Insurtech Europe

-

DATABASE (141)

-

ARTICLES (232)

Alexander von Schirmeister is an angel investor and Executive VP Europe of mobile payments company SumUp. In 2017, he participated in the first seed round of Spanish AI-driven femtech Woom, his only disclosed investment to date.The German native has worked at Spanish telco Telefonica and held various executive roles in the US. He was a manager at eBay and became an executive director on the Board of eBay International.

Alexander von Schirmeister is an angel investor and Executive VP Europe of mobile payments company SumUp. In 2017, he participated in the first seed round of Spanish AI-driven femtech Woom, his only disclosed investment to date.The German native has worked at Spanish telco Telefonica and held various executive roles in the US. He was a manager at eBay and became an executive director on the Board of eBay International.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

CFO, CMO and co-founder of RecyGlo

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Founded in 2010, TA Ventures is a VC headquartered in Kyiv, Ukraine. Since 2010 the firm invests in companies based in the United States and Europe developing cutting-edge technology startups in the field of digital health, mobility, SaaS and fintech. The fund typically invests in Seed stage with an average ticket size between $250,000 to $500,000 and Series A rounds up to $1mn. The team is based in Ukraine, supporting portfolio startups in building cost-effective R&D Centers in Ukraine.

Founded in 2010, TA Ventures is a VC headquartered in Kyiv, Ukraine. Since 2010 the firm invests in companies based in the United States and Europe developing cutting-edge technology startups in the field of digital health, mobility, SaaS and fintech. The fund typically invests in Seed stage with an average ticket size between $250,000 to $500,000 and Series A rounds up to $1mn. The team is based in Ukraine, supporting portfolio startups in building cost-effective R&D Centers in Ukraine.

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

HigoSense launching advanced mobile device for self-triage and diagnosis, boosting telemedicine

The Polish medtech has developed a five-in-one diagnostic device for throat, ear, heart checks and more, with diagnosis in four minutes and compatible with diagnostic equipment

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

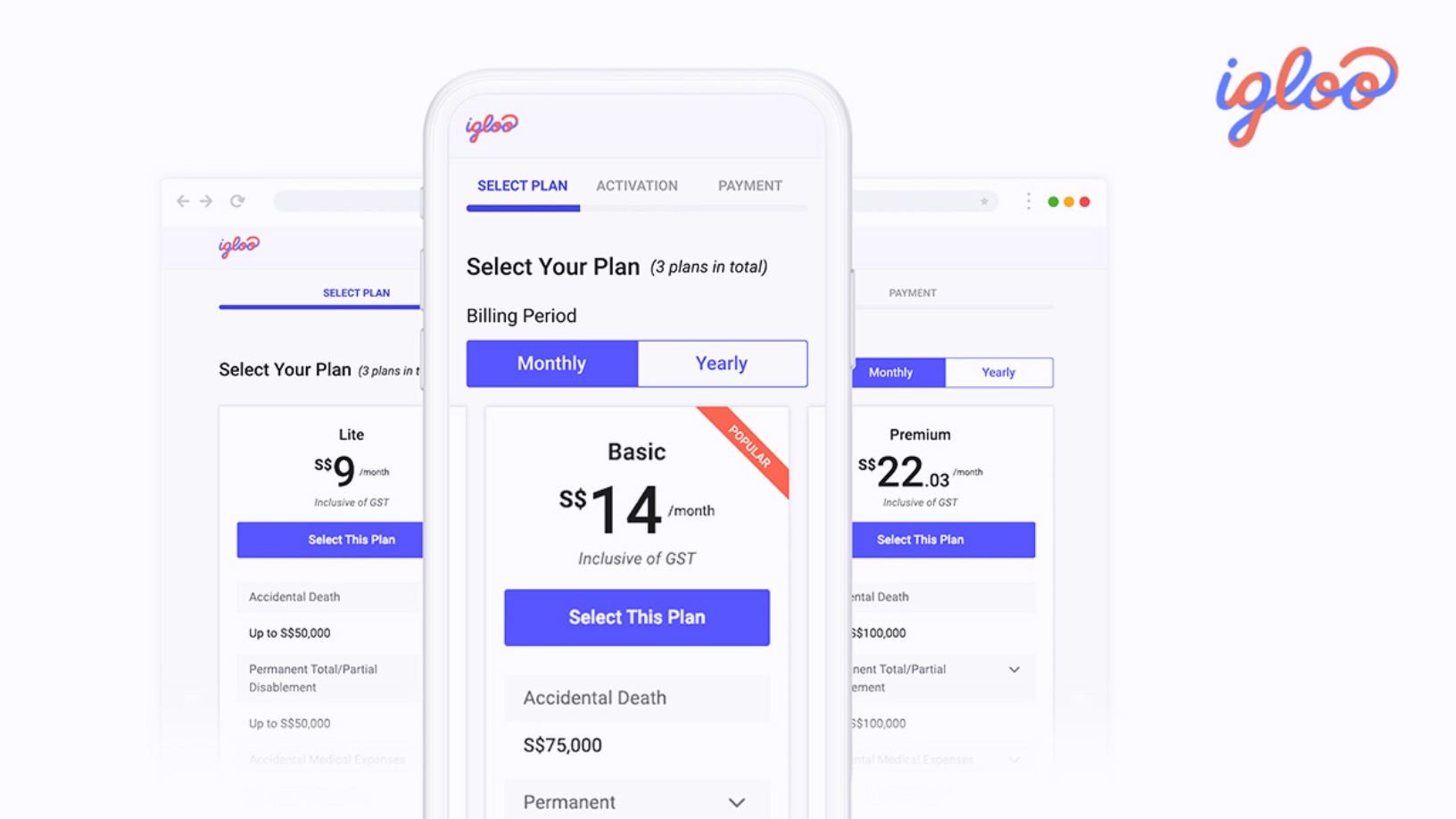

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Sorry, we couldn’t find any matches for“Insurtech Europe”.