INNOV-ID

DATABASE (229)

ARTICLES (314)

CEO and Co-founder of Cobee

Borja Aranguren Herrera has a MSc in Industrial Engineering specializing in both mechanical engineering and business administration. In 2012, he received a scholarship for an exchange program at the San Diego State University in California which he successfully completed with the best possible grades.Since 2018, he has been the CEO and co-founder of Cobee, a fast growing fintech app that helps companies manage employee benefits. Prior to this, Aranguren Herrera worked for several years as a consultant at McKinsey and late led strategy and business expansion at OnTruck, one of the most promising logistics startups in Spain.

Borja Aranguren Herrera has a MSc in Industrial Engineering specializing in both mechanical engineering and business administration. In 2012, he received a scholarship for an exchange program at the San Diego State University in California which he successfully completed with the best possible grades.Since 2018, he has been the CEO and co-founder of Cobee, a fast growing fintech app that helps companies manage employee benefits. Prior to this, Aranguren Herrera worked for several years as a consultant at McKinsey and late led strategy and business expansion at OnTruck, one of the most promising logistics startups in Spain.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Founded in Chicago in 2011, Hyde Park invests in Midwestern US and occasionally Canadian startups from early-stage usually through two investment rounds across tech sectors. It currently has 62 startups in its portfolio and has managed 12 exits to date. Its most recent investments in January 2021 include Canadian e-commerce site BlackCart’s $8.8m Series A round and US podcast database Podchaser’s $5.7m Series A round. In November 2020, it invested in real estate productivity software NestEgg’s $7m Series A round.

Zhan Investment was founded in 2015 in Guangzhou.

CEO and Co-founder of Squirrel AI

Squirrel AI CEO and co-founder Zhou Wei was formerly VP of Only Education International, a K12 educational institution. He was also the GM of Only Education’s strategic expansion department from 2010, growing its student base from 100,000 to 1m over three years, acquiring the biggest share of the children’s English education market in China and once had opened 600 institutions in one year. Prior to joining Only Education, Zhou worked at Avon Products as its GM in Shanghai, where he achieved a record RMB 500m in annual sales and won the Best Regional and Team-Lead Sales Performance title for four consecutive years .

Squirrel AI CEO and co-founder Zhou Wei was formerly VP of Only Education International, a K12 educational institution. He was also the GM of Only Education’s strategic expansion department from 2010, growing its student base from 100,000 to 1m over three years, acquiring the biggest share of the children’s English education market in China and once had opened 600 institutions in one year. Prior to joining Only Education, Zhou worked at Avon Products as its GM in Shanghai, where he achieved a record RMB 500m in annual sales and won the Best Regional and Team-Lead Sales Performance title for four consecutive years .

PICC Capital Equity Investment Company

PICC Capital Equity Investment Company was founded in 2009 as a subsidiary of Chinese listed insurer PICC.In 2018, it set up a RMB 300m fund targeting health and elderly-care sectors. In 2020, the VC set up another fund to invest in cutting-edge technologies like biotech, integrated circuit, etc.

PICC Capital Equity Investment Company was founded in 2009 as a subsidiary of Chinese listed insurer PICC.In 2018, it set up a RMB 300m fund targeting health and elderly-care sectors. In 2020, the VC set up another fund to invest in cutting-edge technologies like biotech, integrated circuit, etc.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Regent Capital is a venture capital firm founded in 2015 in Shenzhen.

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

CTO and co-founder of Onesight

Jiang Tong obtained bachelor's degrees in Civil Engineering from Tongji University and Control Science and Engineering from Zhejiang University between 2011 and 2016. Upon graduation, he joined a robotics startup founded by a team from Zhejiang university, Shanghai Seer Robotics Technology, working as an algorithm engineer from 2016 to 2017. He then joined Bumie Tech in 2017. He specializes in simultaneous localization and mapping (SLAM) and location algorithm. Jiang now serves as CTO at Onesight.

Jiang Tong obtained bachelor's degrees in Civil Engineering from Tongji University and Control Science and Engineering from Zhejiang University between 2011 and 2016. Upon graduation, he joined a robotics startup founded by a team from Zhejiang university, Shanghai Seer Robotics Technology, working as an algorithm engineer from 2016 to 2017. He then joined Bumie Tech in 2017. He specializes in simultaneous localization and mapping (SLAM) and location algorithm. Jiang now serves as CTO at Onesight.

Headquartered in Hong Kong, Valliance Asset Management is a hedge fund manager founded in May 2019.

Headquartered in Hong Kong, Valliance Asset Management is a hedge fund manager founded in May 2019.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

CEO and co-founder of Bygen

Lewis Dunnigan is a researcher turned entrepreneur based in Australia. After earning a master’s degree in Chemical Engineering and working as a researcher at the University of Edinburgh in the UK, Dunnigan returned to Australia. He had a brief stint as a visiting researcher and earned his PhD in Chemical Engineering at the University of Adelaide.During his PhD, Dunnigan was a part of Philip Kwong’s research laboratory. His PhD project involved developing a system to generate activated charcoal and renewable energy from biomass. In 2017, Dunnigan, Kwong, and fellow PhD student Ben Morton decided to commercialize this technology and established a spin-off company called Bygen, which developed a low-cost, novel way to make activated carbon more sustainably using various forms of agricultural waste. Dunnigan is now the CEO of Bygen.

Lewis Dunnigan is a researcher turned entrepreneur based in Australia. After earning a master’s degree in Chemical Engineering and working as a researcher at the University of Edinburgh in the UK, Dunnigan returned to Australia. He had a brief stint as a visiting researcher and earned his PhD in Chemical Engineering at the University of Adelaide.During his PhD, Dunnigan was a part of Philip Kwong’s research laboratory. His PhD project involved developing a system to generate activated charcoal and renewable energy from biomass. In 2017, Dunnigan, Kwong, and fellow PhD student Ben Morton decided to commercialize this technology and established a spin-off company called Bygen, which developed a low-cost, novel way to make activated carbon more sustainably using various forms of agricultural waste. Dunnigan is now the CEO of Bygen.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2017, Momentum Capital is focused on enterprise tech as well as new retail and consumption.

Founded in 2017, Momentum Capital is focused on enterprise tech as well as new retail and consumption.

Shansheng Equity Investment Fund

Shansheng Equity Investment Fund was launched in September 2020 with Beijing Huayao Zhongwei Investment Management as its manager.

Shansheng Equity Investment Fund was launched in September 2020 with Beijing Huayao Zhongwei Investment Management as its manager.

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

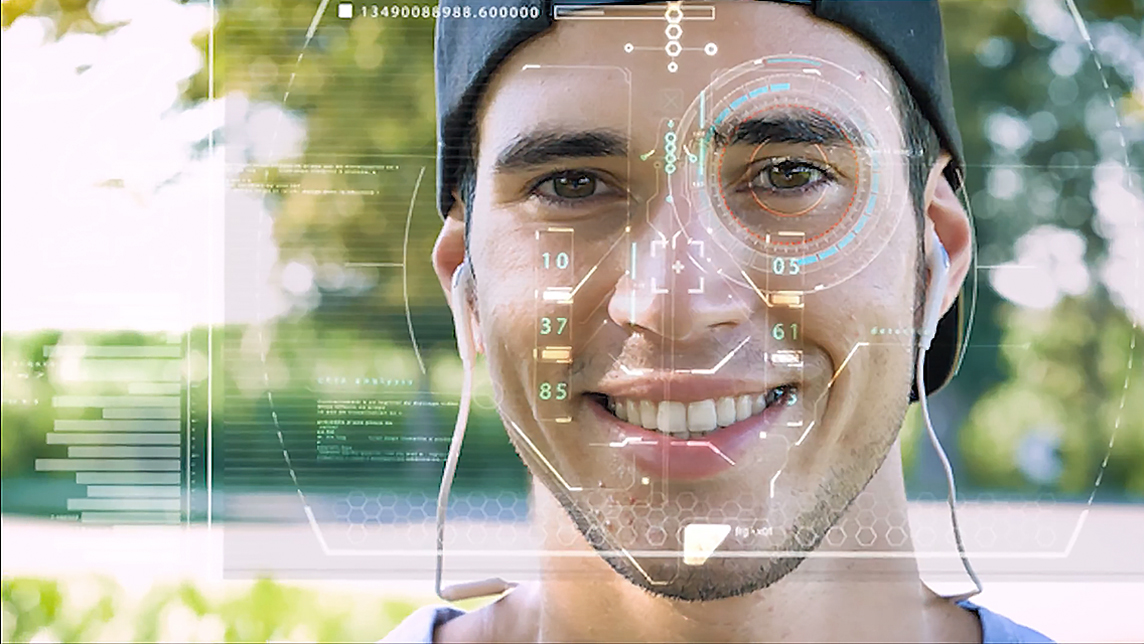

Ecertic Digital Solutions: A Spanish leader in online ID verification

The Spanish biometric tech startup offers online ID verification and tracked document solutions in a US$10 billion market set to double by 2022

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

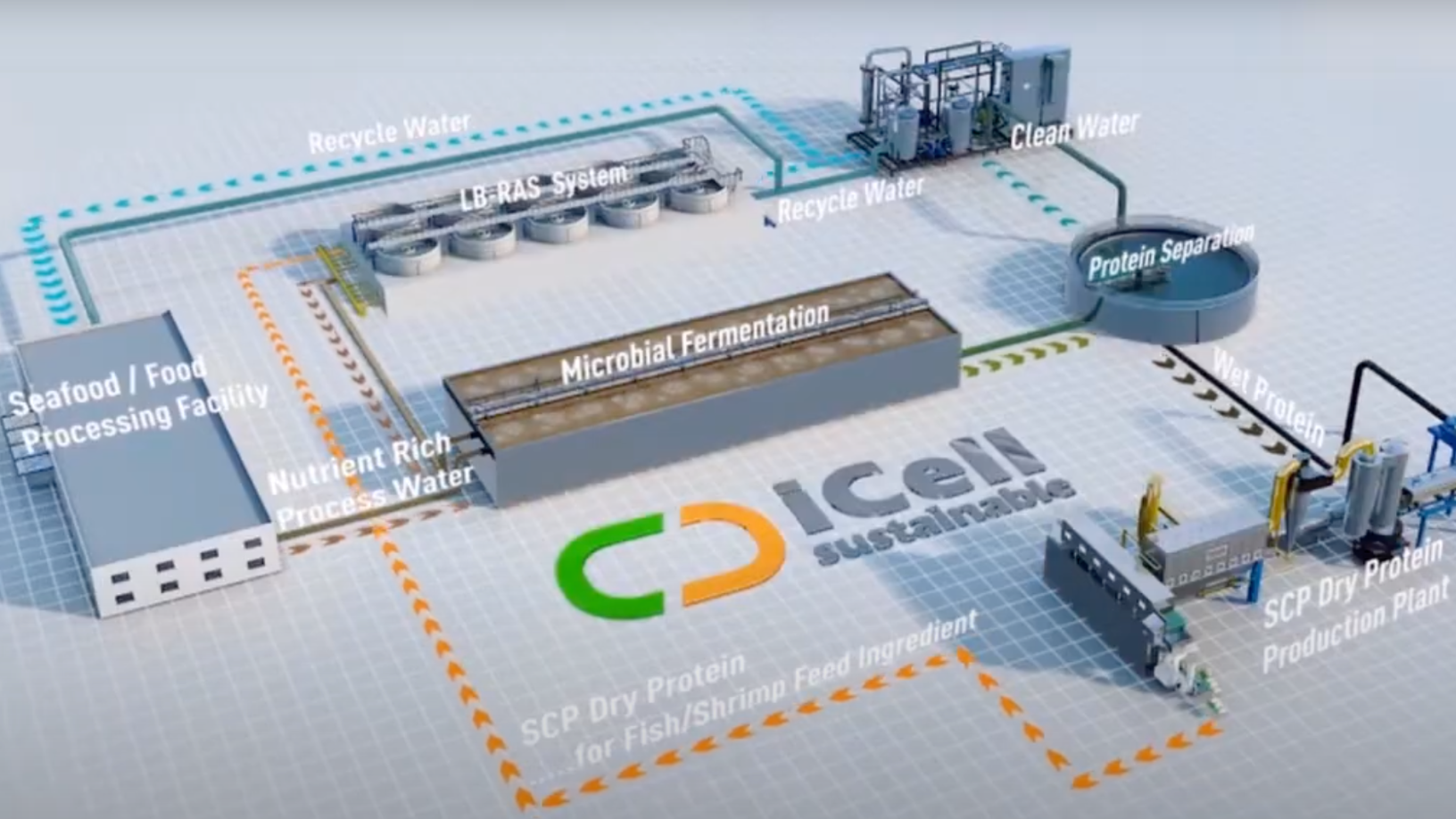

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

Sonic Boom: Using sound wave technology to understand shopper behaviour

Sonic Boom's solution, which enables data to be captured from mobile devices without needing an internet connection, is eyeing Indonesia's huge retail market

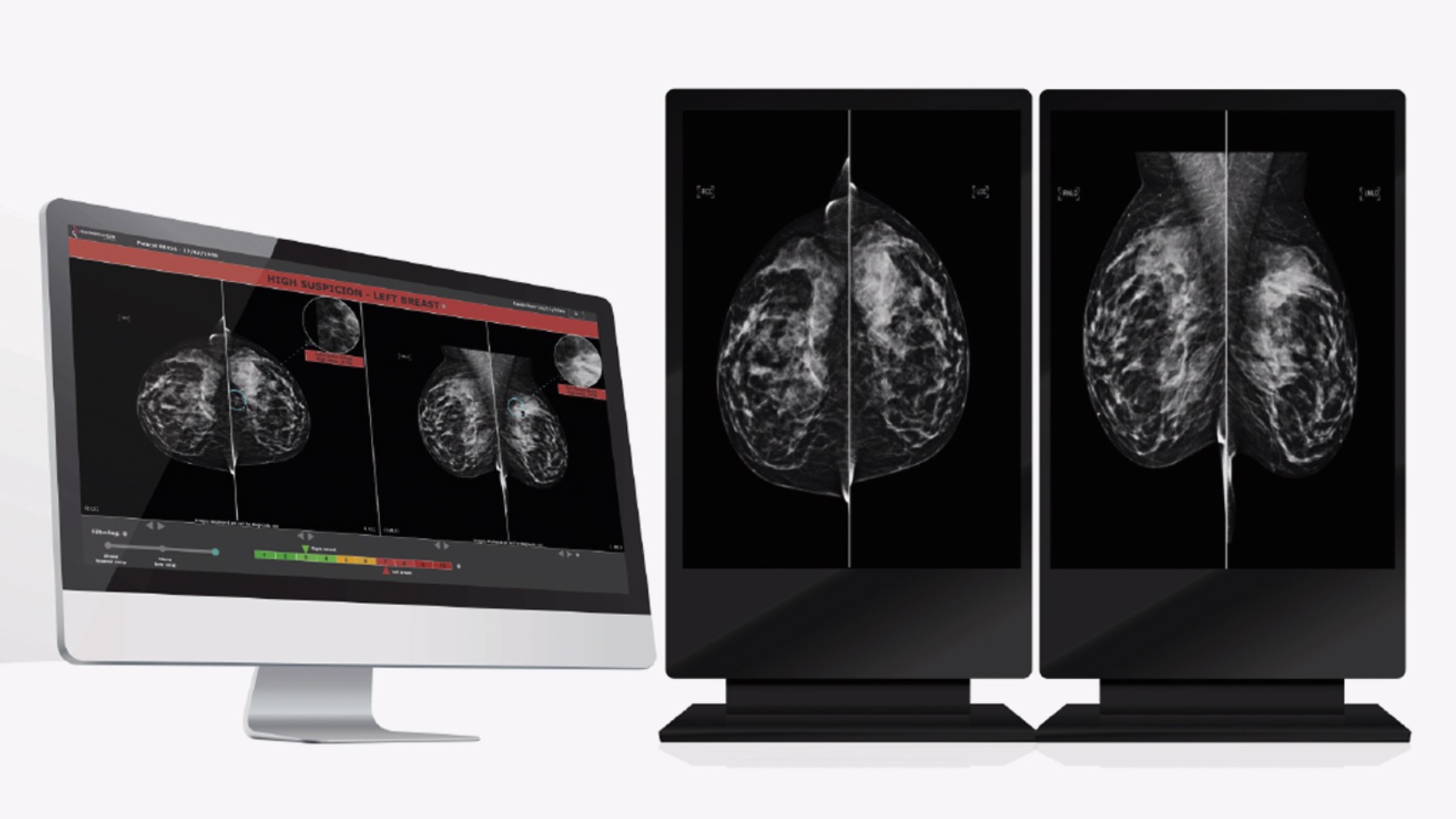

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

SmartAHC: Wearables for pigs and smart farm management to boost productivity

SmartAHC has also expanded beyond pig farms to related sectors in the supply chain, including insurance, banking and local government

Onesight: Reducing building construction errors with 3D, AR/VR visualization apps

Shanghai-based Onesight provides a digital alternative to 2D architectural drawings for teams working on construction sites

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“INNOV-ID”.