INNOV-ID

-

DATABASE (229)

-

ARTICLES (314)

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

Headquartered in Beijing and set up in 2006, China Growth Capital invests in early-stage internet startups in China and the US. As of May 2016, it has two USD-denominated funds and three RMB-denominated funds, valued around RMB 4 billion in total.

CEO and co-founder of Refurbed

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

Google co-founder Larry Page is controlling shareholder of Alphabet Inc, Google’s parent company. As of June 2021, Page’s net worth was $106.2bn, making him the sixth richest person in the world. To date, he has made disclosed investments in five tech companies. The two most recent were both in 2016: an undisclosed quantum of investment in US-based electric personal aircraft startup Kitty Hawk Corporation, as well as participation in space mining company Planetary Resources’ $21m Series A round.

Google co-founder Larry Page is controlling shareholder of Alphabet Inc, Google’s parent company. As of June 2021, Page’s net worth was $106.2bn, making him the sixth richest person in the world. To date, he has made disclosed investments in five tech companies. The two most recent were both in 2016: an undisclosed quantum of investment in US-based electric personal aircraft startup Kitty Hawk Corporation, as well as participation in space mining company Planetary Resources’ $21m Series A round.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Co-founder of Mindstores

Armed with a master’s in Multimedia Arts from Birmingham City University in the UK, Jeffrey Budiman is an experienced creative and branding professional. After his master’s in 2003, he worked at a strategic brand consultancy company DM Brands for five years. He developed a new brand agency DM ID with Daniel Surya. Jeffrey joined Daniel’s WIR Group as CTO and also became a director of WIR’s brand technology unit Spacesym, now known as Redspace.

Armed with a master’s in Multimedia Arts from Birmingham City University in the UK, Jeffrey Budiman is an experienced creative and branding professional. After his master’s in 2003, he worked at a strategic brand consultancy company DM Brands for five years. He developed a new brand agency DM ID with Daniel Surya. Jeffrey joined Daniel’s WIR Group as CTO and also became a director of WIR’s brand technology unit Spacesym, now known as Redspace.

Co-Founder of Sale Stock

The original mastermind of Sale Stock, Ariza Novianti began selling her pre-loved clothing items after giving birth to her first child. She and her husband, current Sale Stock CEO Lingga Madu, initially worked on Sale Stock at their home while retaining their full-time day jobs.

The original mastermind of Sale Stock, Ariza Novianti began selling her pre-loved clothing items after giving birth to her first child. She and her husband, current Sale Stock CEO Lingga Madu, initially worked on Sale Stock at their home while retaining their full-time day jobs.

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

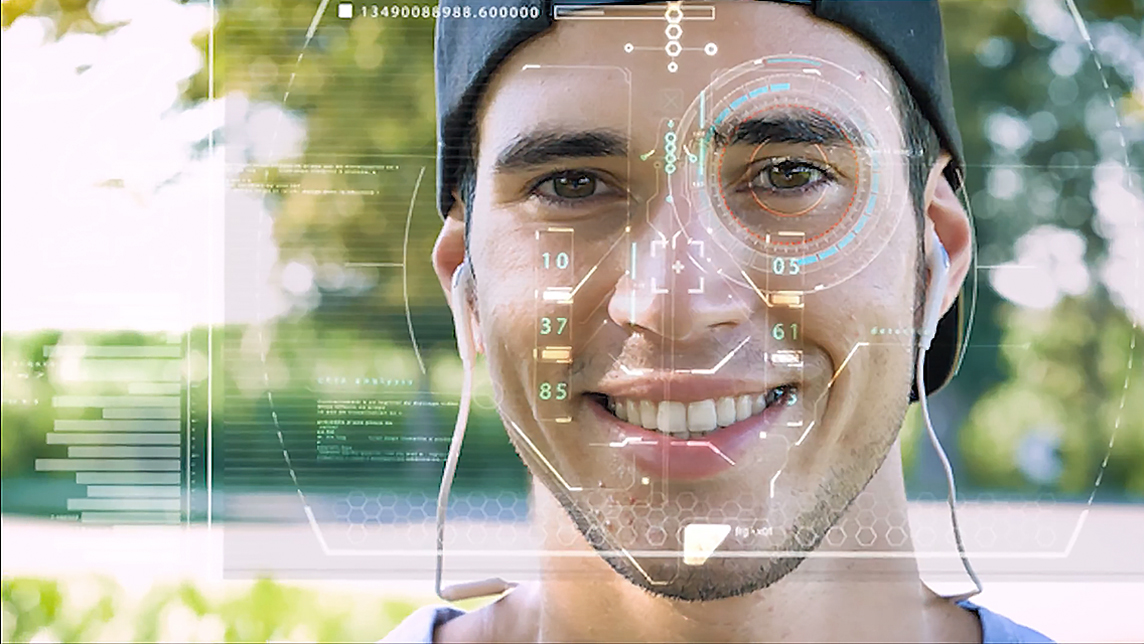

Ecertic Digital Solutions: A Spanish leader in online ID verification

The Spanish biometric tech startup offers online ID verification and tracked document solutions in a US$10 billion market set to double by 2022

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

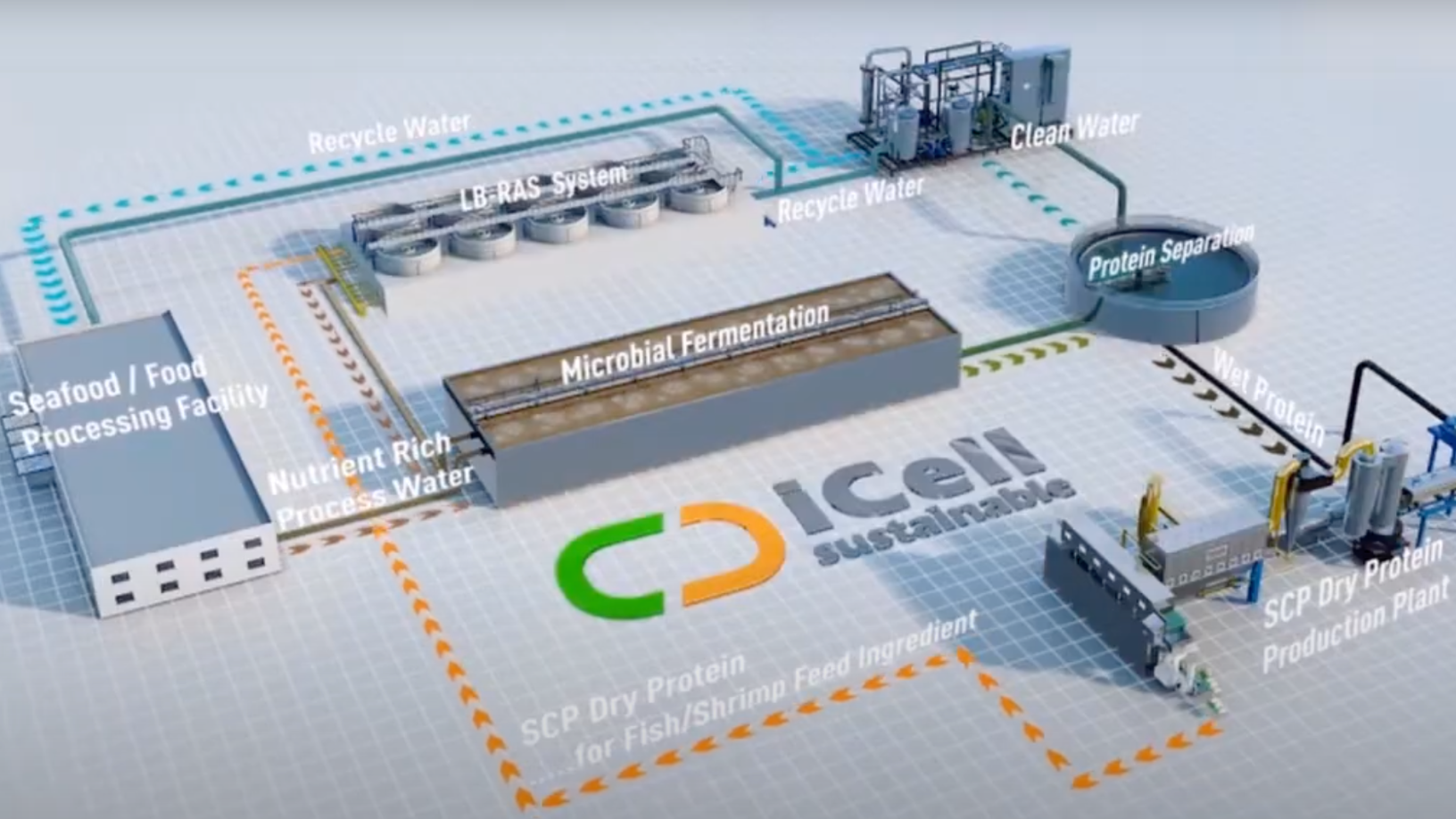

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

Sonic Boom: Using sound wave technology to understand shopper behaviour

Sonic Boom's solution, which enables data to be captured from mobile devices without needing an internet connection, is eyeing Indonesia's huge retail market

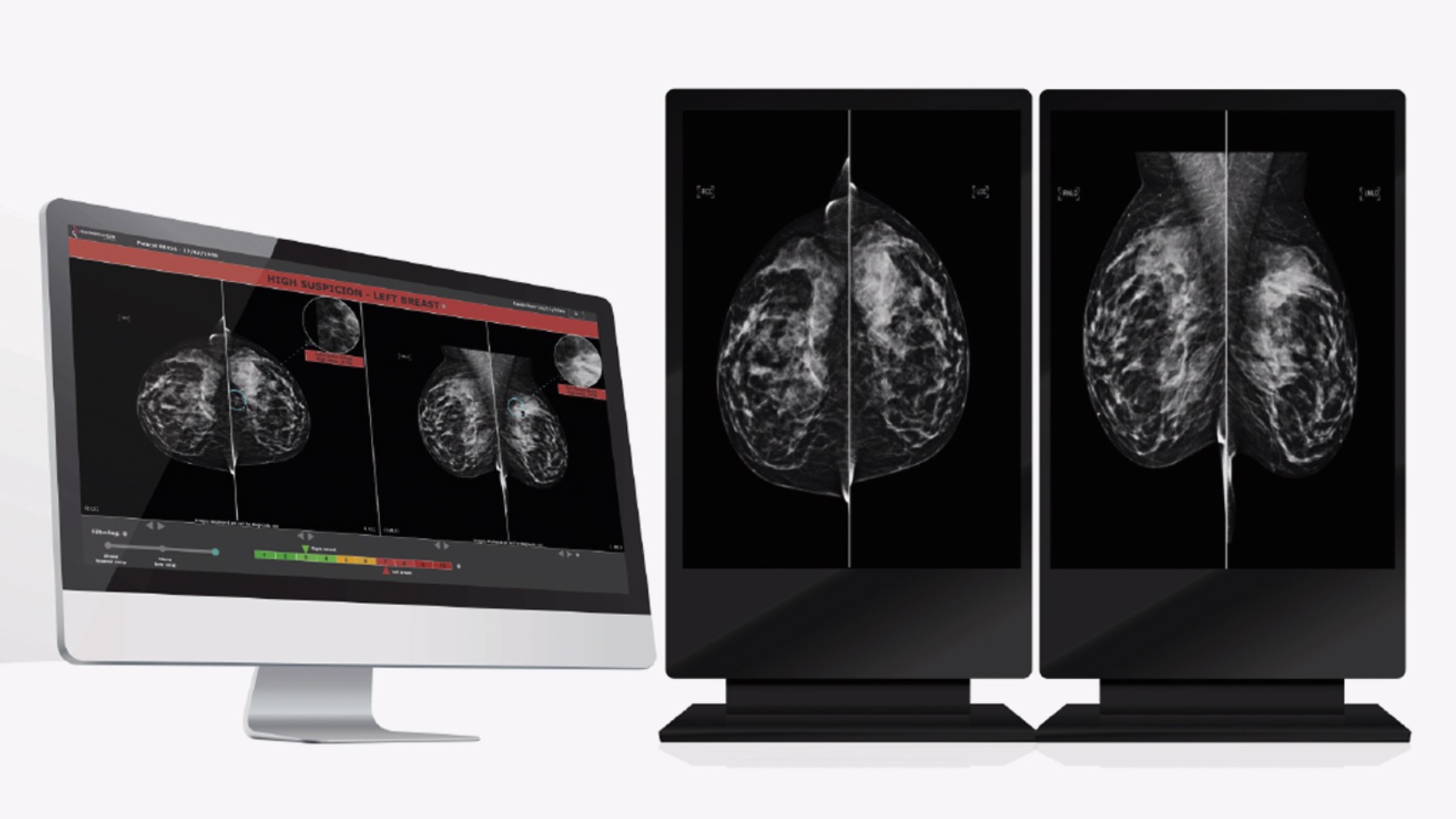

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

SmartAHC: Wearables for pigs and smart farm management to boost productivity

SmartAHC has also expanded beyond pig farms to related sectors in the supply chain, including insurance, banking and local government

Onesight: Reducing building construction errors with 3D, AR/VR visualization apps

Shanghai-based Onesight provides a digital alternative to 2D architectural drawings for teams working on construction sites

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“INNOV-ID”.