INTEC Foundation

-

DATABASE (61)

-

ARTICLES (84)

Founder and CEO of Veniam

Cornell and Stanford-educated Fulbright scholar João Barros is a professor of Electrical and Computer Engineering at the University of Porto and teaches in the MBA program at the Porto Business School. He has also held visiting appointments at MIT and Carnegie Mellon. He has co-founded two startups, Streambolico and Veniam, of which he is also CEO. Between 2009 and 2012, Barros served as National Director of the Carnegie Mellon Portugal Program, a five-year international partnership funded by the Portuguese Foundation of Science and Technology. He holds a Ph.D. in Electrical Engineering and Information Technology from Munich's Technical University.

Cornell and Stanford-educated Fulbright scholar João Barros is a professor of Electrical and Computer Engineering at the University of Porto and teaches in the MBA program at the Porto Business School. He has also held visiting appointments at MIT and Carnegie Mellon. He has co-founded two startups, Streambolico and Veniam, of which he is also CEO. Between 2009 and 2012, Barros served as National Director of the Carnegie Mellon Portugal Program, a five-year international partnership funded by the Portuguese Foundation of Science and Technology. He holds a Ph.D. in Electrical Engineering and Information Technology from Munich's Technical University.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

Kike Sarasola is a successful entrepreneur in the hotel industry. He launched an international boutique hotel chain Room Mate Hotels Group in 2001.Sarasola is also an Olympic sportsman for equestrian sports, four-time horse riding champion in Spain and the first Spaniard to win a bronze medal at a European Championship. He is also a volunteer at the ECOALF sustainable clothing brand and the Minicol Foundation that helps Colombian kids affected by violence.

Kike Sarasola is a successful entrepreneur in the hotel industry. He launched an international boutique hotel chain Room Mate Hotels Group in 2001.Sarasola is also an Olympic sportsman for equestrian sports, four-time horse riding champion in Spain and the first Spaniard to win a bronze medal at a European Championship. He is also a volunteer at the ECOALF sustainable clothing brand and the Minicol Foundation that helps Colombian kids affected by violence.

Co-founder of Halofina

Eko Pratomo graduated from Bandung Institute of Technology (ITB) with a degree in Flight Engineering. He holds an MBA from IPMI International Business School in Jakarta. In the late '80s, he studied Aeronautical Engineering at the Delft University of Technology. Pratomo and his wife run the Syamsi Dhuha Foundation, a social enterprise for people with lupus and low vision. Since 2010, he has been a senior advisor at BNP Paribas Investment Partners. In 2017, he started Halofina with Adjie Wicaksana. Pratomo won Indonesia’s Asset Manager CEO of the Year 2008 award from Asia Asset Management.

Eko Pratomo graduated from Bandung Institute of Technology (ITB) with a degree in Flight Engineering. He holds an MBA from IPMI International Business School in Jakarta. In the late '80s, he studied Aeronautical Engineering at the Delft University of Technology. Pratomo and his wife run the Syamsi Dhuha Foundation, a social enterprise for people with lupus and low vision. Since 2010, he has been a senior advisor at BNP Paribas Investment Partners. In 2017, he started Halofina with Adjie Wicaksana. Pratomo won Indonesia’s Asset Manager CEO of the Year 2008 award from Asia Asset Management.

CEO, co-founder of Psquared

Argentinian native Nicolas Manrique is CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces, where he has worked since 2019. He is also a part-time advisor and investor at startup development agency We Are Grit, since its foundation in 2020. Since 2014, he has also been the owner of a marketing agency for SMEs in his native Buenos Aires, called Estudio Cuervo. In 2018, Manrique founded the Barcelona chapter of Argentinian startup co-working agency La Maquinita. Manrique holds a bachelor’s in business administration from Buenos Aires’ Pontifical Catholic University.

Argentinian native Nicolas Manrique is CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces, where he has worked since 2019. He is also a part-time advisor and investor at startup development agency We Are Grit, since its foundation in 2020. Since 2014, he has also been the owner of a marketing agency for SMEs in his native Buenos Aires, called Estudio Cuervo. In 2018, Manrique founded the Barcelona chapter of Argentinian startup co-working agency La Maquinita. Manrique holds a bachelor’s in business administration from Buenos Aires’ Pontifical Catholic University.

José Neves is best known as the CEO and co-founder of fashion unicorn Farfetch, one of Portugal's most successful startups to date. London-based Neves is also a non-executive director at the British Fashion Council. He has set up his own foundation to spend two-thirds of Farfetch's profits on innovation projects. As an angel investor, he has so far invested in two startups: Portuguese fintech StudentFinance and fashion platform asap54.com where he is also an advisor.

José Neves is best known as the CEO and co-founder of fashion unicorn Farfetch, one of Portugal's most successful startups to date. London-based Neves is also a non-executive director at the British Fashion Council. He has set up his own foundation to spend two-thirds of Farfetch's profits on innovation projects. As an angel investor, he has so far invested in two startups: Portuguese fintech StudentFinance and fashion platform asap54.com where he is also an advisor.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Co-founder and CEO of Mapan by Ruma

Indonesia’s most prominent young social entrepreneur Aldi Haryopratomo was in the Harvard Business School class of 2011, where his peers included Go-Jek founder Nadiem Makarim and Grab founders Anthony Tan and Tan Hooi Ling.Aldi began his career as a security consultant for Ernst & Young. After a one-year stint at the Boston Consulting Group, Aldi worked with Sean Dewitt and Budiman Wikarsa from the Grameen Foundation to develop Ruma, a business-in-a-box startup for low-income Indonesians in 2009. Ruma launched the “Arisan Mapan” group-buying app in 2014.Aldi also holds a Computer Engineering degree from Purdue University. He was selected as a Young Global Leader in the 2012 World Economic Forum.

Indonesia’s most prominent young social entrepreneur Aldi Haryopratomo was in the Harvard Business School class of 2011, where his peers included Go-Jek founder Nadiem Makarim and Grab founders Anthony Tan and Tan Hooi Ling.Aldi began his career as a security consultant for Ernst & Young. After a one-year stint at the Boston Consulting Group, Aldi worked with Sean Dewitt and Budiman Wikarsa from the Grameen Foundation to develop Ruma, a business-in-a-box startup for low-income Indonesians in 2009. Ruma launched the “Arisan Mapan” group-buying app in 2014.Aldi also holds a Computer Engineering degree from Purdue University. He was selected as a Young Global Leader in the 2012 World Economic Forum.

CEO and co-founder of agroSingularity

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

Based in Seattle, Washington, Pivotal Ventures was founded by Melinda Gates in 2015 as a separate, independent organization from the Bill & Melinda Gates Foundation. The VC-arm and incubator aim to foster social innovation in the US, focusing on the social progress of women and families. It has supported diversity & inclusion, healthcare and impact startups by providing early-stage funding to enterprises with philanthropic and scalable goals. In October 2020, Pivotal launched a fund for adolescent mental health in partnership with Panorama Global. In September 2020, it also joined Techstars to create a new accelerator program to find innovative eldercare solutions for seniors and their caregivers.

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

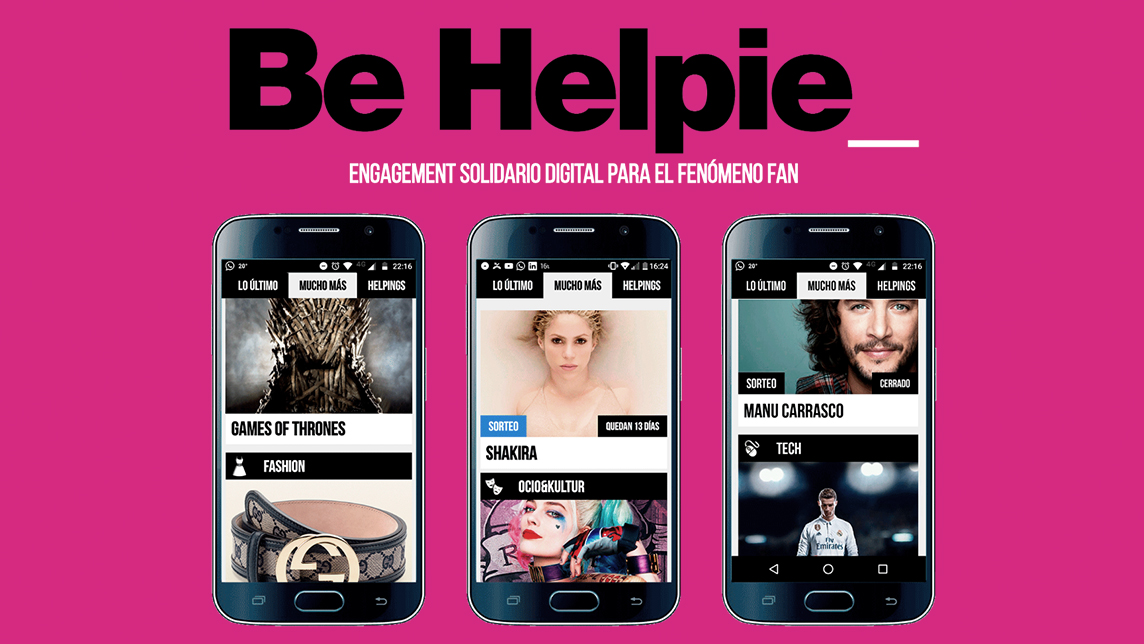

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Du'Anyam: Empowering rural women to work independently and learn financial planning skills

Du’Anyam had to cancel bulk orders to survive the Covid-19 downturn, pivoting to B2C online sales, until the tourism and hospitality sectors recover

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Sorry, we couldn’t find any matches for“INTEC Foundation”.