JOIN Capital

-

DATABASE (750)

-

ARTICLES (434)

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

François Derbaix is a serial entrepreneur and angel investor. In 1997, he began his career in business as a consultant for The Boston Consulting Group. He moved quickly into entrepreneurship. In 2000, he founded Toprural, a rural tourism platform that operates in 10 countries and earned €5m in 2009. In 2012, Toprural was acquired by HomeAway.He also co-founded Rentalia (acquired by Idealista in 2012), Indexa Capital, Bewa7er, Soysuper and Aplazame.Since leaving entrepreneurship, Derbaix has dedicated his time to supporting new internet projects as an angel investor in Spanish tech startups such as Kantox and Deporvillage.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Fondazione Marche, founded in 2009, is a private, non-profit business promotion organization that operates exclusively in the Italian territory of the Marche Region in central-eastern Italy. It is based in the regional capital Ancona. The organization was established by local business leaders in association with banks Banca Popolare di Ancona and BPU, who funded the company with €15m. It invests across sectors and technologies, with both tech and non-tech startups supported. Its most recent investment to date was in Italo-Spanish insect protein flour manufacturer Nutrinsect, with a €350,000 pre-seed investment in May 2020.

Fondazione Marche, founded in 2009, is a private, non-profit business promotion organization that operates exclusively in the Italian territory of the Marche Region in central-eastern Italy. It is based in the regional capital Ancona. The organization was established by local business leaders in association with banks Banca Popolare di Ancona and BPU, who funded the company with €15m. It invests across sectors and technologies, with both tech and non-tech startups supported. Its most recent investment to date was in Italo-Spanish insect protein flour manufacturer Nutrinsect, with a €350,000 pre-seed investment in May 2020.

Paul Allen was an American business magnate and investor. Best known as Microsoft Corporation co-founder with his childhood friend Bill Gates, he left the company after eight years after being diagnosed with Hodgkin’s disease. Allen died in 2018 at the age of 65, with a net worth of $20.3bn.His multibillion-dollar investment arm Vulcan Capital has backed tech startups around the world, including Spotify, Alibaba Group and Flipkart. Allen also owned the NBA's Portland Trail Blazers, the NFL's Seattle Seahawks and has a stake in the Seattle Sounders soccer team. He also donated over $2bn to philanthropic initiatives.

Paul Allen was an American business magnate and investor. Best known as Microsoft Corporation co-founder with his childhood friend Bill Gates, he left the company after eight years after being diagnosed with Hodgkin’s disease. Allen died in 2018 at the age of 65, with a net worth of $20.3bn.His multibillion-dollar investment arm Vulcan Capital has backed tech startups around the world, including Spotify, Alibaba Group and Flipkart. Allen also owned the NBA's Portland Trail Blazers, the NFL's Seattle Seahawks and has a stake in the Seattle Sounders soccer team. He also donated over $2bn to philanthropic initiatives.

Karnataka Information and Biotechnology Venture Fund (KITVEN)

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Accel, formerly known as Accel Partners, is a US venture capital firm, with its headquarters in Palo Alto, California, and additional offices in San Francisco. It also operates funds for Europe and Israel, with offices in London, UK, and has funds for India and China. It was founded in 1983 and has backed some of the most successful startups including Facebook, Spotify and Dropbox, among hundreds of others. It typically invests at the Series A and B levels, but can get involved from seed level, and has seen 253 exits from its portfolio to date, across varied market segments.

Accel, formerly known as Accel Partners, is a US venture capital firm, with its headquarters in Palo Alto, California, and additional offices in San Francisco. It also operates funds for Europe and Israel, with offices in London, UK, and has funds for India and China. It was founded in 1983 and has backed some of the most successful startups including Facebook, Spotify and Dropbox, among hundreds of others. It typically invests at the Series A and B levels, but can get involved from seed level, and has seen 253 exits from its portfolio to date, across varied market segments.

Startups join the fight in China's coronavirus crisis

Chinese startups have discovered their technologies can play a major role in the nationwide efforts to battle the coronavirus epidemic

Gojek CEO resigns to join Indonesia's new cabinet; named education minister

Nadiem Makarim was confirmed as Indonesia's education and culture minister and will become "a passive shareholder" in Gojek

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

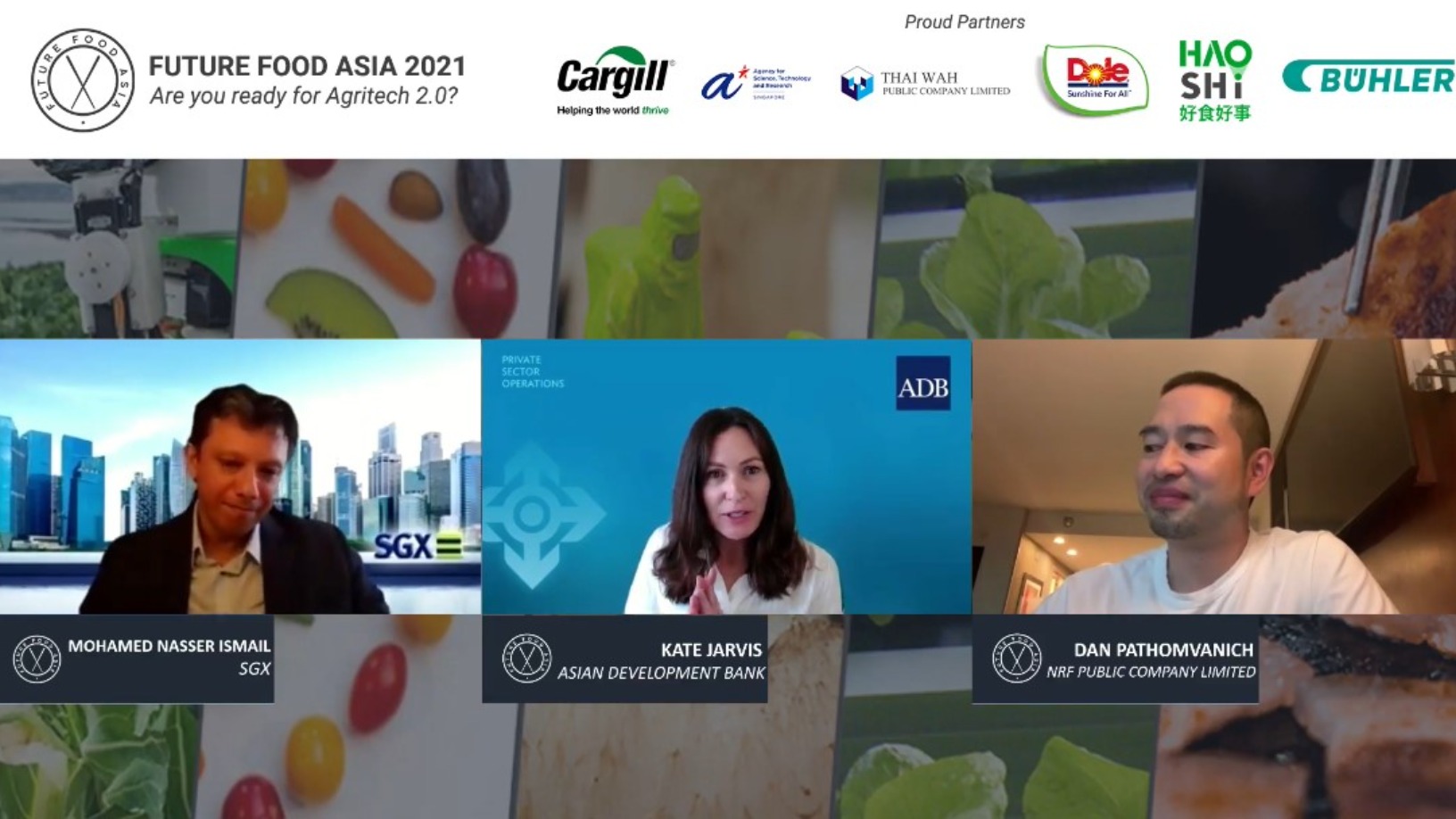

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

Sorry, we couldn’t find any matches for“JOIN Capital”.