Home Credit

-

DATABASE (136)

-

ARTICLES (315)

A members-only platform offering goods and services in lower-tier cities, Blackfish gained 400,000 subscribers and raised RMB 1.3bn just nine months after launch.

A members-only platform offering goods and services in lower-tier cities, Blackfish gained 400,000 subscribers and raised RMB 1.3bn just nine months after launch.

Co-founder, CEO of Sheetgo

Based in Spain since 2016, Yannick Rault van der Vaart is a Brazilian entrepreneur with diverse work experiences in USA, Latin America and Europe. The co-founder and CEO of Sheetgo is also a board member of Impact Hub Network that runs co-working spaces in Spain and Brazil.In 2006, the graduate from the University of Miami co-founded EsMiHogar to help immigrants finance property purchases back home. In 2007, he helped Spanish company Inmoferrocarril to launch 7,600 social home mixed-use urban development "Esmihogar". In 2008, he co-founded Abramar to build low income, environment-friendly residential buildings and neighborhoods in Brazil.

Based in Spain since 2016, Yannick Rault van der Vaart is a Brazilian entrepreneur with diverse work experiences in USA, Latin America and Europe. The co-founder and CEO of Sheetgo is also a board member of Impact Hub Network that runs co-working spaces in Spain and Brazil.In 2006, the graduate from the University of Miami co-founded EsMiHogar to help immigrants finance property purchases back home. In 2007, he helped Spanish company Inmoferrocarril to launch 7,600 social home mixed-use urban development "Esmihogar". In 2008, he co-founded Abramar to build low income, environment-friendly residential buildings and neighborhoods in Brazil.

Co-founder and COO of Blackfish

Wang joined Blackfish as co-founder and COO in 2017. Prior to joining Blackfish, he was president and co-founder of Quark Finance, a company focused on consumer lending and wealth management. Wang has also worked at CreditEase, a Chinese wealth management firm, as well as BNP Paribas and BBVA. He has more than a decade of experience in credit strategy, risk modeling, anti-fraud operations and post-loan management.

Wang joined Blackfish as co-founder and COO in 2017. Prior to joining Blackfish, he was president and co-founder of Quark Finance, a company focused on consumer lending and wealth management. Wang has also worked at CreditEase, a Chinese wealth management firm, as well as BNP Paribas and BBVA. He has more than a decade of experience in credit strategy, risk modeling, anti-fraud operations and post-loan management.

Co-founder of Coinscrap

Diego Gonzalez is a Galician engineer and entrepreneur with more than 15 years' experience in the financial services industry. In 2015, he co-founded Sensitrade, a revolutionary technology that captures stock market sentiment from social networks to predict stock exchange evolution with a success rate of 87%.In 2016, he co-founded Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro.

Diego Gonzalez is a Galician engineer and entrepreneur with more than 15 years' experience in the financial services industry. In 2015, he co-founded Sensitrade, a revolutionary technology that captures stock market sentiment from social networks to predict stock exchange evolution with a success rate of 87%.In 2016, he co-founded Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Co-founder of Tonic App

Christophe de Kalbermatten is the Swiss-born co-founder of Tonic App for medical doctors, which he co-founded in 2016 after meeting the co-founding team on an MBA course at IE Business School in Madrid. He has worked at Credit Suisse for more than 12 years in various capacities related to foreign exchange and is currently the head of its Geneva Trading Floor. Prior to starting work, he gained a BSc at the University of Lausanne's Faculty of Business and Economics in Switzerland.

Christophe de Kalbermatten is the Swiss-born co-founder of Tonic App for medical doctors, which he co-founded in 2016 after meeting the co-founding team on an MBA course at IE Business School in Madrid. He has worked at Credit Suisse for more than 12 years in various capacities related to foreign exchange and is currently the head of its Geneva Trading Floor. Prior to starting work, he gained a BSc at the University of Lausanne's Faculty of Business and Economics in Switzerland.

Chief Mobile Officer and co-founder of Coinscrap

Juan Carlos López is a software engineer specializing in mobile applications. He worked for many years as an iOS Developer. In 2015, he co-founded Sensitrade, a revolutionary technology that captures sentiment about the stock market from social networks, predicting stock exchange evolution with a 87% success rate.A year later, with the same business partners, he co-founded Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro. He is currently Coinscrap's Chief Mobile Officer.

Juan Carlos López is a software engineer specializing in mobile applications. He worked for many years as an iOS Developer. In 2015, he co-founded Sensitrade, a revolutionary technology that captures sentiment about the stock market from social networks, predicting stock exchange evolution with a 87% success rate.A year later, with the same business partners, he co-founded Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro. He is currently Coinscrap's Chief Mobile Officer.

Beijing Easyhome Investment Holdings Group Co., Ltd. was established in 1999. Its main business is home furnishing. Easyhome also works in intelligent logistics, financial services, overseas e-commerce and digital intelligence. In 2017, Easyhome earned sales revenue of more than RMB 60 billion.

Beijing Easyhome Investment Holdings Group Co., Ltd. was established in 1999. Its main business is home furnishing. Easyhome also works in intelligent logistics, financial services, overseas e-commerce and digital intelligence. In 2017, Easyhome earned sales revenue of more than RMB 60 billion.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Co-founder, CTO and Head of Product of James

A computer scientist with nearly a decade of experience, Sam Hopkins received his bachelor’s degree in Computer Science from the University of New Mexico. He started his career in the United States, as a software engineer for Flashgroup in Greater Pittsburgh Area. Hopkins moved to Portugal in 2014 to work at GetSocial.io, and then Unbabel. In 2015, he became the third co-founder of CrowdProcess, the producers of James credit risk assessment platform, where he worked as CTO until September 2017. Since then, he co-founded DareData Engineering and Lisbon Data Science Academy.

A computer scientist with nearly a decade of experience, Sam Hopkins received his bachelor’s degree in Computer Science from the University of New Mexico. He started his career in the United States, as a software engineer for Flashgroup in Greater Pittsburgh Area. Hopkins moved to Portugal in 2014 to work at GetSocial.io, and then Unbabel. In 2015, he became the third co-founder of CrowdProcess, the producers of James credit risk assessment platform, where he worked as CTO until September 2017. Since then, he co-founded DareData Engineering and Lisbon Data Science Academy.

Co-founder and Chief Credit Officer of Akseleran

Christopher Gultom worked as a consultant for four years before establishing P2P lending firm Akseleran. In 2013, after graduating with a Bachelor's in Economics from Universitas Gadjah Mada, he started work at Arghajata Consulting as an associate. He left Arghajata in 2015 and joined AJCapital Advisory as a senior consultant. When he and fellow co-founders started developing Akseleran in 2016, he took on the role as CFO. However, after launching Akseleran and leaving AJCapital in April 2017, he became Akseleran's Chief Investment Officer while Mikhail Tambunan stepped into the CFO role. In September 2017, he became Akseleran's Chief Credit Officer.

Christopher Gultom worked as a consultant for four years before establishing P2P lending firm Akseleran. In 2013, after graduating with a Bachelor's in Economics from Universitas Gadjah Mada, he started work at Arghajata Consulting as an associate. He left Arghajata in 2015 and joined AJCapital Advisory as a senior consultant. When he and fellow co-founders started developing Akseleran in 2016, he took on the role as CFO. However, after launching Akseleran and leaving AJCapital in April 2017, he became Akseleran's Chief Investment Officer while Mikhail Tambunan stepped into the CFO role. In September 2017, he became Akseleran's Chief Credit Officer.

Founder and CEO of Wendy's Choice

Former editor-in-chief at Trends Media Group (publisher of Harper’s Bazaar, Cosmopolitan, Trends Home in China), where she was the publisher and editor-in-chief of “Good Housekeeper” and “Good Housekeeping” for eight years. Wen Jie graduated from the Beijing Institute of Fashion Technology and Kent State University (media studies), USA.

Former editor-in-chief at Trends Media Group (publisher of Harper’s Bazaar, Cosmopolitan, Trends Home in China), where she was the publisher and editor-in-chief of “Good Housekeeper” and “Good Housekeeping” for eight years. Wen Jie graduated from the Beijing Institute of Fashion Technology and Kent State University (media studies), USA.

Co-founder and CTO of Madhang

Fadhil Nur Mahardi graduated from Universitas Dian Nuswantoro with a bachelor's in Information Technology and worked as a web developer for Seven Media Technology from 2015 to 2018. His programming skills includes familiarity with NodeJS, Swift and back-end web development. In late 2017, he co-founded Indonesian home chef meal service Madhang.

Fadhil Nur Mahardi graduated from Universitas Dian Nuswantoro with a bachelor's in Information Technology and worked as a web developer for Seven Media Technology from 2015 to 2018. His programming skills includes familiarity with NodeJS, Swift and back-end web development. In late 2017, he co-founded Indonesian home chef meal service Madhang.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

From China, Clever Home to build “Home Depot” marts in Africa

Combining B2B2C and O2O models, Clever Home is turning its 40,000sqm trade center in Nigeria into the "Yiwu marketplace" for Chinese companies looking to set up shop in Africa

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

HomeRun: IoT devices for home-alone pets

Founded by a pet owner who worried about leaving his dog alone at home, HomeRun is chalking up big sales in China's billion-dollar pet care market

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Covid-19: Indonesia's P2P lenders ready for slower business, default risk

P2P lending startups set up stricter scrutiny, budget reserves; playing key role in helping Indonesian businesses survive the Covid-19 crisis

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

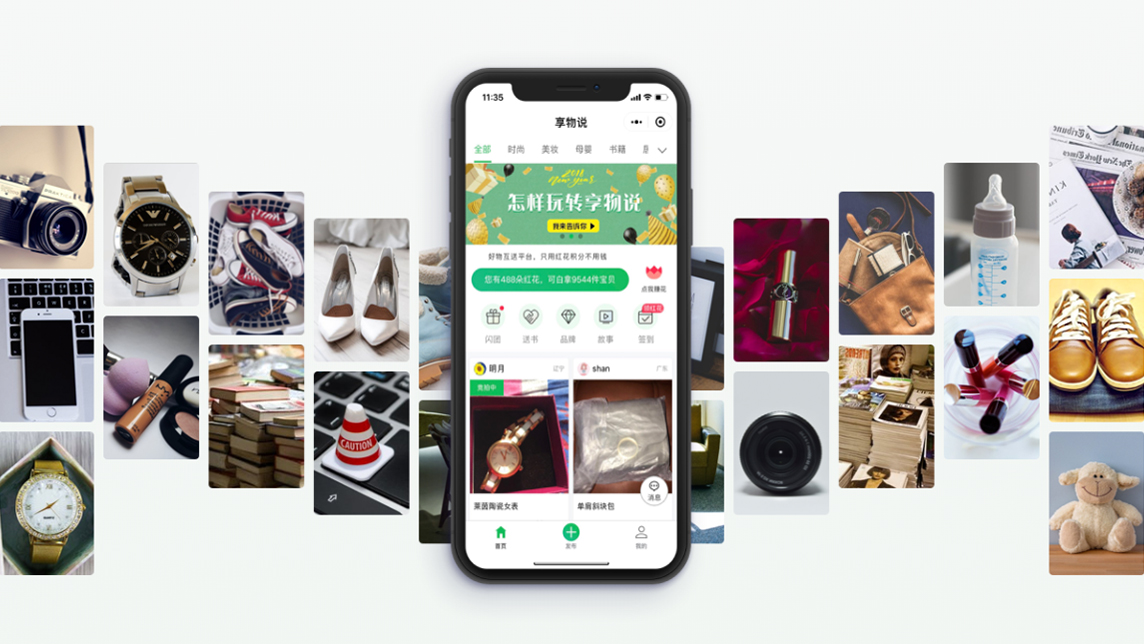

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Sorry, we couldn’t find any matches for“Home Credit”.