Insurtech Europe

-

DATABASE (141)

-

ARTICLES (232)

COO and Co-founder of Impress

Diliara Lupenko is the COO and co-founder of Impress, an invisible aligners company regarded as one of the fastest-growing telemedicine startups in Europe. Prior to Impress, Lupenko served for over eight years as COO and CFO of Aquaton, a bathroom furniture plant and a subsidiary of the ROCA Group. She also worked in the Transaction Service Group in KPMG, managing financial due diligence of over 100 targets, pre-sale preparation of vendors, and restructuring, amongst other tasks. Impress is not Lupenko’s first entrepreneurial experience. In 2013 she co-founded Style Me Up the first Russian marketplace for designers of jewelry and accessories.

Diliara Lupenko is the COO and co-founder of Impress, an invisible aligners company regarded as one of the fastest-growing telemedicine startups in Europe. Prior to Impress, Lupenko served for over eight years as COO and CFO of Aquaton, a bathroom furniture plant and a subsidiary of the ROCA Group. She also worked in the Transaction Service Group in KPMG, managing financial due diligence of over 100 targets, pre-sale preparation of vendors, and restructuring, amongst other tasks. Impress is not Lupenko’s first entrepreneurial experience. In 2013 she co-founded Style Me Up the first Russian marketplace for designers of jewelry and accessories.

Co-Founder & CEO of Bipi

Hans Christ has worked internationally across Latin America, Europe and the USA. He is the co-founder of transport technology startup Bipi, a Spanish on-demand car rental app and Lollo Mobility, Bipi’s parent company and transport app company. He co-founded Colombia Cave Box Crossfit in 2013 and was previously Groupon Iberia’s Head of Goods, where he helped established its product department. Christ started his career as a Credit Manager in Walls Cargo Bank. Christ holds a Business Administration degree from Southern Methodist University (SMU) and an MBA in Marketing from the University of Dallas.

Hans Christ has worked internationally across Latin America, Europe and the USA. He is the co-founder of transport technology startup Bipi, a Spanish on-demand car rental app and Lollo Mobility, Bipi’s parent company and transport app company. He co-founded Colombia Cave Box Crossfit in 2013 and was previously Groupon Iberia’s Head of Goods, where he helped established its product department. Christ started his career as a Credit Manager in Walls Cargo Bank. Christ holds a Business Administration degree from Southern Methodist University (SMU) and an MBA in Marketing from the University of Dallas.

With offices in UK's capital city London and Herzliya in Israel, Entrée Capital is led by Avi Eyal, a serial entrepreneur behind eight companies across South Africa, Europe and the US. The firm invests in companies at all stages and manages total assets worth $300m globally.

With offices in UK's capital city London and Herzliya in Israel, Entrée Capital is led by Avi Eyal, a serial entrepreneur behind eight companies across South Africa, Europe and the US. The firm invests in companies at all stages and manages total assets worth $300m globally.

Headquartered in Nanjing, Fullshare Group was founded in 2002 and listed on the Stock Exchange of Hong Kong in 2013. Its business includes multiple industries, namely, tourism, education, healthcare, real estate and renewable energy. It has expanded to Europe, America, Africa, Central Asia and Australia.

Headquartered in Nanjing, Fullshare Group was founded in 2002 and listed on the Stock Exchange of Hong Kong in 2013. Its business includes multiple industries, namely, tourism, education, healthcare, real estate and renewable energy. It has expanded to Europe, America, Africa, Central Asia and Australia.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Co-founder of Wallapop

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Telstra is a corporate venture capitalist headquartered in Sydney, Australia. It has significant investments in Asia, USA and Europe. It typically invests from US$5 million to US$50 million in established businesses that generate millions of dollars in existing revenue.

Telstra is a corporate venture capitalist headquartered in Sydney, Australia. It has significant investments in Asia, USA and Europe. It typically invests from US$5 million to US$50 million in established businesses that generate millions of dollars in existing revenue.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Burda Principal Investments is part of Hubert Burda Media, an international media and tech conglomerate based in Germany. The VC also has offices in London and Singapore. Since 1998, BPI has invested mainly in consumer internet companies in Europe, Asia and the US. Key investments include Skillshare, fashion marketplace Zilingo and photography services platform SweetEscape.

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

HigoSense launching advanced mobile device for self-triage and diagnosis, boosting telemedicine

The Polish medtech has developed a five-in-one diagnostic device for throat, ear, heart checks and more, with diagnosis in four minutes and compatible with diagnostic equipment

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

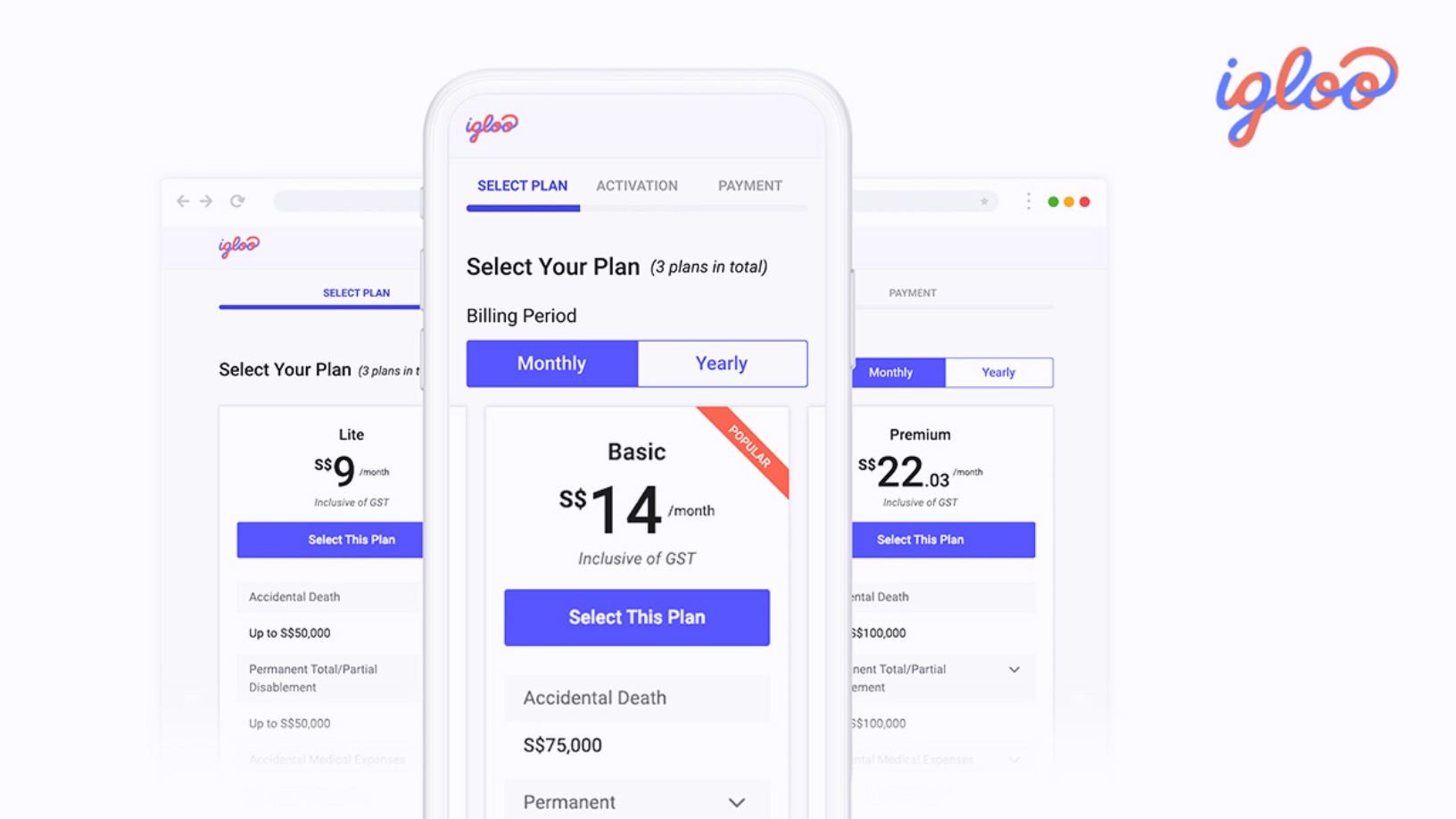

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Sorry, we couldn’t find any matches for“Insurtech Europe”.