IDG Capital

-

DATABASE (700)

-

ARTICLES (371)

Co-CEO and co-founder of Elio

Waldo Hartanto graduated with a BSc in Accounting and Finance in 2012 at Boston College, Wallace E Carroll Graduate School of Management. After graduation, he worked as an equity research analyst at Mandiri Sekuritas for seven months and later joined Rothschild's global financial advisory team in Jakarta.In January 2014, he moved to Singapore to work for one year at Heritas Capital Management as healthcare investment analyst. In 2015, he became the managing director of Wahyu Abadi, an Indonesian business process outsourcing company. His younger brother Walton is also at Wahyu based in Jakarta. In April 2018, both brothers co-founded Elio to focus online healthcare for men.

Waldo Hartanto graduated with a BSc in Accounting and Finance in 2012 at Boston College, Wallace E Carroll Graduate School of Management. After graduation, he worked as an equity research analyst at Mandiri Sekuritas for seven months and later joined Rothschild's global financial advisory team in Jakarta.In January 2014, he moved to Singapore to work for one year at Heritas Capital Management as healthcare investment analyst. In 2015, he became the managing director of Wahyu Abadi, an Indonesian business process outsourcing company. His younger brother Walton is also at Wahyu based in Jakarta. In April 2018, both brothers co-founded Elio to focus online healthcare for men.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2014 by China’s No.1 high-end human resource and online social platform for entrepreneurs, Zhisland Capital is an investment platform.

Founded in 2014 by China’s No.1 high-end human resource and online social platform for entrepreneurs, Zhisland Capital is an investment platform.

HuaGai Capital was founded in 2012. Its asset volume is in the tens of billions of RMB. It now manages multiple private equity funds.

HuaGai Capital was founded in 2012. Its asset volume is in the tens of billions of RMB. It now manages multiple private equity funds.

Sinopharm-CICC Capital was co-founded by Sinopharm and China International Capital Corporation (CICC) in October 2016. It focuses on investments in the healthcare industry.

Sinopharm-CICC Capital was co-founded by Sinopharm and China International Capital Corporation (CICC) in October 2016. It focuses on investments in the healthcare industry.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded by Chen Xiaohong, Tiger Global's former China managing partner, H Capital is a venture capital firm focused on China internet firms. The team also includes DCM co-founder Lu Rong (Ruby Lu).

Founded by Chen Xiaohong, Tiger Global's former China managing partner, H Capital is a venture capital firm focused on China internet firms. The team also includes DCM co-founder Lu Rong (Ruby Lu).

Challengers Capital was founded in 2014. Its founding partners are angel investors Xie Xianlin and Tang Binsen. It manages three RMB funds with around RMB 2 billion in management.Challengers Capital focuses on areas like consumption upgrade, entertainment, gaming, enterprise services and fintech.

Challengers Capital was founded in 2014. Its founding partners are angel investors Xie Xianlin and Tang Binsen. It manages three RMB funds with around RMB 2 billion in management.Challengers Capital focuses on areas like consumption upgrade, entertainment, gaming, enterprise services and fintech.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Onroad Capital was founded in 2015 and is headquartered in Shenzhen. It invests in TMT and focuses on cloud computing, big data, IoT, artificial intelligence, SaaS and consumption.

Onroad Capital was founded in 2015 and is headquartered in Shenzhen. It invests in TMT and focuses on cloud computing, big data, IoT, artificial intelligence, SaaS and consumption.

Headquartered in Hangzhou, Yiqichuang Capital was established in 2015. It invests mainly in the TMT, consumer goods and healthcare sectors.

Headquartered in Hangzhou, Yiqichuang Capital was established in 2015. It invests mainly in the TMT, consumer goods and healthcare sectors.

Tongdaoo Capital was founded in October 2014, with headquarters in Kunshan, Jiangsu Province. The VC specializes in private equity funds.

Tongdaoo Capital was founded in October 2014, with headquarters in Kunshan, Jiangsu Province. The VC specializes in private equity funds.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

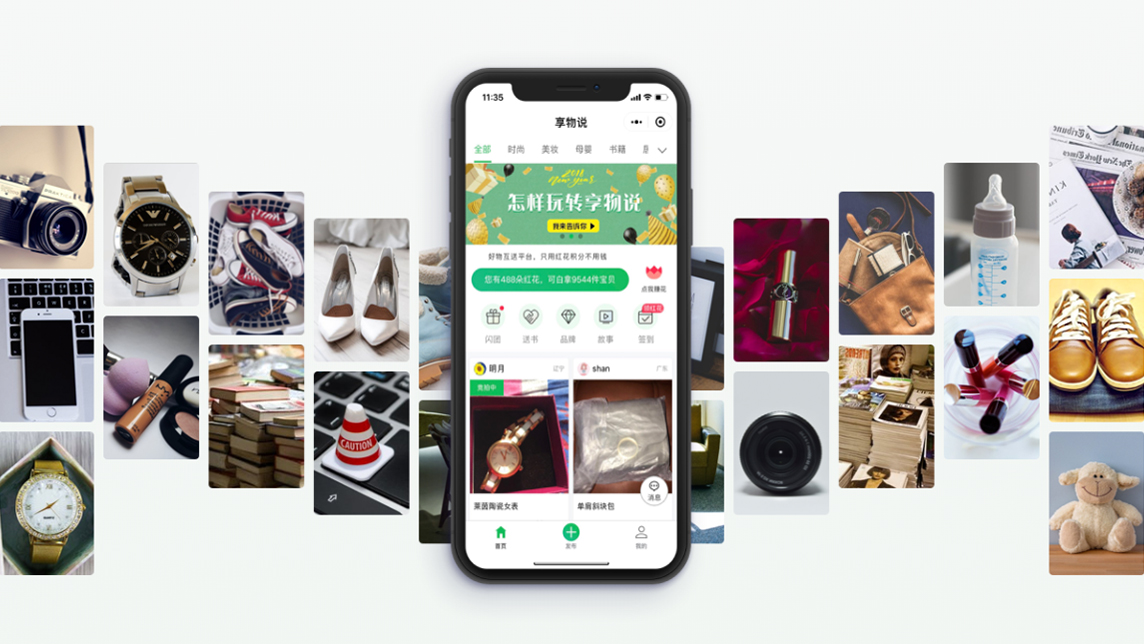

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

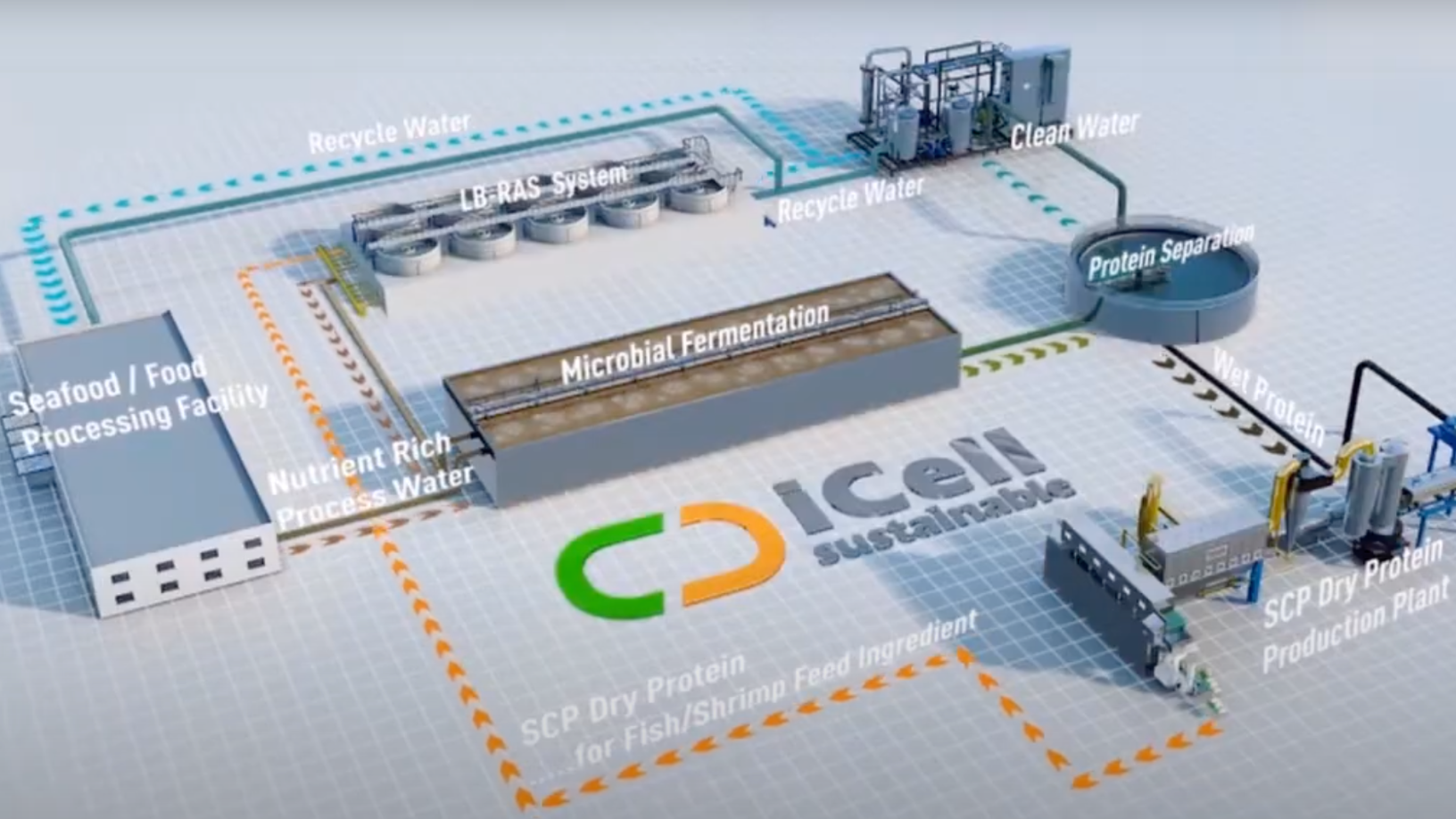

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

Kuaipeilian wins largest seed round in China arts education sector

In the hotly contested online-to-offline piano tutoring market, will an injection of funds help Kuaipeilian trounce the competition?

China's Yuanfudao now the world's most valuable edtech with $2.2bn new funding

Yuanfudao’s second tranche of its Series G funding follows the $1bn it raised in March, bringing its valuation to $15.5bn

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Sorry, we couldn’t find any matches for“IDG Capital”.