IDG Capital

-

DATABASE (700)

-

ARTICLES (371)

Headquartered in Guangzhou, Mobai Capital (Shenzhen Qianhai Asset Management Co Ltd) was founded in 2015 with an investment focus on big data and fintech companies.

Headquartered in Guangzhou, Mobai Capital (Shenzhen Qianhai Asset Management Co Ltd) was founded in 2015 with an investment focus on big data and fintech companies.

Founded in 2013, Qiao Jing Capital is an investment management firm focuses on healthcare, consumer health, and supply-chain finance industry. The co-founder, Jin Dan, is the former executive director at Cube Capital.

Founded in 2013, Qiao Jing Capital is an investment management firm focuses on healthcare, consumer health, and supply-chain finance industry. The co-founder, Jin Dan, is the former executive director at Cube Capital.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Founder by Vipshop (a Chinese e-commerce company specializing in online discount sales) founding shareholder Wu Jiang in 2015, Daosheng Capital prioritizes technology startups in its investments.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

NGP Capital was founded in 2005 with Nokia and Bell Labs as its limited partners. It has investment teams in Asia (India and China), North America and Europe. It invests mainly in growth-stage companies with typical investments ranging from $8m–$12m.With more than $1.2bn under management, NGP Capital's portfolio includes Xiaomi, Deliveroo and UCweb. As of July 2019, NGP Capital had invested in more than 90 companies, including eight IPOs and 33 M&As. It focuses also on mobility and digital health sectors.

NGP Capital was founded in 2005 with Nokia and Bell Labs as its limited partners. It has investment teams in Asia (India and China), North America and Europe. It invests mainly in growth-stage companies with typical investments ranging from $8m–$12m.With more than $1.2bn under management, NGP Capital's portfolio includes Xiaomi, Deliveroo and UCweb. As of July 2019, NGP Capital had invested in more than 90 companies, including eight IPOs and 33 M&As. It focuses also on mobility and digital health sectors.

Toutoushidao Capital (Datou Capital)

Toutoushidao Capital was co-founded in 2015 by Cao Guoxiong, partner of Matrix Partners China, and Wu Xiaobo, a well-known financial writer. Mainly targeting the culture and entertainment sectors, it had planned to invest RMB 2bn–RMB 3bn in the next three years.

Toutoushidao Capital was co-founded in 2015 by Cao Guoxiong, partner of Matrix Partners China, and Wu Xiaobo, a well-known financial writer. Mainly targeting the culture and entertainment sectors, it had planned to invest RMB 2bn–RMB 3bn in the next three years.

Founded in 2017, Momentum Capital is focused on enterprise tech as well as new retail and consumption.

Founded in 2017, Momentum Capital is focused on enterprise tech as well as new retail and consumption.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

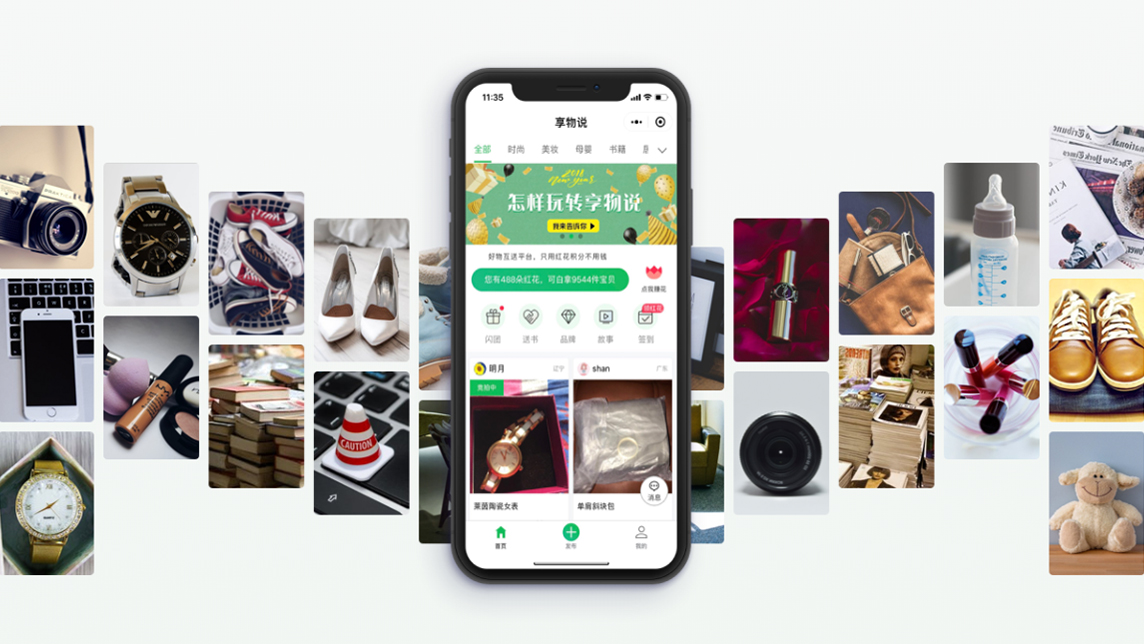

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

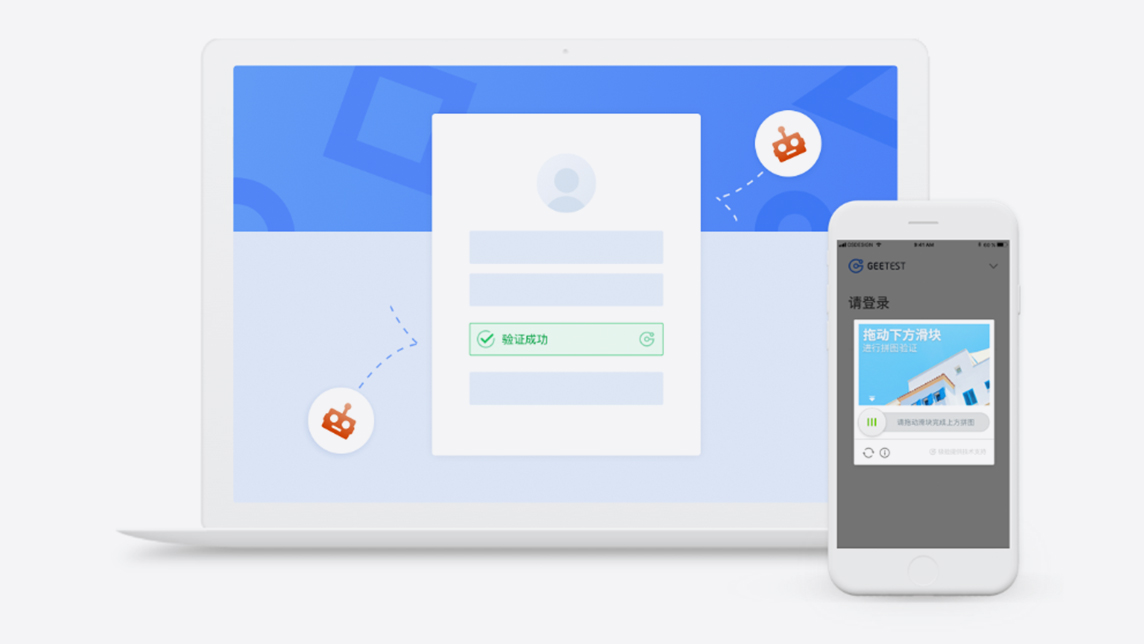

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

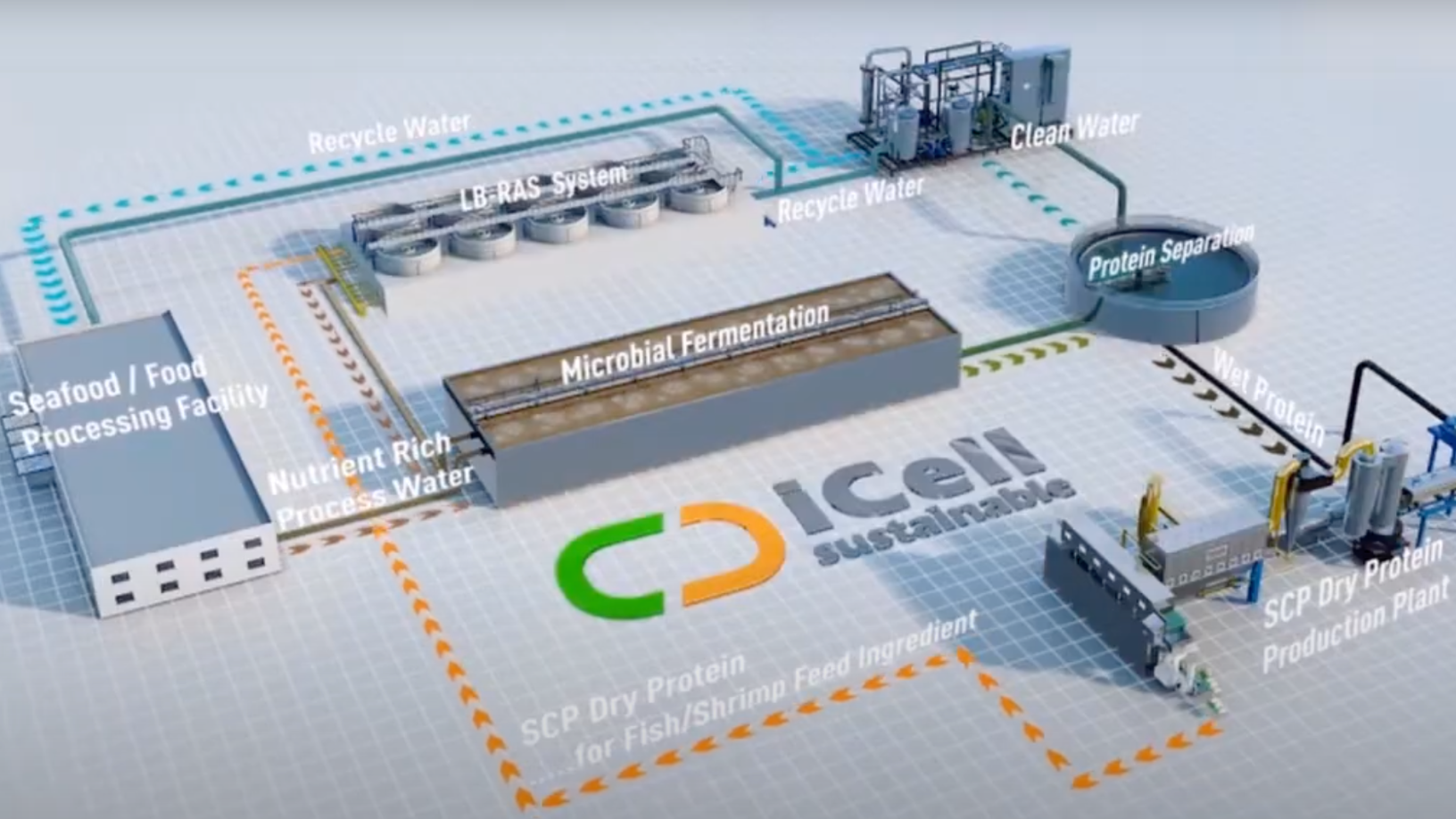

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

Kuaipeilian wins largest seed round in China arts education sector

In the hotly contested online-to-offline piano tutoring market, will an injection of funds help Kuaipeilian trounce the competition?

China's Yuanfudao now the world's most valuable edtech with $2.2bn new funding

Yuanfudao’s second tranche of its Series G funding follows the $1bn it raised in March, bringing its valuation to $15.5bn

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Sorry, we couldn’t find any matches for“IDG Capital”.