Hustle Fund

-

DATABASE (402)

-

ARTICLES (215)

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Cosun Fund is a wholly-owned subsidiary of Cosun, an electronic communication devices manufacturer. Founded in 2014, Cosun Fund is based in Huizhou, Guangdong province.

Cosun Fund is a wholly-owned subsidiary of Cosun, an electronic communication devices manufacturer. Founded in 2014, Cosun Fund is based in Huizhou, Guangdong province.

Established in 2011, ShouTaiJinXin Fund is the institutional manager of a private fund under Shoutai Group. Qualified for private securities investment, equity investment and venture capital investment, ShouTaiJinXin Fund invests in the fields of education, automobile, transportation, healthcare, entertainment, corporate services, among others. By the end of 2016, it had managed funds worth RMB 60 billion in total.

Established in 2011, ShouTaiJinXin Fund is the institutional manager of a private fund under Shoutai Group. Qualified for private securities investment, equity investment and venture capital investment, ShouTaiJinXin Fund invests in the fields of education, automobile, transportation, healthcare, entertainment, corporate services, among others. By the end of 2016, it had managed funds worth RMB 60 billion in total.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

Founded by a group of Tsinghua alumni in 2013, Innoangel Fund has invested in 200+ startups. With over RMB 2 billion under management, Innoangel Fund focuses on artificial intelligence and robotics, Internet of Things and the cultural creative industry.

Founded by a group of Tsinghua alumni in 2013, Innoangel Fund has invested in 200+ startups. With over RMB 2 billion under management, Innoangel Fund focuses on artificial intelligence and robotics, Internet of Things and the cultural creative industry.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

Softbank-Indosat Fund (SB-ISAT Fund)

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

Payfazz offers Indonesia's rural unbanked convenient access to an expanding range of app-based personal financial services, from bill payments to loan applications and fund transfers.

Payfazz offers Indonesia's rural unbanked convenient access to an expanding range of app-based personal financial services, from bill payments to loan applications and fund transfers.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Co-founder and co-CEO of Indexa Capital

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Startups join the fight in China's coronavirus crisis

Chinese startups have discovered their technologies can play a major role in the nationwide efforts to battle the coronavirus epidemic

Pushed by Covid-19, Landing.Jobs repositions itself as IT talent ecosystem

The Portuguese tech jobs portal is pivoting into global talent hub with Future.Works, providing AI-driven recruitment services, training and career management for IT professionals

Lota Digital: Disrupting fishing in Portugal for a sustainable future

The “digital fish market” app helps fishermen compete in a market dominated by large players

As more Chinese opt for cosmetic surgery, startups have emerged to help them make informed decisions

China’s medical aesthetic services platforms face both opportunities and challenges with the rise of Generation Z

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

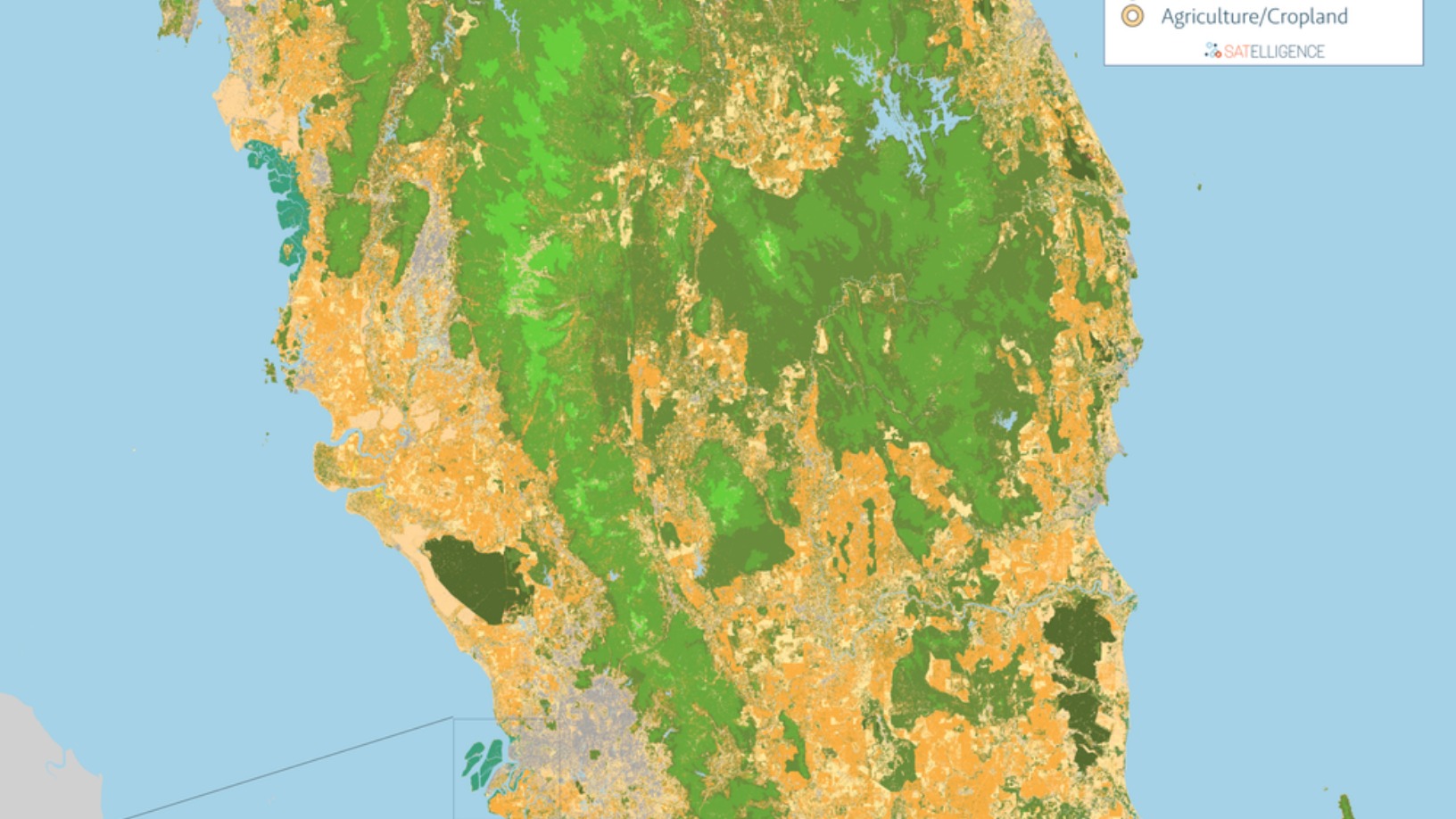

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

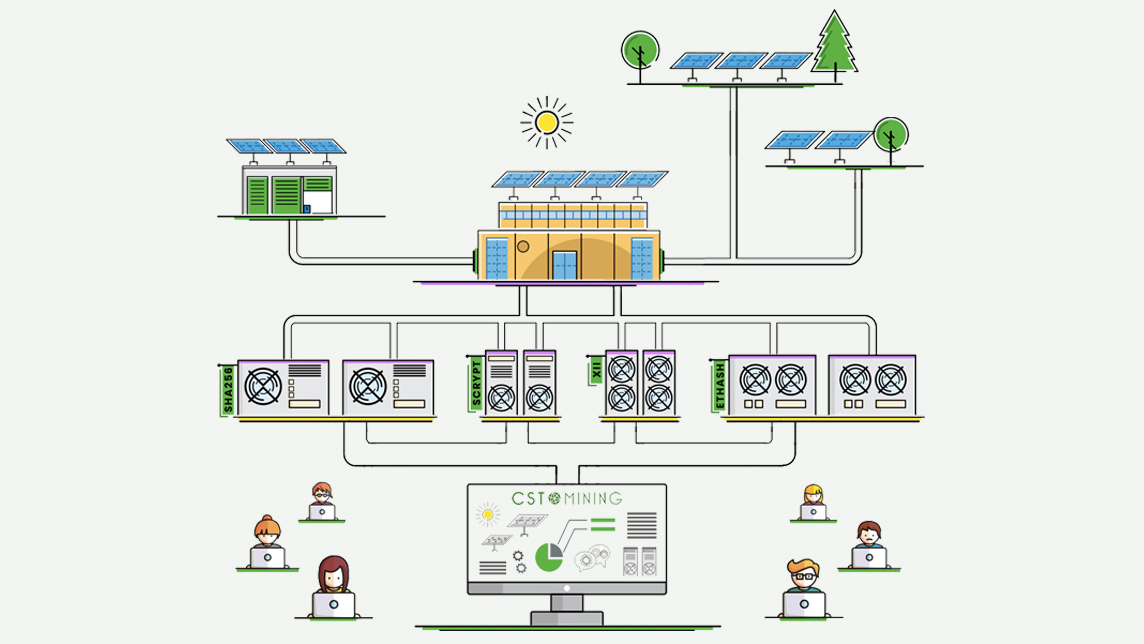

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

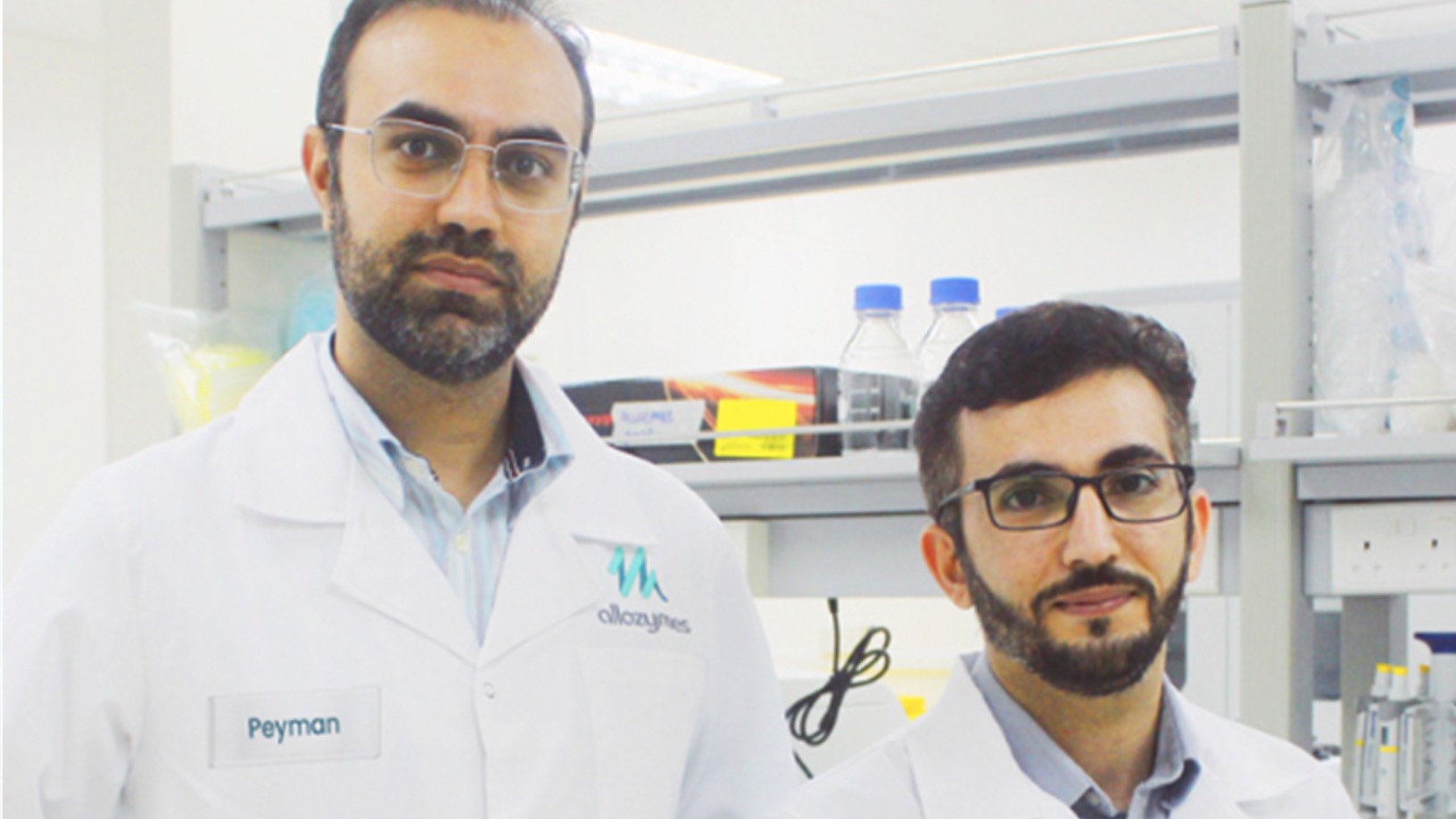

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

After emulating Chinese business models, Indonesian startups seek success abroad

Indonesia adapted and furthered the successful business models that created unicorns in China. Now, it's exporting its own to the rest of Southeast Asia, even beyond

Smart Agrifood Summit 2019 big winner Agri Marketplace makes fair trade easy

Winner of Best Startup and Best Innovative Agrifood Startup, Agri Marketplace presented its fast, transparent and interconnected crop trading platform at Málaga Smart Agrifood Summit 2019

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Sorry, we couldn’t find any matches for“Hustle Fund”.