IDG Capital

-

DATABASE (700)

-

ARTICLES (371)

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

Chu Ge is a founding partner of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects. Formerly creative director at Bates and Ogilvy, he was also a guest lecturer at Communication University of China. He has been listed as one of China’s 50 most influential creators.

Chu Ge is a founding partner of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects. Formerly creative director at Bates and Ogilvy, he was also a guest lecturer at Communication University of China. He has been listed as one of China’s 50 most influential creators.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Warren Shaeffer is the co-founder of online video community Vidme. He was also COO of SocialEngine, co-founded by Vidme co-founder Alex Benzer. He had also worked at Golden Gate Capital and JPMorgan. Shaeffer received his bachelor’s degree in Government from Harvard University and was a Detur Book Prize recipient.

Warren Shaeffer is the co-founder of online video community Vidme. He was also COO of SocialEngine, co-founded by Vidme co-founder Alex Benzer. He had also worked at Golden Gate Capital and JPMorgan. Shaeffer received his bachelor’s degree in Government from Harvard University and was a Detur Book Prize recipient.

Founded in 2001, Oriza Holdings manages over RMB 51.4 billion in assets. The fund focuses on equity investment, debt financing and equity investment services. Through its equity investment platforms and venture capital funds, Oriza Holdings has backed 65 startups that have gone public.

Founded in 2001, Oriza Holdings manages over RMB 51.4 billion in assets. The fund focuses on equity investment, debt financing and equity investment services. Through its equity investment platforms and venture capital funds, Oriza Holdings has backed 65 startups that have gone public.

Minsheng Securities Co., Ltd. was established in Beijing in 1986 with registered capital of RMB 9.619 billion. China Securities Regulatory Commission has authorized Minsheng Securities to engage in securities trading and securities underwriting and serve as a sponsor. It is one of the first securities companies in China.

Minsheng Securities Co., Ltd. was established in Beijing in 1986 with registered capital of RMB 9.619 billion. China Securities Regulatory Commission has authorized Minsheng Securities to engage in securities trading and securities underwriting and serve as a sponsor. It is one of the first securities companies in China.

Chongqing Environmental Fund was established by China’s Ministry of Ecology and Environment and the Chongqing Municipal Government in June 2015. As of late December 2018, the fund has invested RMB 448m in 28 projects. It has launched 13 funds with a total capital of about RMB 8bn.

Chongqing Environmental Fund was established by China’s Ministry of Ecology and Environment and the Chongqing Municipal Government in June 2015. As of late December 2018, the fund has invested RMB 448m in 28 projects. It has launched 13 funds with a total capital of about RMB 8bn.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

China International Capital Corp (CICC)

A leading Chinese investment bank, Beijing-based CICC is a publicly listed company in Hong Kong.

A leading Chinese investment bank, Beijing-based CICC is a publicly listed company in Hong Kong.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

Launched in 2007, 2bpartner is a venture capital firm created by the Minho regional business association (AIMinho) and several private investors and companies. The VC invests through the Minho Inovação e Internacionalização fund that was launched in 2011 and co-financed by COMPETE and private investors. DST Group became its major shareholder in 2012.

Launched in 2007, 2bpartner is a venture capital firm created by the Minho regional business association (AIMinho) and several private investors and companies. The VC invests through the Minho Inovação e Internacionalização fund that was launched in 2011 and co-financed by COMPETE and private investors. DST Group became its major shareholder in 2012.

Former investment banker Tian Jiangchuan is co-founder of Initial Venture Capital, which focuses on early-stage investment in the mobile internet, O2O, e-commerce and education sectors. She holds a bachelor’s degree in Statistics and Economics from the University of London, and was an associate director at UBS. Tian was born in 1987.

Former investment banker Tian Jiangchuan is co-founder of Initial Venture Capital, which focuses on early-stage investment in the mobile internet, O2O, e-commerce and education sectors. She holds a bachelor’s degree in Statistics and Economics from the University of London, and was an associate director at UBS. Tian was born in 1987.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

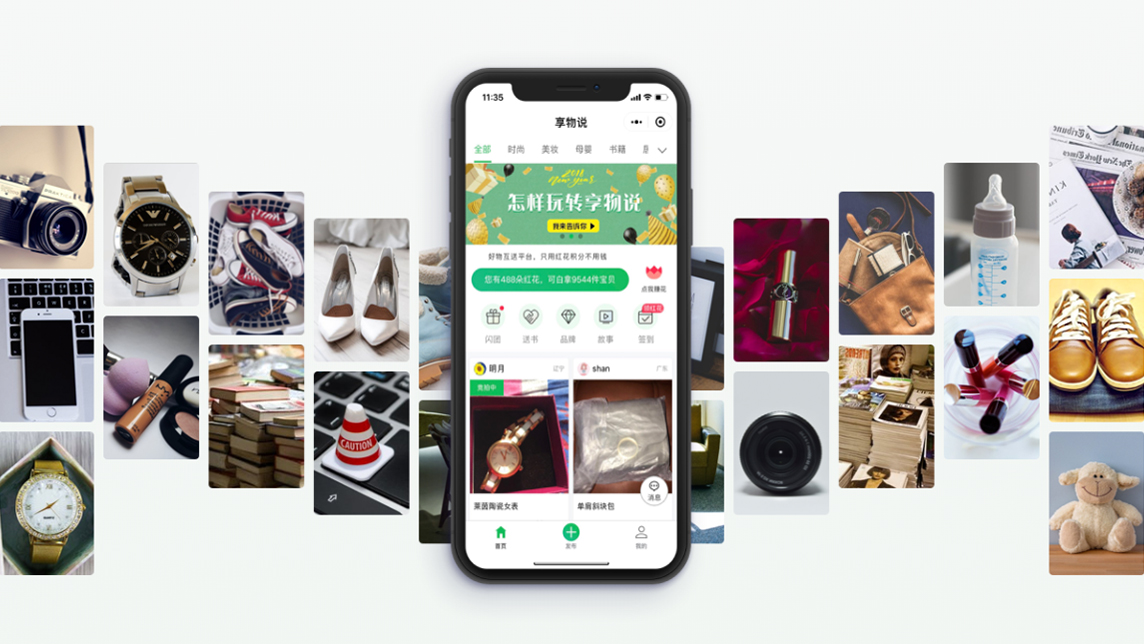

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

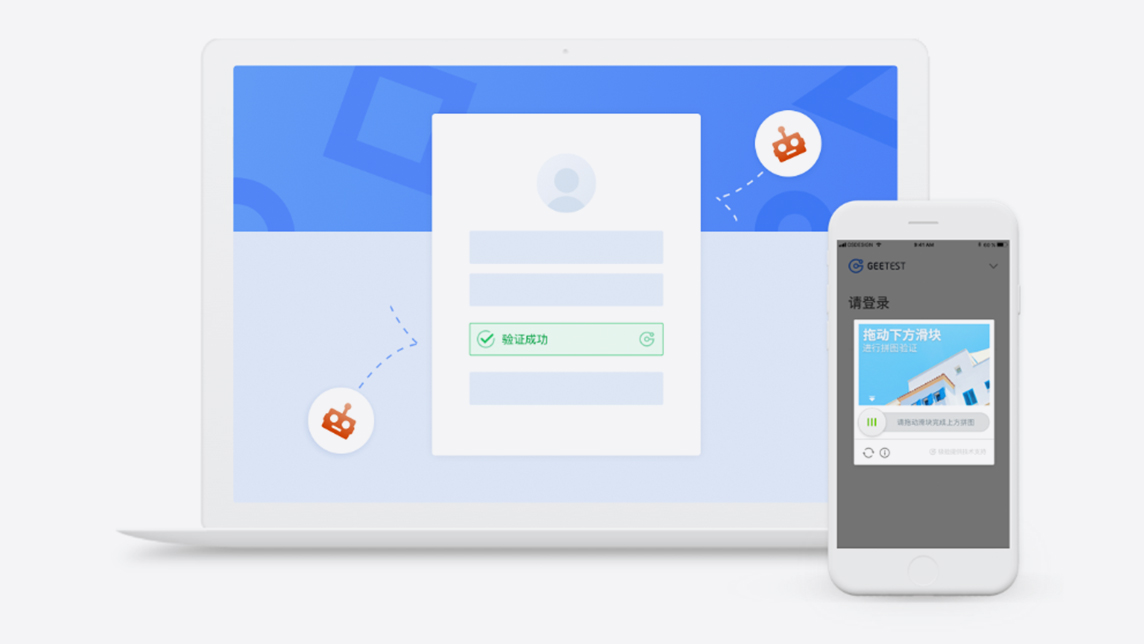

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

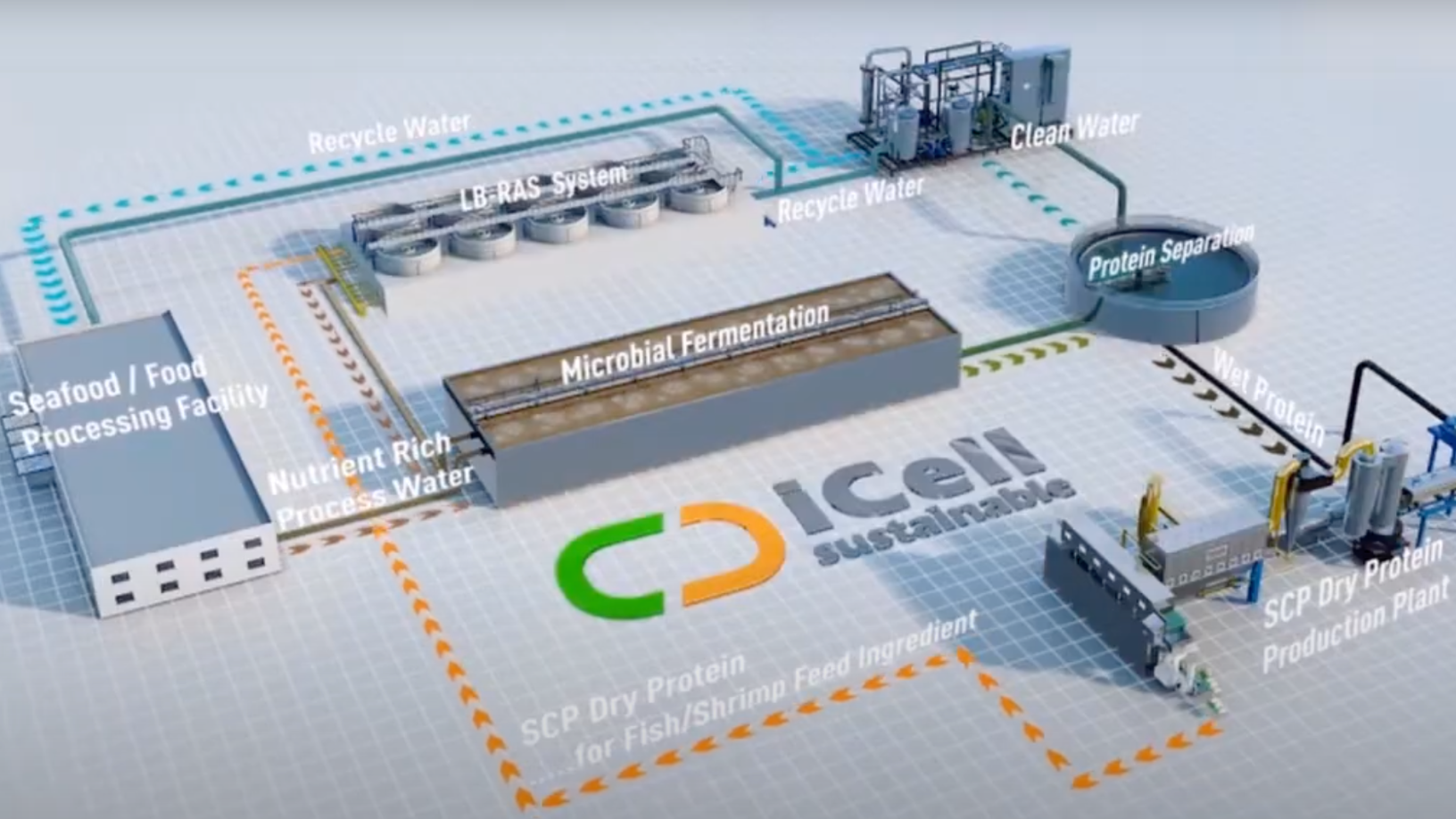

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

Kuaipeilian wins largest seed round in China arts education sector

In the hotly contested online-to-offline piano tutoring market, will an injection of funds help Kuaipeilian trounce the competition?

China's Yuanfudao now the world's most valuable edtech with $2.2bn new funding

Yuanfudao’s second tranche of its Series G funding follows the $1bn it raised in March, bringing its valuation to $15.5bn

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Sorry, we couldn’t find any matches for“IDG Capital”.