Indexa Capital

-

DATABASE (699)

-

ARTICLES (370)

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Co-founder and co-CEO of Indexa Capital

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

Pedro Luis Uriarte Santamarina

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Marta Esteve co-founded Toprural with François Derbaix in 2000. The Spanish travel startup was later sold to American giant HomeAway in 2012. Esteve was also a founding member of other startups like Rentalia, a holiday rental platform that was acquired by Idealista, a real-estate leader in Spain.She is also co-founder and CEO of supermarket aggregator Soysuper that compares prices across brands. As a business angel, she has backed projects like Bewa7er, Indexa Capital, Vinogusto, Palbin and Familiafacil.

Marta Esteve co-founded Toprural with François Derbaix in 2000. The Spanish travel startup was later sold to American giant HomeAway in 2012. Esteve was also a founding member of other startups like Rentalia, a holiday rental platform that was acquired by Idealista, a real-estate leader in Spain.She is also co-founder and CEO of supermarket aggregator Soysuper that compares prices across brands. As a business angel, she has backed projects like Bewa7er, Indexa Capital, Vinogusto, Palbin and Familiafacil.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

The first on-demand mobility service in francophone West Africa, Teliman is boosting transportation links and drivers’ economic development, especially for women; eyes expanding to logistics.

The first on-demand mobility service in francophone West Africa, Teliman is boosting transportation links and drivers’ economic development, especially for women; eyes expanding to logistics.

Founder and CEO of Zhinanmao

Former partner, Mount Venture Capital; vice president, Power Capital. The economics graduate from Jiangsu University is an avid backpacker and certified tour guide. A serial entrepreneur too (with previous startups in bicycle rental, education and training, e-commerce, F&B).

Former partner, Mount Venture Capital; vice president, Power Capital. The economics graduate from Jiangsu University is an avid backpacker and certified tour guide. A serial entrepreneur too (with previous startups in bicycle rental, education and training, e-commerce, F&B).

Co-founder and COO of Ebaoyang

Former vice-president of China Aerospace Capital, with over 12 years’ experience in finance, investment and operation management.

Former vice-president of China Aerospace Capital, with over 12 years’ experience in finance, investment and operation management.

Co-founder and Head of Strategy of Huajuan Mall

Bao holds two bachelor’s degrees in Finance and Communications Engineering from the Harbin Institute of Technology and a master’s degree in Financial Mathematics from the University of Chicago. He worked as an associate at Morgan Stanley's Global Capital Markets business unit from 2011 to 2015. Bao then worked as an investment associate at Chinese group buying website Meituan-Dianping from 2015 to 2016 and at Legend Capital from 2016 to 2017. In 2017, he co-founded Huajuan Mall and has since served as head of strategy.

Bao holds two bachelor’s degrees in Finance and Communications Engineering from the Harbin Institute of Technology and a master’s degree in Financial Mathematics from the University of Chicago. He worked as an associate at Morgan Stanley's Global Capital Markets business unit from 2011 to 2015. Bao then worked as an investment associate at Chinese group buying website Meituan-Dianping from 2015 to 2016 and at Legend Capital from 2016 to 2017. In 2017, he co-founded Huajuan Mall and has since served as head of strategy.

Co-founder of Dana+

Holding an MBA from Lancaster University, UK, Yang co-founded Dana+ with Ren Xinxin and Lv Xin in 2015. He’s also a partner of Lidafeng Investment, and of Ming Capital, an investment management company co-founded by popular Chinese actor Huang Xiaoming.

Holding an MBA from Lancaster University, UK, Yang co-founded Dana+ with Ren Xinxin and Lv Xin in 2015. He’s also a partner of Lidafeng Investment, and of Ming Capital, an investment management company co-founded by popular Chinese actor Huang Xiaoming.

Co-founder and Co-CEO of Dianrong

Former private equity partner and intellectual property lawyer with over a decade of experience, whose clients included Google, Microsoft, and venture capital funds. A councilor of the Shanghai branch of the All-China Youth Federation, Guo holds an EMBA from PBC School of Finance, Tsinghua University.

Former private equity partner and intellectual property lawyer with over a decade of experience, whose clients included Google, Microsoft, and venture capital funds. A councilor of the Shanghai branch of the All-China Youth Federation, Guo holds an EMBA from PBC School of Finance, Tsinghua University.

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Farm Friend: World’s first agri-drone sharing platform wins over users, investors

Gone are the days of the lone Chinese farmer toiling under the sun. Now drones are here to help – and there’s even a drone sharing platform too

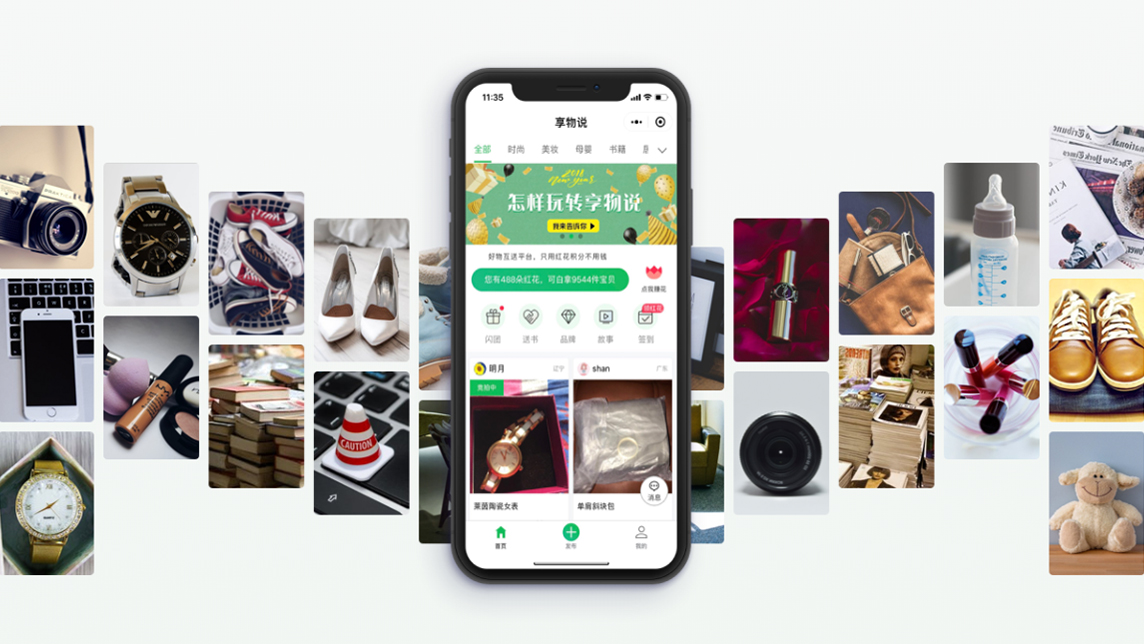

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

eFishery poised to benefit from Indonesia's growing aquaculture sector

eFishery's IoT automatic feeding system is delivering efficiencies and boosting output for small fish farmers, driving strong growth for the aquaculture startup.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Xuebacoming: Promising edtech had compliance issues from day one

Other hefty mistakes also contributed to Xuebacoming's demise – proof that investor and media support, and a booming market, won't guarantee success

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Sorry, we couldn’t find any matches for“Indexa Capital”.