Inter-American Development Bank

-

DATABASE (562)

-

ARTICLES (494)

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Co-CEO and co-founder of Elio

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Puxin Fintech Fund was co-launched by Shanghai Pudong Development Bank and Shanghai Trust in late October 2019. Operated by Puxin Capital, a subsidiary of Shanghai Trust, the fund mainly invests in fintech startups.

Puxin Fintech Fund was co-launched by Shanghai Pudong Development Bank and Shanghai Trust in late October 2019. Operated by Puxin Capital, a subsidiary of Shanghai Trust, the fund mainly invests in fintech startups.

Beijing Weijing Culture Development Co., Ltd.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

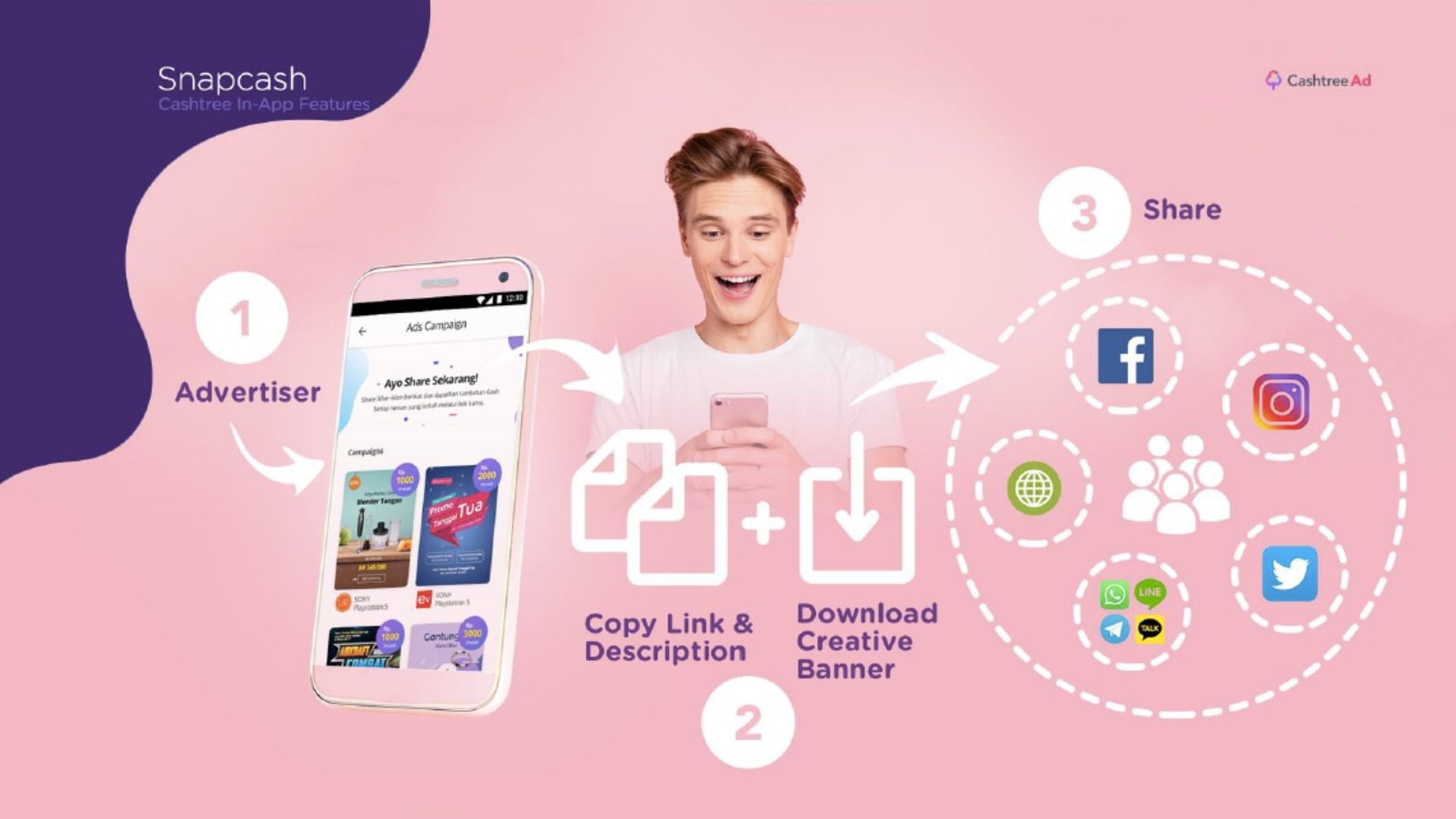

Cashtree combines locksreen ads and rewards-based marketing to help businesses go viral

The Indonesian mobile advertising platform encourages users to share ads on social media and WhatsApp so they go viral

Treasury: Bringing gold savings to millennials

Gold savings online platform Treasury targets a younger demographic with its playful and contemporary branding

From Porto to Phnom Penh: Last2Ticket expands to Asia

Their first stop is Cambodia, where tourism-related ticketing is big business yet underserved by technology. Emilía Simões, founder and CEO of the Portuguese e-ticketing startup, tells us more

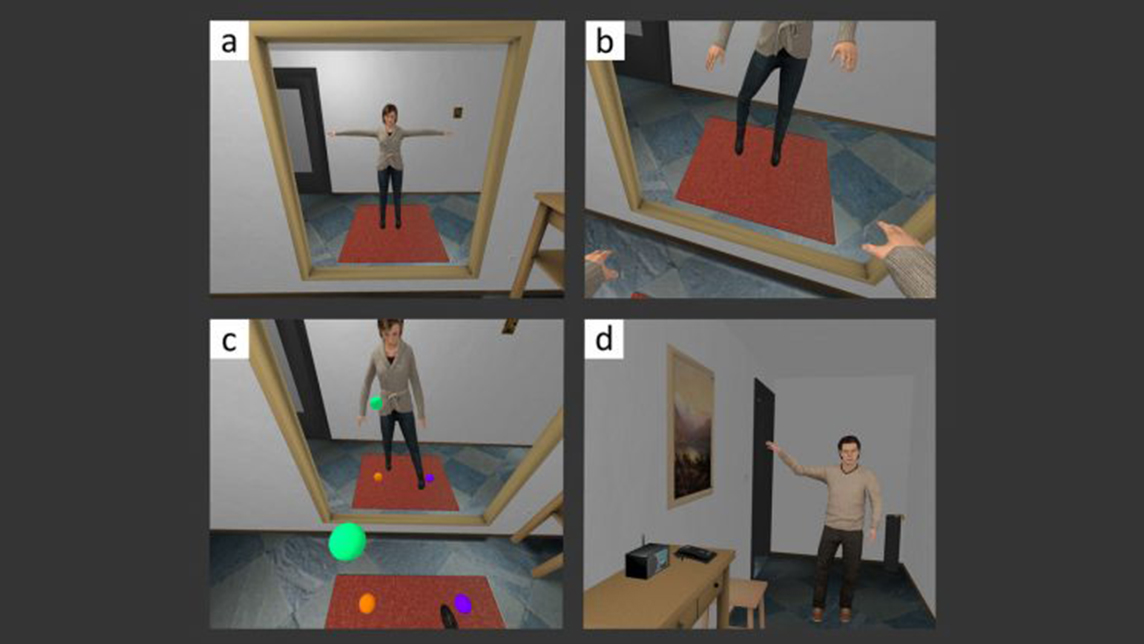

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Indonesian startup Traval goes virtual to stay afloat during pandemic

The startup is also trying to set itself apart from mainstream tourism with tours like Zero Waste Journey where travelers do not bring plastic items and even plant trees

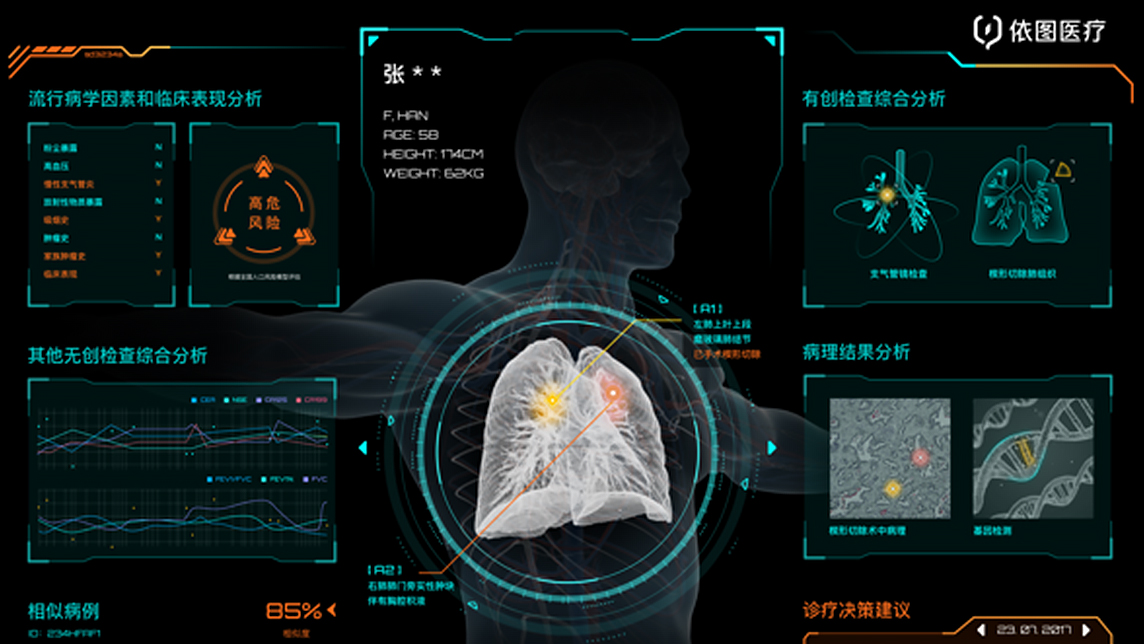

YITU takes smart healthcare to the next level

AI programs developed by this Chinese medtech startup provide more accurate diagnoses by reading medical images in conjunction with patients’ medical records

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

The rising Indonesian edtech star wants to help high-school dropouts earn their diploma and learn the relevant skills to find a job – with an innovative solution lauded at this year’s MIT Solve Challenge

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

As AI assistant market heats up, Sherpa zooms in on smart autos, smart homes

Spanish AI assistant startup Sherpa launches Sherpa Platform, a new set of APIs for smart cars, phones and home devices

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

Ambit Robotics: Automated crop spraying for Southeast Asia's smallholder farmers

Small, affordable crop-spraying robots can help farmers save on labor costs and protect humans from exposure to harmful chemicals

Sorry, we couldn’t find any matches for“Inter-American Development Bank”.