IDG Capital

-

DATABASE (700)

-

ARTICLES (371)

Founded in 2015 by venture capitalists from renowned Chinese investment firms including Morningside, Qiming and Ceyuan, Panda Capital focuses on early-stage investment in the internet sectors of real estate, automobile, finance, corporate services, logistics and healthcare.

Founded in 2015 by venture capitalists from renowned Chinese investment firms including Morningside, Qiming and Ceyuan, Panda Capital focuses on early-stage investment in the internet sectors of real estate, automobile, finance, corporate services, logistics and healthcare.

Founded in 2004 by one of China’s best-known venture capitalists Cao Guoxiong (Tony Cao), Puhua Capital currently has RMB 1 billion under management. It has invested about 300 startups, including 40+ that have gone public.

Founded in 2004 by one of China’s best-known venture capitalists Cao Guoxiong (Tony Cao), Puhua Capital currently has RMB 1 billion under management. It has invested about 300 startups, including 40+ that have gone public.

Founded in 2015, GaoZhang Capital invests exclusively in new media. With RMB 300 million assets under management, it had invested in 35 projects as of the end of 2017.

Founded in 2015, GaoZhang Capital invests exclusively in new media. With RMB 300 million assets under management, it had invested in 35 projects as of the end of 2017.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Lenovo Capital & Incubator Group

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Co-founded by Chinese celebrity actor Huang Xiaoming in 2016, Ming Capital focuses on the culture, creative, entertainment and consumption-upgrading sectors. Its first round of fundraising was set at about RMB 500 million. Huang is also the board chairman.

Co-founded by Chinese celebrity actor Huang Xiaoming in 2016, Ming Capital focuses on the culture, creative, entertainment and consumption-upgrading sectors. Its first round of fundraising was set at about RMB 500 million. Huang is also the board chairman.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Founded in October 2014 in Hangzhou, Demonow Capital focuses on local early stage internet startups. In order to better serve startups and entrepreneurs, Demonow set up an incubator to provide early stage startups with professional services.

Founded in October 2014 in Hangzhou, Demonow Capital focuses on local early stage internet startups. In order to better serve startups and entrepreneurs, Demonow set up an incubator to provide early stage startups with professional services.

Based in Shanghai, BA Capital focuses on investments in various consumer sectors. The VC, a subsidiary of Black Ant Group in Shenzhen, was founded in 2016 by three partners Chen Feng, He Yu and Zhang Peiyuan

Based in Shanghai, BA Capital focuses on investments in various consumer sectors. The VC, a subsidiary of Black Ant Group in Shenzhen, was founded in 2016 by three partners Chen Feng, He Yu and Zhang Peiyuan

Horus Capital is a private equity firm founded at the end of 2012. It currently manages over RMB 10bn in assets and is focused on healthcare, AI, media, consumer goods, new materials and energy. The company has invested in about 100 companies.

Horus Capital is a private equity firm founded at the end of 2012. It currently manages over RMB 10bn in assets and is focused on healthcare, AI, media, consumer goods, new materials and energy. The company has invested in about 100 companies.

Founded in 2012 by Wang Yawei, the former vice-president of China Asset Management and the founder of Top Ace Asset Management, Qianhe Capital provides asset management, equity investment and investment management services. As of April 2017, Qianhe Capital had RMB 24 billion under management and issued 11 trust plans and asset management plans.

Founded in 2012 by Wang Yawei, the former vice-president of China Asset Management and the founder of Top Ace Asset Management, Qianhe Capital provides asset management, equity investment and investment management services. As of April 2017, Qianhe Capital had RMB 24 billion under management and issued 11 trust plans and asset management plans.

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

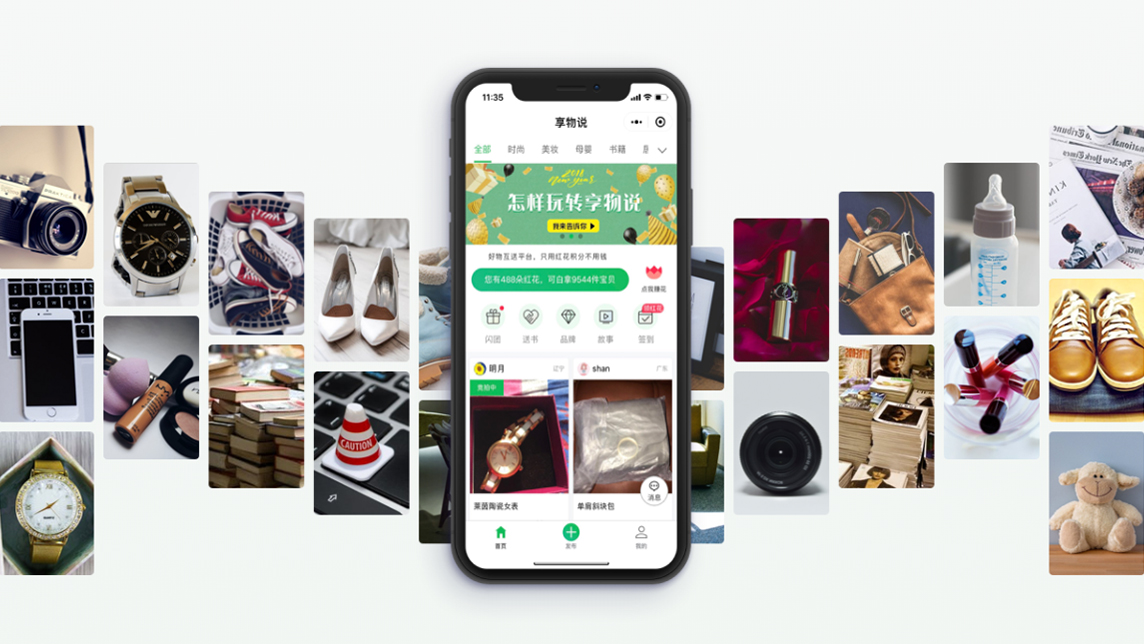

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

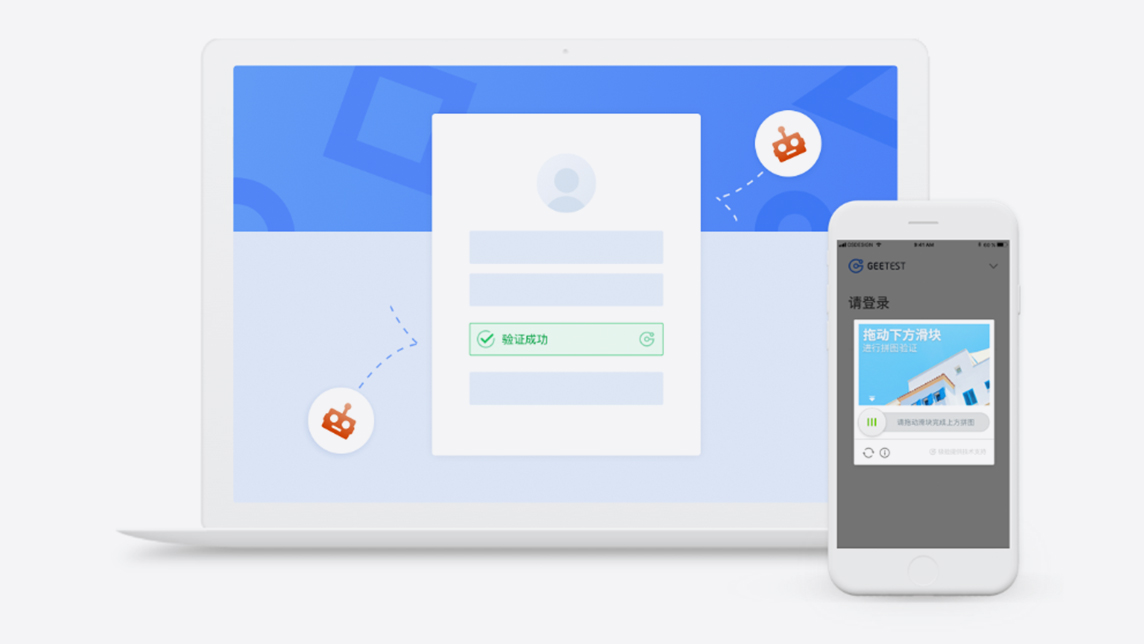

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

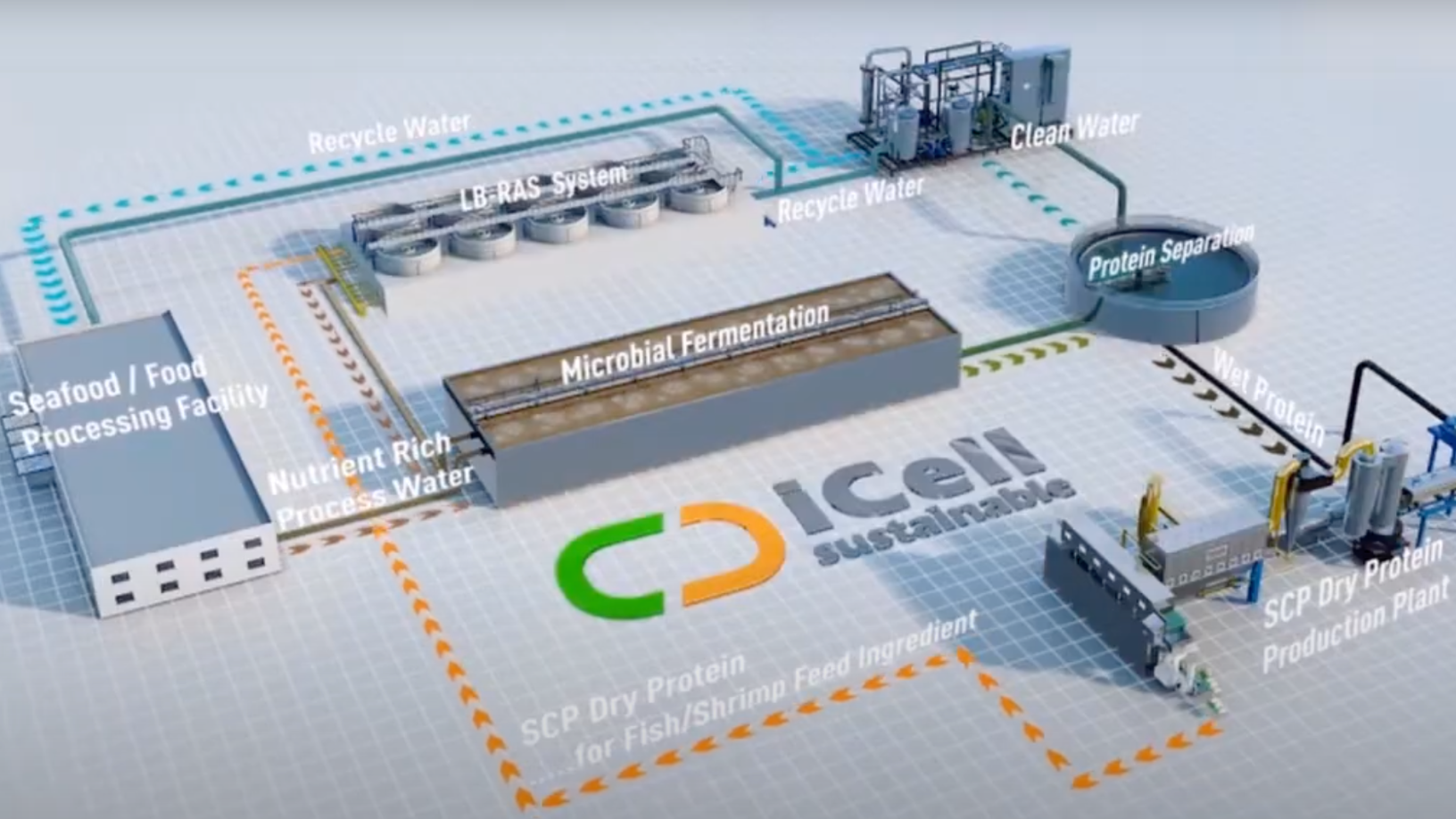

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

Kuaipeilian wins largest seed round in China arts education sector

In the hotly contested online-to-offline piano tutoring market, will an injection of funds help Kuaipeilian trounce the competition?

China's Yuanfudao now the world's most valuable edtech with $2.2bn new funding

Yuanfudao’s second tranche of its Series G funding follows the $1bn it raised in March, bringing its valuation to $15.5bn

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Sorry, we couldn’t find any matches for“IDG Capital”.