INNOV-ID

-

DATABASE (229)

-

ARTICLES (314)

CTO and co-founder of Bygen

Ben Morton is an Australian entrepreneur and a chemical engineer by training. While serving in the Royal Australian Infantry, he attended Flinders University, pursuing a double honours degree in physics and organic chemistry. After graduating in 2013, Morton briefly worked as a chemist at fertilizer company SprayGro. In 2016, he enrolled at the University of Adelaide to pursue a PhD in Chemical Engineering. There, he joined Philip Kwong’s research group and met fellow PhD student Lewis Dunnigan. Using technology they developed at the research group, in 2017 Morton, and Dunnigan established Bygen, a startup offering a low-cost, novel way process of making activated carbon using various forms of agricultural waste, with Kwong as a technical adviser and fellow co-founder. Morton is now CTO of Bygen.

Ben Morton is an Australian entrepreneur and a chemical engineer by training. While serving in the Royal Australian Infantry, he attended Flinders University, pursuing a double honours degree in physics and organic chemistry. After graduating in 2013, Morton briefly worked as a chemist at fertilizer company SprayGro. In 2016, he enrolled at the University of Adelaide to pursue a PhD in Chemical Engineering. There, he joined Philip Kwong’s research group and met fellow PhD student Lewis Dunnigan. Using technology they developed at the research group, in 2017 Morton, and Dunnigan established Bygen, a startup offering a low-cost, novel way process of making activated carbon using various forms of agricultural waste, with Kwong as a technical adviser and fellow co-founder. Morton is now CTO of Bygen.

Founded in 2004, Richlink Capital has 70% of its investments in leading companies in the growth or mature stage, and 20% in early/middle-stage startups.

Founded in 2004, Richlink Capital has 70% of its investments in leading companies in the growth or mature stage, and 20% in early/middle-stage startups.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

K2VC was founded in 2010 and focuses on early-stage investment in technology start-ups in China, with the objective of promoting change and technological progress, as well as innovative business models and lifestyles.

K2VC was founded in 2010 and focuses on early-stage investment in technology start-ups in China, with the objective of promoting change and technological progress, as well as innovative business models and lifestyles.

Former co-founder of Growpal

Raka Kurnia Novriantama is an information systems graduate from Indonesia’s Universitas Brawijaya. He joined aquaculture investment crowdfunding platform Growpal as CTO in 2016 while still reading his degree. He left Growpal in early 2018 to focus on his role at software development house Berry ID, where he is an executive director.

Raka Kurnia Novriantama is an information systems graduate from Indonesia’s Universitas Brawijaya. He joined aquaculture investment crowdfunding platform Growpal as CTO in 2016 while still reading his degree. He left Growpal in early 2018 to focus on his role at software development house Berry ID, where he is an executive director.

Co-founder of Reworld

Yao Guangshi is a well-known game distributor and angel investor in the gaming industry. Born in 1972, he graduated from the University of Shanghai for Science and Technology in 1992. He studied for an EMBA in Renmin University of China from 2011 to 2013. In 1995, he joined the edible oil manufacturer Luhua Group, where he was in charge of import and export management. He founded Jinshi Software in 1997. In 2003, he became the exclusive distributor of many prominent gaming companies like Tencent and Shengqu Games in Shandong province. In 2008, he founded Xinhe Technology as an exclusive distributor for top games including Genghis Khan and Shumen. He invested in the online game developer Locojoy in 2011 and joined the company in 2013. In 2018, he co-founded Beijing Code View Technology, which launched Reworld in 2019.

Yao Guangshi is a well-known game distributor and angel investor in the gaming industry. Born in 1972, he graduated from the University of Shanghai for Science and Technology in 1992. He studied for an EMBA in Renmin University of China from 2011 to 2013. In 1995, he joined the edible oil manufacturer Luhua Group, where he was in charge of import and export management. He founded Jinshi Software in 1997. In 2003, he became the exclusive distributor of many prominent gaming companies like Tencent and Shengqu Games in Shandong province. In 2008, he founded Xinhe Technology as an exclusive distributor for top games including Genghis Khan and Shumen. He invested in the online game developer Locojoy in 2011 and joined the company in 2013. In 2018, he co-founded Beijing Code View Technology, which launched Reworld in 2019.

CEO and co-founder of IXON Food Technology

Felix Cheung graduated in physics from Adelaide’s Flinders University in 1999 and obtained a PhD in physics from the University of Sydney in 2005. He obtained a master’s in food analysis and food safety management from Hong Kong Baptist University in 2015. Cheung met Elton Ho during the master’s program at university and they teamed up to co-develop the advanced sous-vide aseptic packaging (ASAP) technology. In January 2017, they established IXON Food Technology to further develop and commercialize ASAP for the food industry.Cheung previously worked as a website designer and administrator at the Complex Plasma Laboratory, University of Sydney, from 2002–2006. He was also an editor at Macmillan Science Communication for one year before joining the Springer Nature publishing group to work as editor at Nature China from 2007–2014.

Felix Cheung graduated in physics from Adelaide’s Flinders University in 1999 and obtained a PhD in physics from the University of Sydney in 2005. He obtained a master’s in food analysis and food safety management from Hong Kong Baptist University in 2015. Cheung met Elton Ho during the master’s program at university and they teamed up to co-develop the advanced sous-vide aseptic packaging (ASAP) technology. In January 2017, they established IXON Food Technology to further develop and commercialize ASAP for the food industry.Cheung previously worked as a website designer and administrator at the Complex Plasma Laboratory, University of Sydney, from 2002–2006. He was also an editor at Macmillan Science Communication for one year before joining the Springer Nature publishing group to work as editor at Nature China from 2007–2014.

Co-founder of Infinited Fiber

Ali Harlin completed two doctorates in chemical engineering and in polymer science in 1995 and 1996 respectively. He spent 11 years developing the Borstar technology related to bimodal PE and PP. He has also worked as a research director for packaging materials and cable machinery. He currently works as a research professor and lecturer at two local universities in Finland. In 2003, he joined Tampere University of Technology as a professor for fiber materials and technical textiles. In 2014, he also started lecturing at LUT University as a professor specializing in packaging and polymeric materials.Since 2005, the industrial biomaterial specialist has also been working at the Technical Research Centre of Finland VTT where he became the product R&D team leader for Infinited Fiber, a startup he co-founded in 2016 with CEO Petri Alava.

Ali Harlin completed two doctorates in chemical engineering and in polymer science in 1995 and 1996 respectively. He spent 11 years developing the Borstar technology related to bimodal PE and PP. He has also worked as a research director for packaging materials and cable machinery. He currently works as a research professor and lecturer at two local universities in Finland. In 2003, he joined Tampere University of Technology as a professor for fiber materials and technical textiles. In 2014, he also started lecturing at LUT University as a professor specializing in packaging and polymeric materials.Since 2005, the industrial biomaterial specialist has also been working at the Technical Research Centre of Finland VTT where he became the product R&D team leader for Infinited Fiber, a startup he co-founded in 2016 with CEO Petri Alava.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Ecertic Digital Solutions: A Spanish leader in online ID verification

The Spanish biometric tech startup offers online ID verification and tracked document solutions in a US$10 billion market set to double by 2022

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

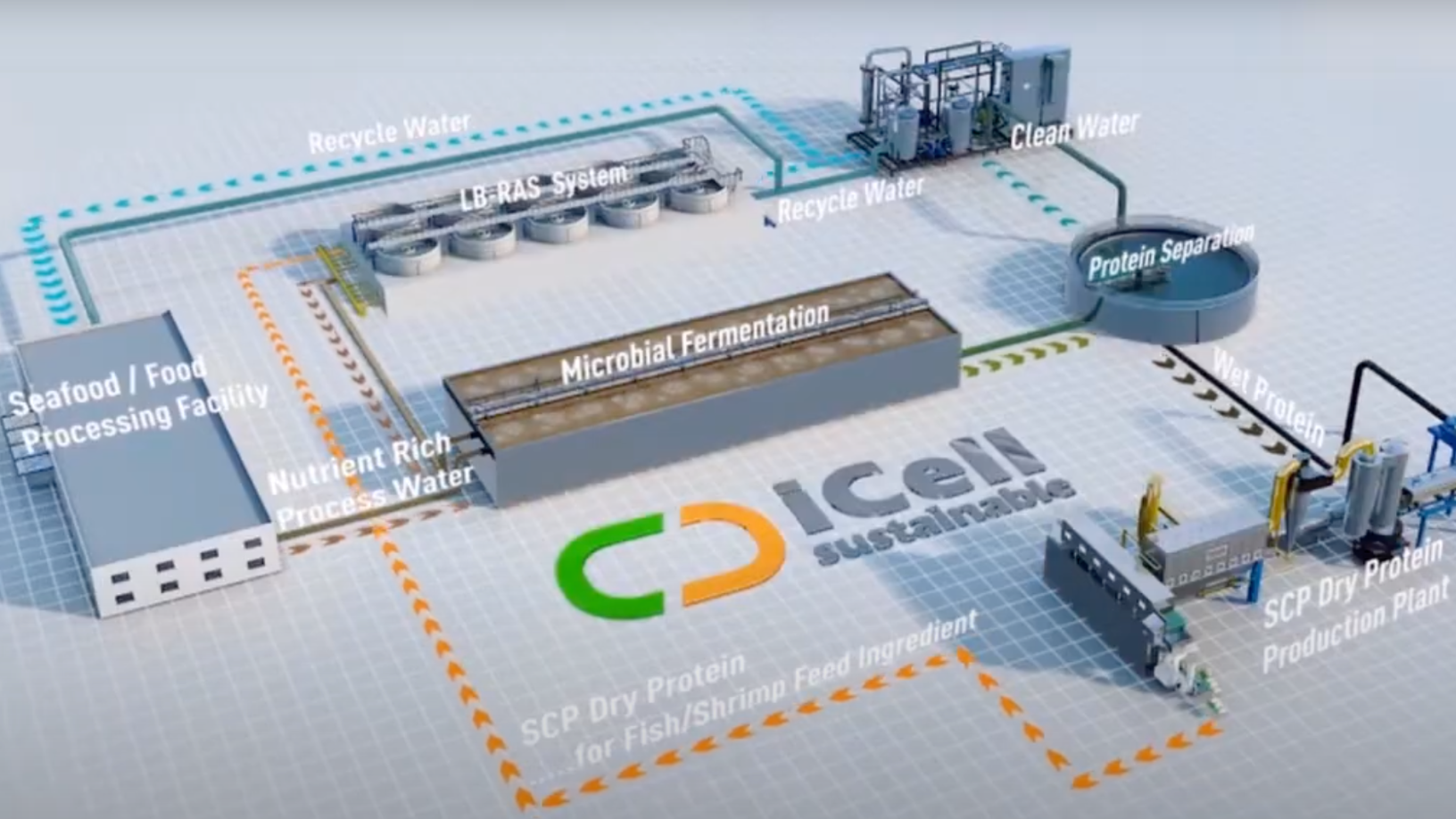

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

Sonic Boom: Using sound wave technology to understand shopper behaviour

Sonic Boom's solution, which enables data to be captured from mobile devices without needing an internet connection, is eyeing Indonesia's huge retail market

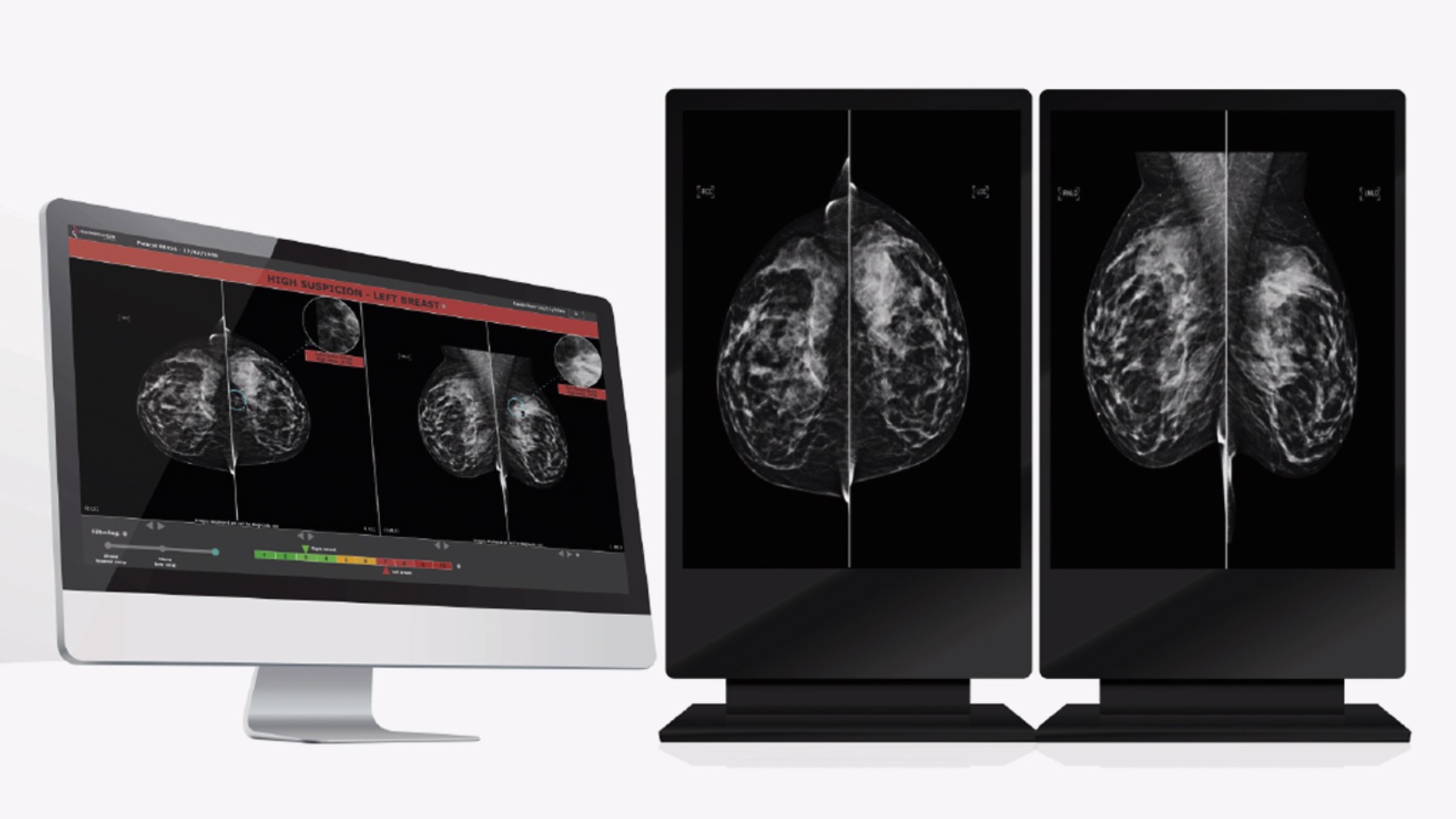

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

SmartAHC: Wearables for pigs and smart farm management to boost productivity

SmartAHC has also expanded beyond pig farms to related sectors in the supply chain, including insurance, banking and local government

Onesight: Reducing building construction errors with 3D, AR/VR visualization apps

Shanghai-based Onesight provides a digital alternative to 2D architectural drawings for teams working on construction sites

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“INNOV-ID”.