Home Credit

-

DATABASE (136)

-

ARTICLES (315)

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

From China, Clever Home to build “Home Depot” marts in Africa

Combining B2B2C and O2O models, Clever Home is turning its 40,000sqm trade center in Nigeria into the "Yiwu marketplace" for Chinese companies looking to set up shop in Africa

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

HomeRun: IoT devices for home-alone pets

Founded by a pet owner who worried about leaving his dog alone at home, HomeRun is chalking up big sales in China's billion-dollar pet care market

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Covid-19: Indonesia's P2P lenders ready for slower business, default risk

P2P lending startups set up stricter scrutiny, budget reserves; playing key role in helping Indonesian businesses survive the Covid-19 crisis

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

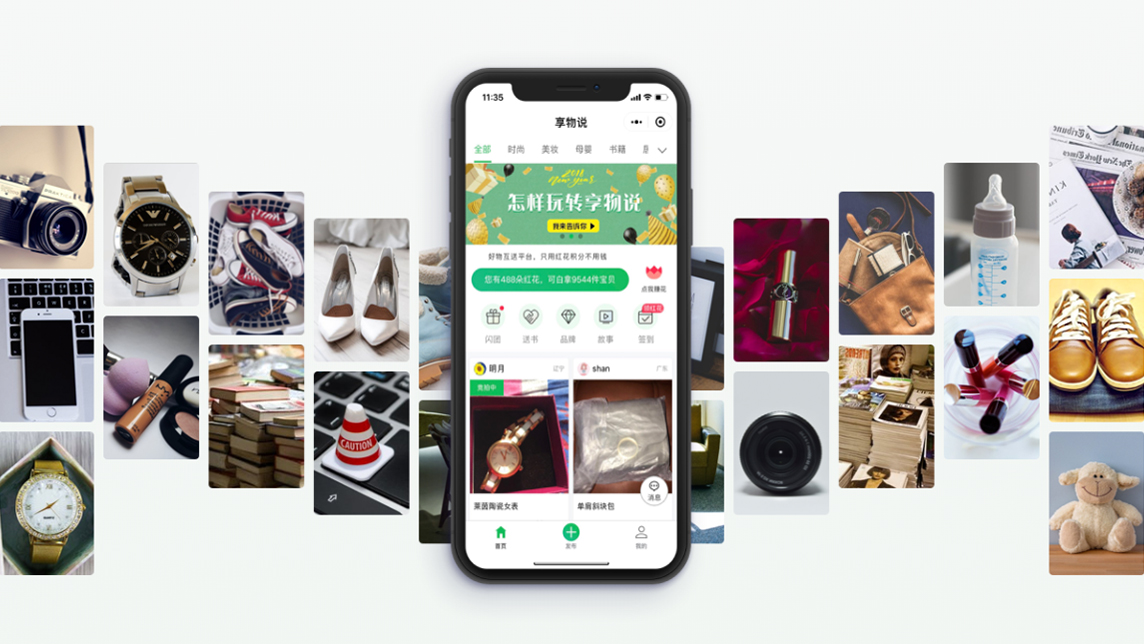

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Sorry, we couldn’t find any matches for“Home Credit”.