rico’s varied career has also seen him as head designer of children's parks and gyms at Mader Play, as an IT teacher at a worker’s foundation and as both a graphic and an artistic designer in two communication agencies and a lighting company. During his career, Rico has had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Rico did not attend university. He studied music and design at high school.

Co-founder, CTO of Meatable

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

COO and co-founder of OLIO

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

Saasha Celestial-One is the American-born COO and co-founder of zero food waste app OLIO. Celestial-One, a name chosen by her hippy parents in rural Iowa, went on to work as an analyst at Morgan Stanley after graduating in economics at the University of Chicago in 1998. She started an MBA program at Stanford University Graduate School of Business in 2002 where she met OLIO’s British co-founder Tessa Clarke.The American banker joined McKinsey & Co in 2003 as an associate in New York and managed to get a transfer to work at McKinsey in London in 2005 when her boyfriend went to study at Cambridge University in England. In 2007, she became VP of business development for American Express. She left Amex in June 2013 and co-founded My Crèche in London as CEO of the pay-as-you-go childcare service. Both OLIO co-founders were mums with young children in North London when they decided to pool together their savings to develop the OLIO app in 2015.

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Gorry Holdings: Promoting staff wellness in Indonesia

The healthtech startup wants companies to understand how healthy employees can translate into good business

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

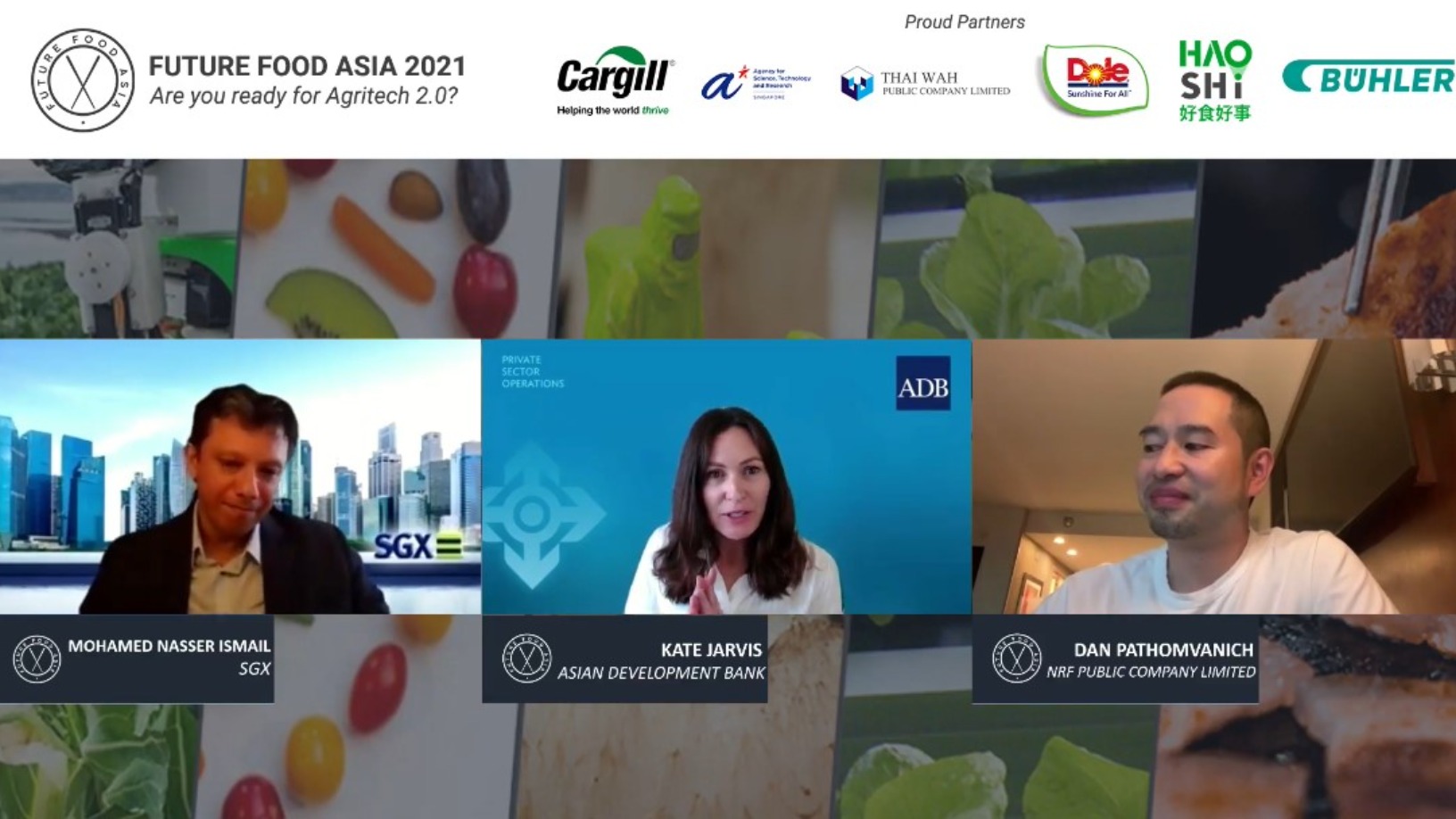

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

SWORD Health: Reinventing the wheel for physiotherapy

AI-powered healthcare tech brings relief to overworked and understaffed physiotherapy providers

Benergy: A new app to track gut health with smart data

The Benergy app allows results to be shared with doctors to facilitate diagnosis and includes swap tests

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Sorry, we couldn’t find any matches for“Health food”.