Horizon 2020

-

DATABASE (143)

-

ARTICLES (400)

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Iberis Capital is a Portuguese investor established in 2017. Currently with 10 investments with more than €100m under management, it invests in both tech and non-tech startups and in real estate. Iberis was founded by ex-partner at Oxy Capital Luís Quaresma and João Henriques, ex-CFO of Vodafone Portugal. One of its prominent portfolio companies is Australian medtech LBT Innovations that seeks to automate healthcare processes and, to date, has the only US Food and Drug Administration-cleared instrument leveraging AI in clinical microbiology. Its most recent investment was a participation in a €32m Series C investment round in December 2020 for Portugal-based international online print store, 360imprimir.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded by Hillhouse Capital in February 2020, GL Ventures mainly invests in early-stage startups from diverse sectors like pharmaceutical, SaaS, internet-based consumption/technology and emerging consumer goods/services.The RMB/USD dual currency VC-arm of Hillhouse currently manages total funds worth RMB 10bn from limited partners including university endowments, sovereign wealth funds, pension funds, FOF and family offices. The VC has made nearly 200 investments in its first year of operations.

Founded by Hillhouse Capital in February 2020, GL Ventures mainly invests in early-stage startups from diverse sectors like pharmaceutical, SaaS, internet-based consumption/technology and emerging consumer goods/services.The RMB/USD dual currency VC-arm of Hillhouse currently manages total funds worth RMB 10bn from limited partners including university endowments, sovereign wealth funds, pension funds, FOF and family offices. The VC has made nearly 200 investments in its first year of operations.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Co-CEO, co-founder of Psquared

Argentinian native Nicolas Araujo Müller is co-CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces. He has worked there since its foundation in April 2018, originally as part of startup hub CoBuilder, and is now its CFO. He is also a part-time advisor and investor at startup development agency We Are Grit, since its launch in 2020.Earlier, Araujo was CFO and co-founder at digital talent agency Bandit, for two years, until 2017. Before that, he held the same roles at his previous Barcelona-based startup, Nubelo, another tech recruitment agency for freelancers, between 2012 and 2016, when it was acquired by Freelancer.com. In 2016, Araujo was a visiting professor at the Autonomous University of Barcelona on digital economy.His first startup was Work At Home in Argentina, where he was a co-founder for two years from 2011–13, for which he won local innovation prizes. Prior to this, Araujo held various management consultancy roles, working in business analysis and research at Ernst & Young, Standard & Poor’s and Accenture, from 2008–2012, and completed a stint at the US embassy in Buenos Aires. He is also a founding member of Argentina’s entrepreneur organization, ASEA, established in 2013. Araujo holds a degree in economics from CEMA University, Buenos Aires and a qualification from Harvard University in negotiation. In 2017 and 2013, Araujo was named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Argentinian native Nicolas Araujo Müller is co-CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces. He has worked there since its foundation in April 2018, originally as part of startup hub CoBuilder, and is now its CFO. He is also a part-time advisor and investor at startup development agency We Are Grit, since its launch in 2020.Earlier, Araujo was CFO and co-founder at digital talent agency Bandit, for two years, until 2017. Before that, he held the same roles at his previous Barcelona-based startup, Nubelo, another tech recruitment agency for freelancers, between 2012 and 2016, when it was acquired by Freelancer.com. In 2016, Araujo was a visiting professor at the Autonomous University of Barcelona on digital economy.His first startup was Work At Home in Argentina, where he was a co-founder for two years from 2011–13, for which he won local innovation prizes. Prior to this, Araujo held various management consultancy roles, working in business analysis and research at Ernst & Young, Standard & Poor’s and Accenture, from 2008–2012, and completed a stint at the US embassy in Buenos Aires. He is also a founding member of Argentina’s entrepreneur organization, ASEA, established in 2013. Araujo holds a degree in economics from CEMA University, Buenos Aires and a qualification from Harvard University in negotiation. In 2017 and 2013, Araujo was named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Co-founder of Psquared

Argentinian native Jorge Araujo Müller is co-founder and investor at Psquared, Spain’s first flexible workplace management and design company, Psquared, for hybrid workspaces, where he has worked since its foundation in April 2019. Psquared is a spin-off of startup innovation hub CoBuilder, founded one year earlier and which Araujo co-founded. He has several other roles. Since 2020, he is a co-founder at startup development agency We Are Grit and advisor of a talent agency for Latin Americans in Spain, Base España. He is also an investor and advisor at e-commerce recruitment agency RSV Outsourcing. Araujo also holds part-time educational roles, speaking on innovation at Barcelona’s ESADE institution to MBA students and as a mentor at Mexico’s chapter of the MassChallenge accelerator. Earlier, Araujo worked as a business advisor to the digital agency JustDigital, and was co-founder and sales director at the digital talent agency Bandit, for a year. Before that, from 2012–2016, he was CSO and co-founder of Barcelona-based startup Nubelo – a tech recruitment agency for freelancers – until it was acquired by Freelancer.com. Prior to this, Araujo worked for two years as a business researcher at JP Morgan Chase and for almost two years at West Side Consultants, both in Argentina. Araujo holds a business administration qualification from CEMA University, Buenos Aires.In 2013, Araujo and his brother were named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Argentinian native Jorge Araujo Müller is co-founder and investor at Psquared, Spain’s first flexible workplace management and design company, Psquared, for hybrid workspaces, where he has worked since its foundation in April 2019. Psquared is a spin-off of startup innovation hub CoBuilder, founded one year earlier and which Araujo co-founded. He has several other roles. Since 2020, he is a co-founder at startup development agency We Are Grit and advisor of a talent agency for Latin Americans in Spain, Base España. He is also an investor and advisor at e-commerce recruitment agency RSV Outsourcing. Araujo also holds part-time educational roles, speaking on innovation at Barcelona’s ESADE institution to MBA students and as a mentor at Mexico’s chapter of the MassChallenge accelerator. Earlier, Araujo worked as a business advisor to the digital agency JustDigital, and was co-founder and sales director at the digital talent agency Bandit, for a year. Before that, from 2012–2016, he was CSO and co-founder of Barcelona-based startup Nubelo – a tech recruitment agency for freelancers – until it was acquired by Freelancer.com. Prior to this, Araujo worked for two years as a business researcher at JP Morgan Chase and for almost two years at West Side Consultants, both in Argentina. Araujo holds a business administration qualification from CEMA University, Buenos Aires.In 2013, Araujo and his brother were named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

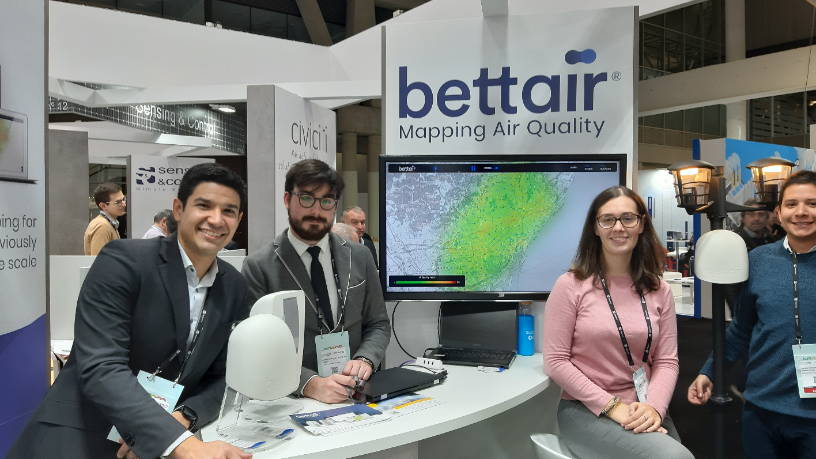

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Neosentec: Open source SaaS helping enterprises create customized AR experiences

Neosentec has created an open source SaaS for businesses to offer customized AR experiences

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Sorry, we couldn’t find any matches for“Horizon 2020”.