India Alternative Protein Fund

-

DATABASE (487)

-

ARTICLES (339)

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

GaochengVenture Capital is a new growth fund. A subsidiary of Hillhouse Capital, it was started by Hillhouse founding partner Hong Jing. She oversaw the company’s private equity business, strategizing and expanding its investments in multiple industries.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

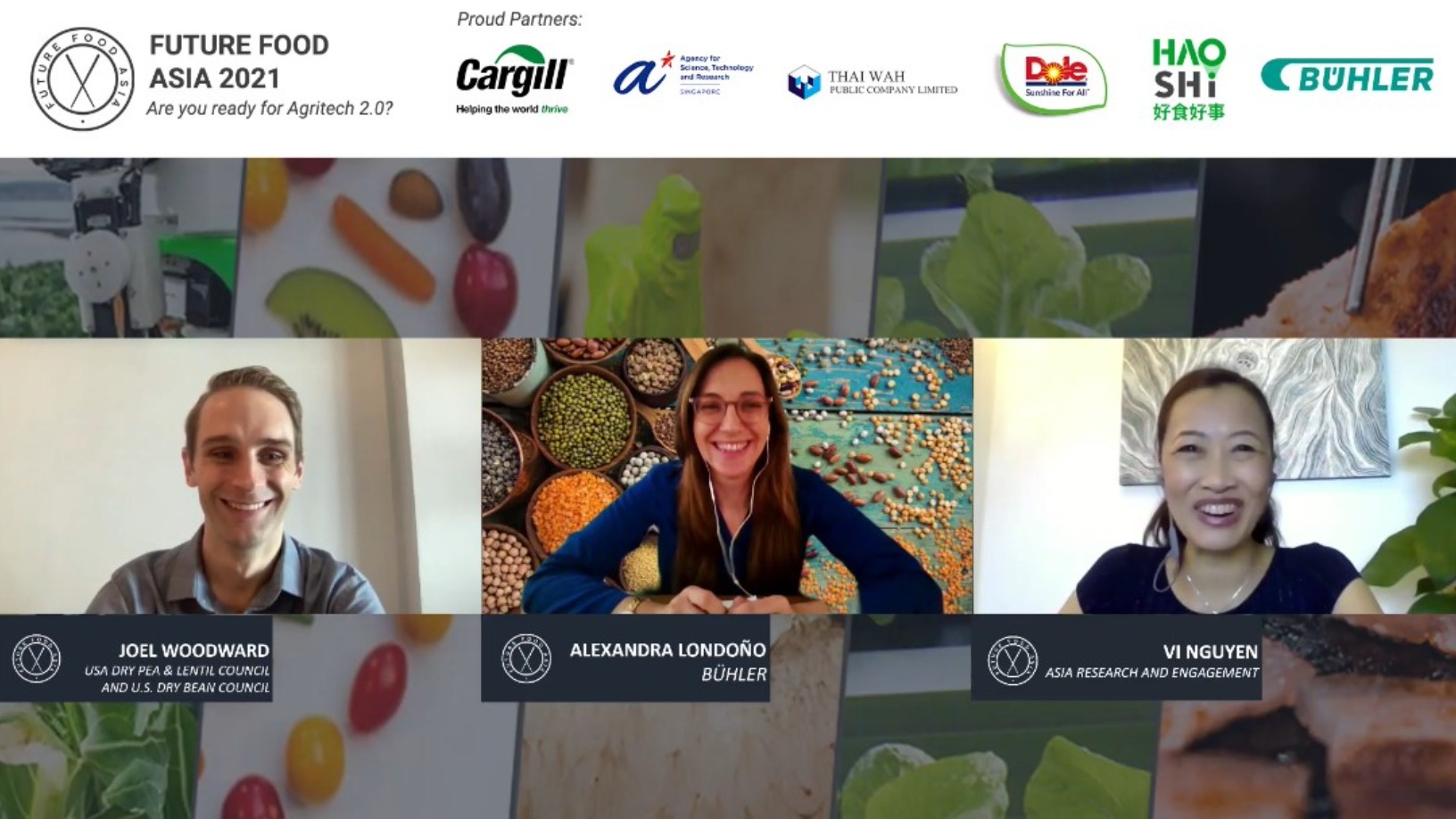

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Sophie's Bionutrients: Alternative protein from microalgae

Inspired by fish in the ocean, the startup developed microalgae-based flour that can take on unlimited forms, textures or colors to make almost any alt protein product

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Sorry, we couldn’t find any matches for“India Alternative Protein Fund”.