JD Finance

-

DATABASE (190)

-

ARTICLES (135)

CFO and co-founder of Modulous Tech

Sarah Hordern is a co-founder, CFO and Group Development Leader at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where she has worked since 2019. She is simultaneously a non-executive director at Oxford University Hospitals NHS Foundation Trust and at lenders Newbury Building Society. She was previously executive advisor at the Cambridge Code 2018-19, the first digital tool that measures subconscious drivers of behavior, and spent two years as COO at residential management company Meyrick Estate Management. From 1999 to 2014, she was a joint managing director in the area of property and finance at Newbury Racecourse, one of the UK’s largest horse-racing establishments, where she was responsible for the design and commercial negotiations for a new community of 1,500 homes. Prior to this, Hordern spent five years at PwC in corporate tax management. She holds a Bachelor’s degree from Oxford University in Politics, Philosophy and Economics.

Sarah Hordern is a co-founder, CFO and Group Development Leader at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where she has worked since 2019. She is simultaneously a non-executive director at Oxford University Hospitals NHS Foundation Trust and at lenders Newbury Building Society. She was previously executive advisor at the Cambridge Code 2018-19, the first digital tool that measures subconscious drivers of behavior, and spent two years as COO at residential management company Meyrick Estate Management. From 1999 to 2014, she was a joint managing director in the area of property and finance at Newbury Racecourse, one of the UK’s largest horse-racing establishments, where she was responsible for the design and commercial negotiations for a new community of 1,500 homes. Prior to this, Hordern spent five years at PwC in corporate tax management. She holds a Bachelor’s degree from Oxford University in Politics, Philosophy and Economics.

CEO and co-founder of Vence

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

CCO and co-founder of Modulous Tech

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

Co-founder of Vence

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Co-founder of Vence

Industrial business entrepreneur Jasper Holdsworth comes from a multi-generational family of cattle ranchers. In 2013, he became a director of his family’s 100-year-old Paringahau Farm Company in New Zealand. He also co-founded a virtual fencing startup for livestock management, Vence Corp, with US-based investment banker Frank Wooten in 2016.After graduating in forestry engineering in 1995, Holdsworth obtained a master’s in engineering management at his alma mater University of Canterbury. In 1998, he completed a master’s in applied finance at Macquarie University and started his banking career at WestLB and Deutsche Bank in Sydney.He completed an entrepreneurship development program run by MIT’s Sloan School of Management in 2010. He has also undertaken an advanced management program run by Harvard Business School in 2012.Since 2004, he has been working as the CEO of New Zealand-based Pultron Composites Ltd, an industrial technology company focused on the development and manufacture of glass fiber-reinforced polymers.In 2019, he became the chairman and co-founder of Mateenbar Ltd to produce composite reinforcement for infrastructure building materials in New Zealand, North Carolina and Saudi Arabia.

Industrial business entrepreneur Jasper Holdsworth comes from a multi-generational family of cattle ranchers. In 2013, he became a director of his family’s 100-year-old Paringahau Farm Company in New Zealand. He also co-founded a virtual fencing startup for livestock management, Vence Corp, with US-based investment banker Frank Wooten in 2016.After graduating in forestry engineering in 1995, Holdsworth obtained a master’s in engineering management at his alma mater University of Canterbury. In 1998, he completed a master’s in applied finance at Macquarie University and started his banking career at WestLB and Deutsche Bank in Sydney.He completed an entrepreneurship development program run by MIT’s Sloan School of Management in 2010. He has also undertaken an advanced management program run by Harvard Business School in 2012.Since 2004, he has been working as the CEO of New Zealand-based Pultron Composites Ltd, an industrial technology company focused on the development and manufacture of glass fiber-reinforced polymers.In 2019, he became the chairman and co-founder of Mateenbar Ltd to produce composite reinforcement for infrastructure building materials in New Zealand, North Carolina and Saudi Arabia.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Founder and CEO of Yidianling

Xu Yingqi has over a decade of work experience in the gaming, pharmaceutical and finance sectors. He joined an online gaming company named 5173 in 2003 and expanded the team from 20 to 3,000 employees, increasing the yearly GMV from US$3m to more than US$1.5bn. Xu then joined a pharmaceutical company named 818 in 2009, helping over 300 pharmacies go online. The company's business grew 248% annually under his leadership. In 2003, Xu started financial services platform 658 that generated RMB1.3bn worth of transactions. In 2015, he went on to establish Yidianling, an online mental health consultancy.

Xu Yingqi has over a decade of work experience in the gaming, pharmaceutical and finance sectors. He joined an online gaming company named 5173 in 2003 and expanded the team from 20 to 3,000 employees, increasing the yearly GMV from US$3m to more than US$1.5bn. Xu then joined a pharmaceutical company named 818 in 2009, helping over 300 pharmacies go online. The company's business grew 248% annually under his leadership. In 2003, Xu started financial services platform 658 that generated RMB1.3bn worth of transactions. In 2015, he went on to establish Yidianling, an online mental health consultancy.

CEO and co-founder of Kobo360

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

CEO and co-founder of The Not Company (NotCo)

Matías Muchnick graduated among the top 10% in business administration from the University of Chile in 2011 and went on to complete a master’s in Finance in 2012. He gained some work experience in Santiago as an analyst at LarrainVial in 2010 and spent the summer working at JP Morgan in Hong Kong after his graduation in 2011.In 2012, he became an entrepreneur and founded the wellness app Chooz, a project sponsored by the Chilean government. In 2013, he co-founded Eggless, the first food company in Chile to offer vegan mayonnaise in Chilean supermarkets like Walmart and Jumbo. He exited the business in 2015 and, in the same year, joined an entrepreneurship bootcamp at the University of California, Berkley, where he approached the biochemistry department to learn more about data and science. He also completed executive programs at Harvard Business School in 2015 and at the Stanford University in 2018.In November 2015, he co-founded the Chilean foodtech Not Company (NotCo) with astrophysicist Karim Pichara, who he met in Harvard, and Pablo Zamora. Based in New York, Muchnick is the CEO of NotCo, which combines AI with food science to create plant-based products that mimic animal-based food like milk and burgers.

Matías Muchnick graduated among the top 10% in business administration from the University of Chile in 2011 and went on to complete a master’s in Finance in 2012. He gained some work experience in Santiago as an analyst at LarrainVial in 2010 and spent the summer working at JP Morgan in Hong Kong after his graduation in 2011.In 2012, he became an entrepreneur and founded the wellness app Chooz, a project sponsored by the Chilean government. In 2013, he co-founded Eggless, the first food company in Chile to offer vegan mayonnaise in Chilean supermarkets like Walmart and Jumbo. He exited the business in 2015 and, in the same year, joined an entrepreneurship bootcamp at the University of California, Berkley, where he approached the biochemistry department to learn more about data and science. He also completed executive programs at Harvard Business School in 2015 and at the Stanford University in 2018.In November 2015, he co-founded the Chilean foodtech Not Company (NotCo) with astrophysicist Karim Pichara, who he met in Harvard, and Pablo Zamora. Based in New York, Muchnick is the CEO of NotCo, which combines AI with food science to create plant-based products that mimic animal-based food like milk and burgers.

Co-CEO and co-founder of Pula

Dutch-born Rosa Goslinga has spent most of her career working in Africa and speaks five languages, including Swahili. She graduated in business, economics and international development at the University of Amsterdam in 2004. She also completed a master’s in political economy of development at the School for Oriental and African Studies (SOAS) in London in 2005.In 2006, she worked as an economist at the Ministry of Agriculture and Animal Resources in Rwanda where she realized there was an urgent need for small-scale farming insurance to protect the local farmers’ livelihoods against natural hazards.In 2008, she joined Syngenta Foundation for Sustainable Agriculture (SFSA) in Kenya, where she initiated a pilot Kilimo Salama in Nairobi as program director. The program was a success, starting with 185 farmers taking up index insurance and growing to be the largest in Africa with over 185,000 participants. Goslinga also met and started working with Thomas Njeru, the lead actuary for UAP Insurance for the Kilimo project.In 2013, with investors backing her project, she developed and patented a system and method for providing a site-related weather insurance contract. She left SFSA in 2014 and went on to set up Kenya’s pioneering insurtech Pula with Njeru as co-founder in 2015.Both are now co-CEOs of the Nairobi-based startup, education and helping over 4m small-scale farmers to protect their livelihoods from environmental hazards with tailor-made micro-finance and insurance products.

Dutch-born Rosa Goslinga has spent most of her career working in Africa and speaks five languages, including Swahili. She graduated in business, economics and international development at the University of Amsterdam in 2004. She also completed a master’s in political economy of development at the School for Oriental and African Studies (SOAS) in London in 2005.In 2006, she worked as an economist at the Ministry of Agriculture and Animal Resources in Rwanda where she realized there was an urgent need for small-scale farming insurance to protect the local farmers’ livelihoods against natural hazards.In 2008, she joined Syngenta Foundation for Sustainable Agriculture (SFSA) in Kenya, where she initiated a pilot Kilimo Salama in Nairobi as program director. The program was a success, starting with 185 farmers taking up index insurance and growing to be the largest in Africa with over 185,000 participants. Goslinga also met and started working with Thomas Njeru, the lead actuary for UAP Insurance for the Kilimo project.In 2013, with investors backing her project, she developed and patented a system and method for providing a site-related weather insurance contract. She left SFSA in 2014 and went on to set up Kenya’s pioneering insurtech Pula with Njeru as co-founder in 2015.Both are now co-CEOs of the Nairobi-based startup, education and helping over 4m small-scale farmers to protect their livelihoods from environmental hazards with tailor-made micro-finance and insurance products.

Ambitious startup Kuaidiniao aims to be the Alipay of logistics

Kuaidiniao carves out a niche for itself in the logistics market by targeting small- and medium-sized businesses

Indonesia finance ministry cans e-commerce tax compliance law

The ministry says the law was misunderstood, but industry players had long questioned the need for such regulation

China's new unicorn: Secondhand electronics platform Aihuishou now worth US$1.5 billion

Aihuishou's latest funding round is the largest yet for a secondhand electronics platform

Now called Wanwu Xinsheng, the startup recycles over 70,000 used electronic goods in China daily, clocking over RMB 2bn of transactions every month

Covid-19: A closer look at how China's businesses and consumer behavior have changed

The lockdown in China has reshaped how people work and live. Some of the changes may be short-term, but others probably have become a part of life

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

Tigerobo: Building the next-generation search engine with natural language processing

With the success of Tigerobo Search, its flagship AI-based finance industry search engine, the startup is also diversifying into government, energy and media sectors

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

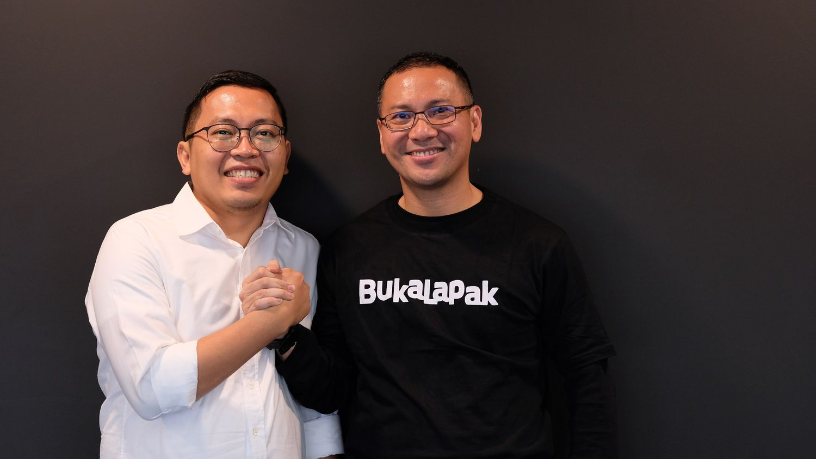

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Jojonomic's fintech PaaS helps corporates automate reimbursement, prevent fraud

Jojonomic is used by big companies including Pertamina Patra Niaga, Lazada, Tokopedia and Gojek

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Smart Agrifood Summit: Investors on key focuses and outlook in European agrifood

From boosting public-private funds to grow more European scale-ups, to improving the investment ecosystem, key investors at the Smart Agrifood Summit offer their take on how the EU agrifood sector could go a longer way

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Sorry, we couldn’t find any matches for“JD Finance”.