IOT Solutions World Congress

-

DATABASE (337)

-

ARTICLES (533)

As online video dominates the Internet, NPAW's AI-powered business intelligence solutions give media companies an edge in understanding, serving and retaining their customers.

As online video dominates the Internet, NPAW's AI-powered business intelligence solutions give media companies an edge in understanding, serving and retaining their customers.

TuSimple aims to become profitable by revving up mass production of self-driving trucks and launching world’s first freight version of Waymo One by 2024.

TuSimple aims to become profitable by revving up mass production of self-driving trucks and launching world’s first freight version of Waymo One by 2024.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

MININGLAMP Technology is a B2B big data solutions provider. Founded in Beijing in 2014, its product lines range from data platforms and data applications to data visualizations. The company sells three major products: data platform BDP, data mining tool DataInsight and a data visualization suite. MININGLAMP Technology recently raised RMB 2bn in its Series D round from investors such as Tencent.

MININGLAMP Technology is a B2B big data solutions provider. Founded in Beijing in 2014, its product lines range from data platforms and data applications to data visualizations. The company sells three major products: data platform BDP, data mining tool DataInsight and a data visualization suite. MININGLAMP Technology recently raised RMB 2bn in its Series D round from investors such as Tencent.

Chief Growth Officer and co-founder of Kobo360

After graduating in business administration at the University of Michigan-Dearborn in 2013, Ife Oyedele II stayed on at the university to obtain a master’s in information technology in 2016.While studying in Michigan, Oyedele met up with Obi Ozor and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor later moved to Philadelphia to continue his studies at Wharton School.Still at university, he gained work experience in business intelligence at Michigan consultancy firm CFI Group for about three years. He has also conducted some research for pharma group iLabs and completed stints in business analysis and quality assurance at various companies. In May 2014, he joined General Fuels company in Detroit and worked as a business manager for almost two years.In 2016, Ozor and Oyedele co-founded Uber-style logistics platform Kobo360 in Nigeria. Oyedele was CTO at Kobo360 until 2020 when he became the company’s Chief Growth Officer.

After graduating in business administration at the University of Michigan-Dearborn in 2013, Ife Oyedele II stayed on at the university to obtain a master’s in information technology in 2016.While studying in Michigan, Oyedele met up with Obi Ozor and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor later moved to Philadelphia to continue his studies at Wharton School.Still at university, he gained work experience in business intelligence at Michigan consultancy firm CFI Group for about three years. He has also conducted some research for pharma group iLabs and completed stints in business analysis and quality assurance at various companies. In May 2014, he joined General Fuels company in Detroit and worked as a business manager for almost two years.In 2016, Ozor and Oyedele co-founded Uber-style logistics platform Kobo360 in Nigeria. Oyedele was CTO at Kobo360 until 2020 when he became the company’s Chief Growth Officer.

CTO and co-founder of Carbo Culture

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

The Boston-based Grantham Environmental Trust is part of the Grantham Foundation for the Protection of the Environment. The philanthropic organization was founded in 1997 by entrepreneurs Jeremy Grantham and his wife Hannelore as a private foundation controlled by family members. Grantham is chairman and co-founder of investment management firm GMO. The charitable trust has independent trustees like the CEOs of World Wildlife Fund US and the Rocky Mountain Institute. The trust’s Neglected Climate Opportunities LLC invests in little-funded yet promising climate change prevention technologies. Recent investments include the $12m Series A round of Vence, a US-based producer of a virtual fencing wearable for livestock management in May 2021 and the January 2021 investment round of US sustainable electrofuels producer Infinium.

The Boston-based Grantham Environmental Trust is part of the Grantham Foundation for the Protection of the Environment. The philanthropic organization was founded in 1997 by entrepreneurs Jeremy Grantham and his wife Hannelore as a private foundation controlled by family members. Grantham is chairman and co-founder of investment management firm GMO. The charitable trust has independent trustees like the CEOs of World Wildlife Fund US and the Rocky Mountain Institute. The trust’s Neglected Climate Opportunities LLC invests in little-funded yet promising climate change prevention technologies. Recent investments include the $12m Series A round of Vence, a US-based producer of a virtual fencing wearable for livestock management in May 2021 and the January 2021 investment round of US sustainable electrofuels producer Infinium.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

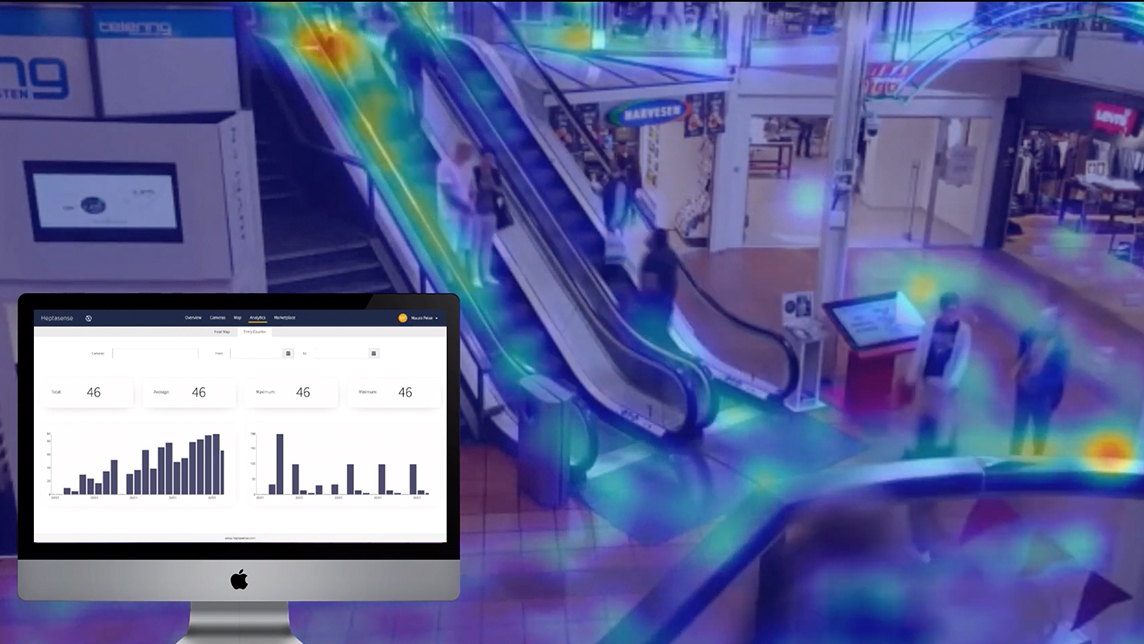

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Proppos FastPay: Reducing food waste through food recognition tech for restaurants

In a market with few competitors, SaaS startup Proppos FastPay brings operational efficiency to the food services industry with self-checkout machines

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

Interview with Qlue CEO, part II: Smart cities in Indonesia and beyond

Continuing from the first part of an interview, Qlue CEO Rama Raditya discusses trends, achievements and challenges in smart city development

Zoundream: Deciphering and mining the data in baby cries

The world’s first algorithm to translate baby cries into actionable insights for parents and hospitals seeks to boost early detection of pathologies and developmental disorders

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Sorry, we couldn’t find any matches for“IOT Solutions World Congress”.