Inter-American Development Bank

-

DATABASE (562)

-

ARTICLES (494)

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Co-CEO and co-founder of Elio

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Puxin Fintech Fund was co-launched by Shanghai Pudong Development Bank and Shanghai Trust in late October 2019. Operated by Puxin Capital, a subsidiary of Shanghai Trust, the fund mainly invests in fintech startups.

Puxin Fintech Fund was co-launched by Shanghai Pudong Development Bank and Shanghai Trust in late October 2019. Operated by Puxin Capital, a subsidiary of Shanghai Trust, the fund mainly invests in fintech startups.

Beijing Weijing Culture Development Co., Ltd.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Plantruption: Transforming Irish seaweed into sustainable alt-protein seafood

Using abundant local seaweed as highly nutritious, eco-friendly alternatives to fish, the Dublin-based startup is gearing up to tap into new markets in Europe and the US

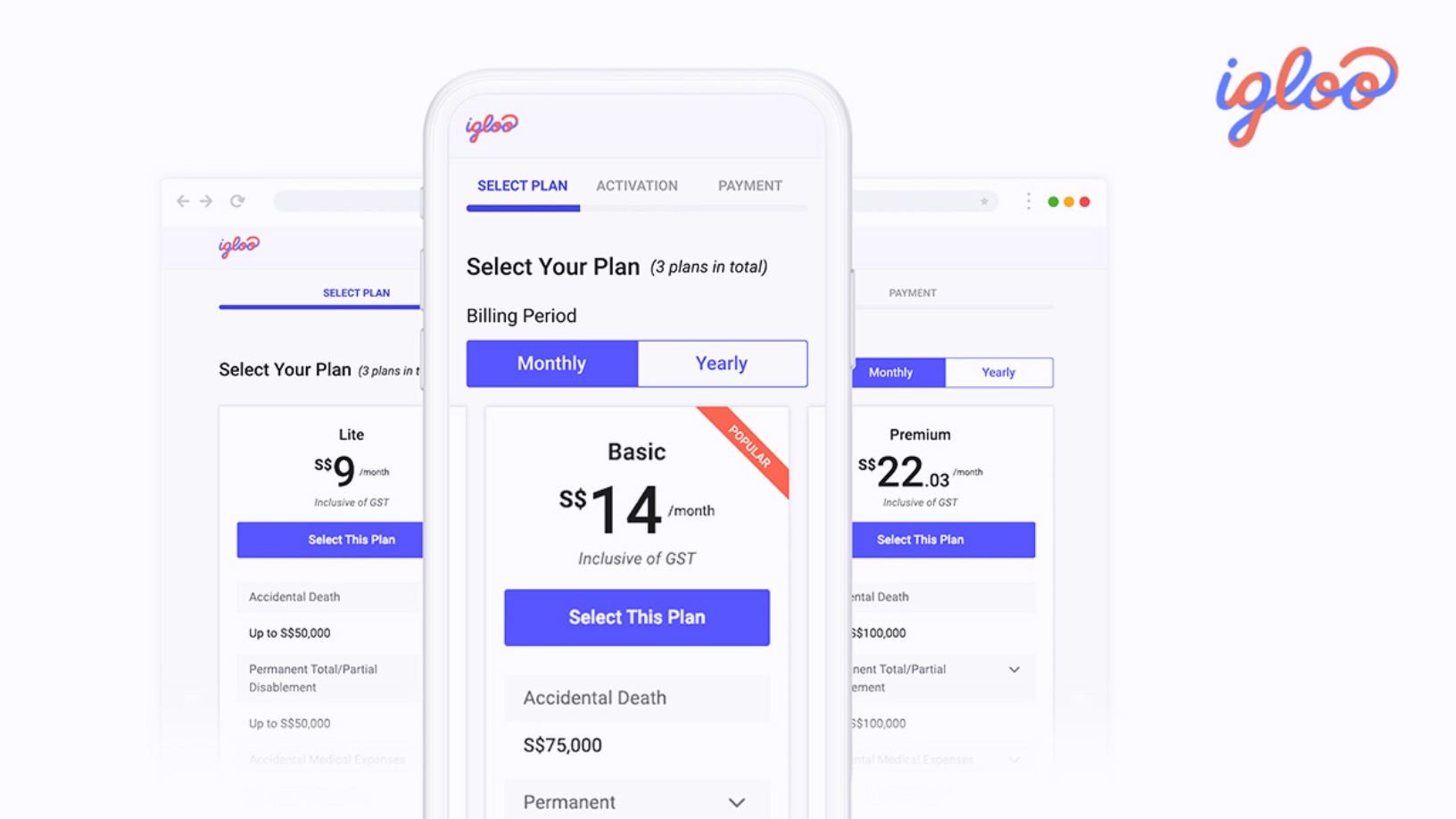

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

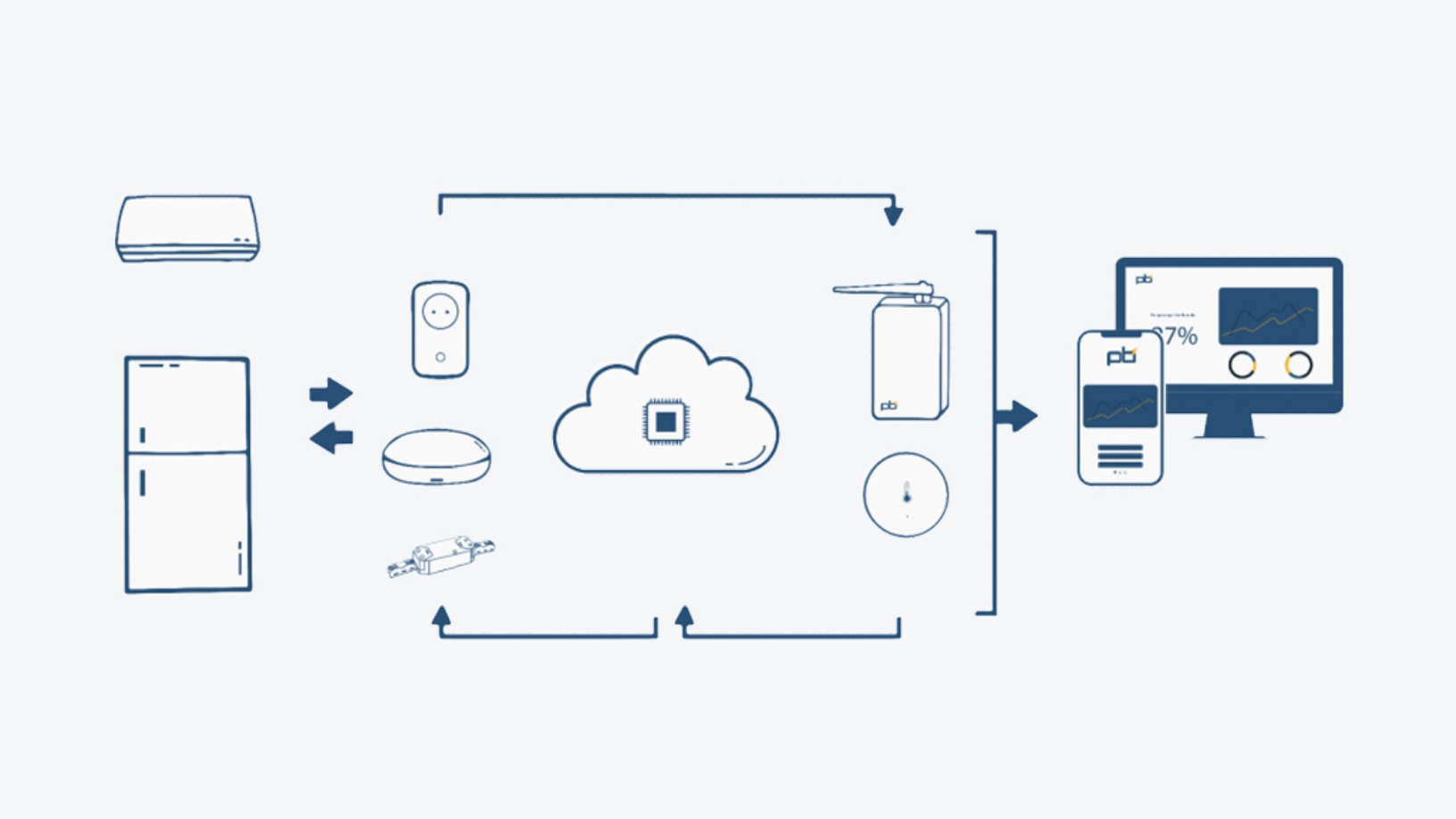

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Delman helps enterprises wrangle data for machine learning and automation

With fresh $1.6m seed funding and high-profile partners, Delman’s data services are helping Indonesian clients achieve digital transformation

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

How Sea Water Analytics is using IoT to help keep beaches safe in Covid-19 era

Sea Water Analytics checks water quality, overcrowding, even jelly fish threats in Spanish beaches

Sound Particles: the CGI for sound effects taking Hollywood by storm

This revolutionary 3D audio software has propelled Portuguese founder Nuno Fonseca from teaching music to credits in Star Wars, Game of Thrones and Frozen II.

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

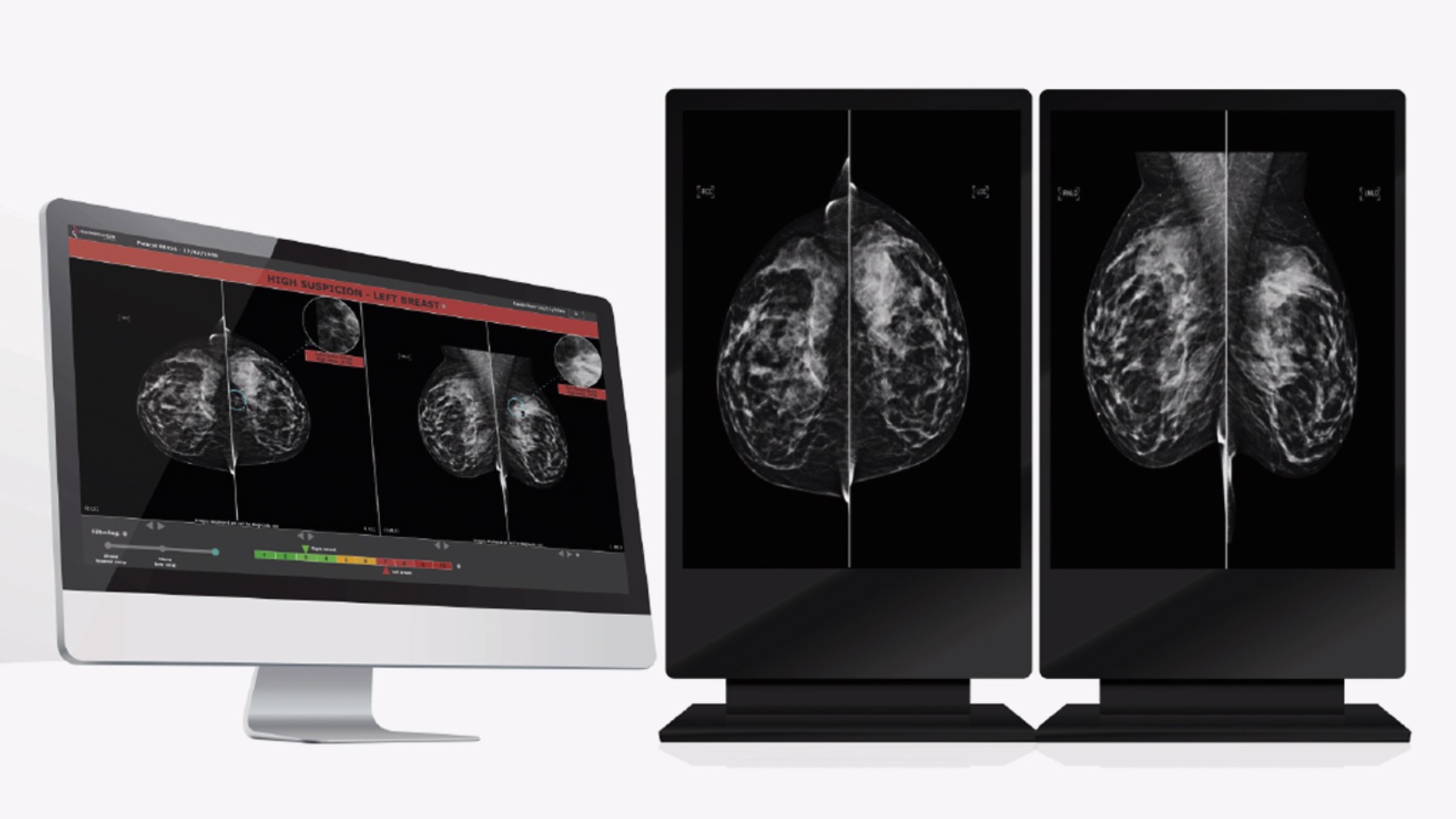

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Tonic App: Just the tonic for overburdened doctors

CEO Daniela Seixas and COO Gonçalo Vilaça discussed Tonic App, their free solution for streamlining administrative tasks in the medical sector

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

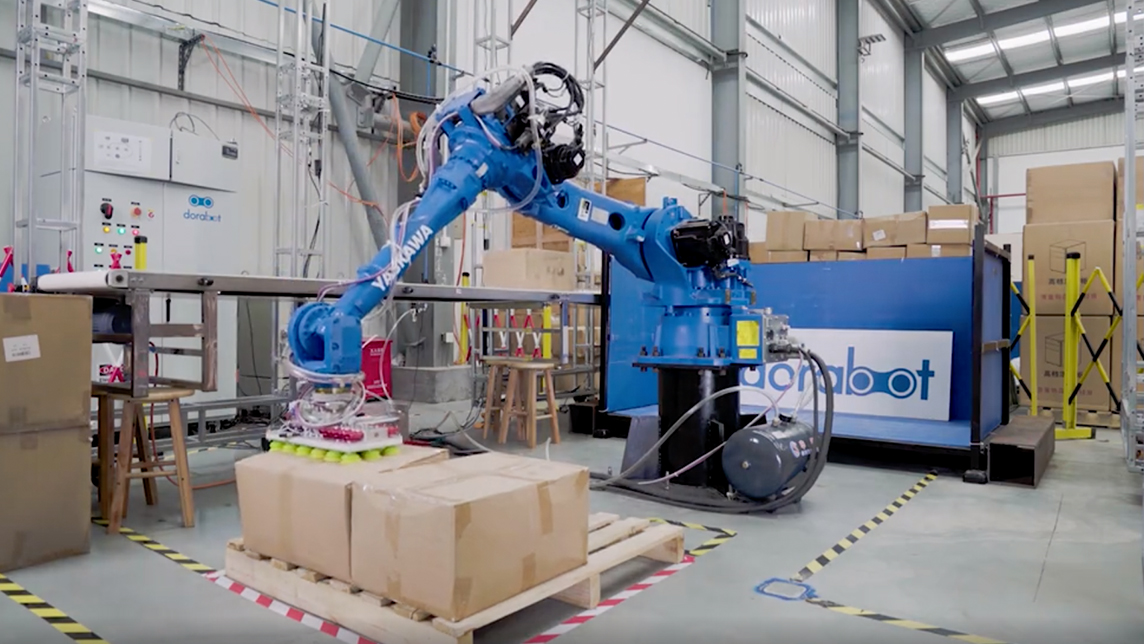

Dorabot's aim for warehousing: No humans allowed

With a combination of AI, global partnerships and speed, Dorabot is leaping into the future

Luo Yonghao: Maverick founder who gave Smartisan its allure, but couldn't build a winner

The Smartisan founder and internet celebrity is making a comeback with live commerce, after failing to sell enough smartphones at his own company

Sorry, we couldn’t find any matches for“Inter-American Development Bank”.