Jungle Ventures

-

DATABASE (298)

-

ARTICLES (213)

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Established in October 2015, Cantor Jungle incubates businesses and invests in early-stage high-tech startups in the fields of integrated circuit and artificial intelligence.

Established in October 2015, Cantor Jungle incubates businesses and invests in early-stage high-tech startups in the fields of integrated circuit and artificial intelligence.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Co-founded by Angel Asin, Yago Perrin and Yago Arbeloa in 2000, Viriditas Ventures is an angel investment firm that provides funds for tech startups in the IT related sector. Viriditas Ventures invests in early-stage startups and helps entrepreneurs get to the next funding stage.

Co-founded by Angel Asin, Yago Perrin and Yago Arbeloa in 2000, Viriditas Ventures is an angel investment firm that provides funds for tech startups in the IT related sector. Viriditas Ventures invests in early-stage startups and helps entrepreneurs get to the next funding stage.

BW Ventures was established in February 2015 by Xu Min. The firm has offices in Beijing and Shanghai. BW Ventures' angel investments usually range from RMB 500,000 to 1,500,000.

BW Ventures was established in February 2015 by Xu Min. The firm has offices in Beijing and Shanghai. BW Ventures' angel investments usually range from RMB 500,000 to 1,500,000.

Anthill Ventures is an accelerator VC firm that provides early stage investments and support services for pre-Series A startups to facilitate rapid growth based on a proprietary “Scalability Quotient” score. Based on 108 parameters, the SQ score is used by Anthill Ventures to evaluate a startup’s potential for quick scalability.

Anthill Ventures is an accelerator VC firm that provides early stage investments and support services for pre-Series A startups to facilitate rapid growth based on a proprietary “Scalability Quotient” score. Based on 108 parameters, the SQ score is used by Anthill Ventures to evaluate a startup’s potential for quick scalability.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

Founded in 1999, Comcast Ventures is the private venture capital affiliate of Comcast Corporation, an American global telecommunications conglomerate. It invests in companies with a focus on advertising, consumption, enterprise services and infrastructure. Comcast Ventures will invest in promising businesses at any stage of development, from seed through late stage.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

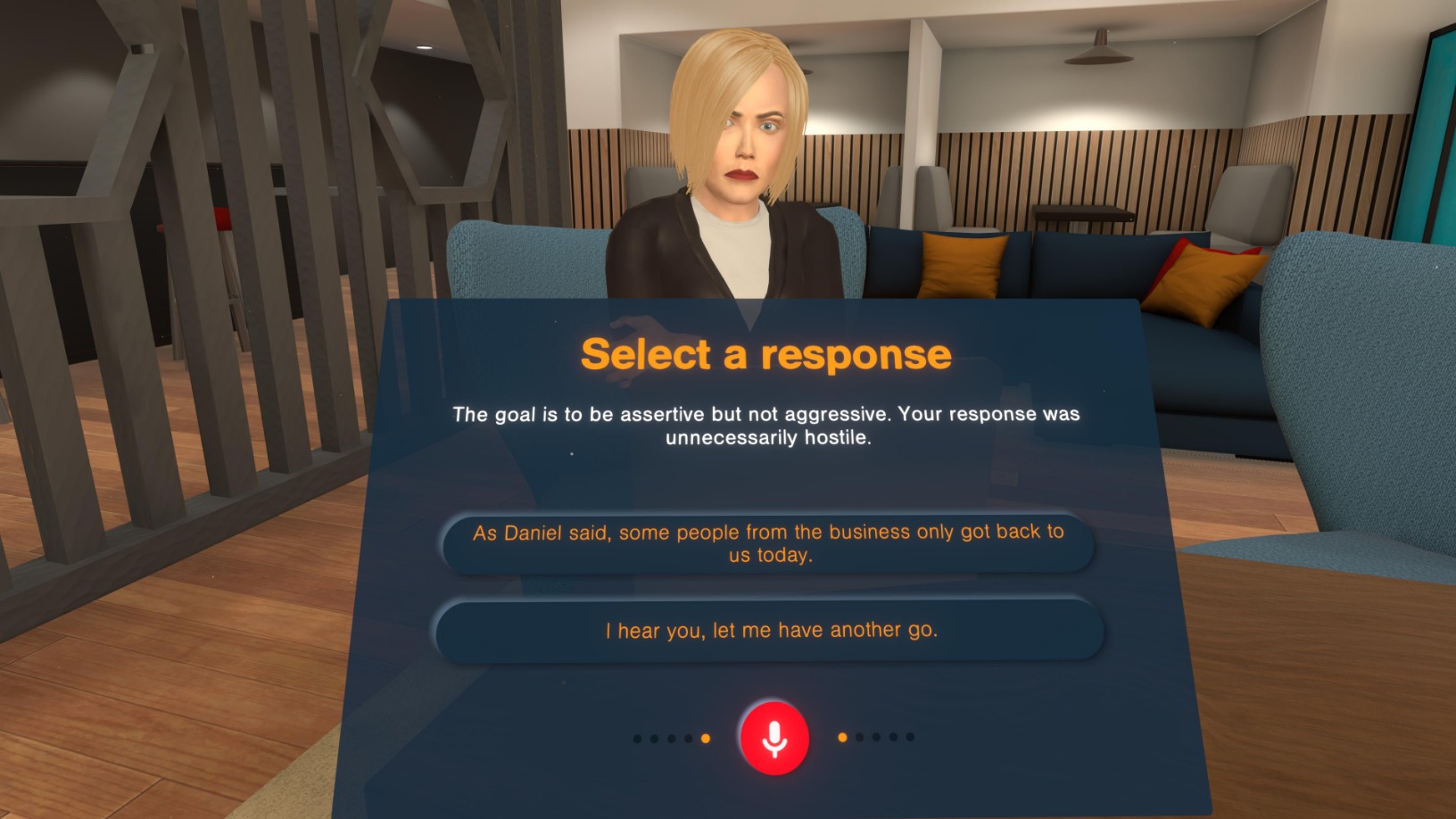

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Doinn: Impeccable housekeeping for lucrative holiday rentals

With its tech tools, better working conditions and 5-star ratings, the Portuguese startup now wants to expand to Southeast Asia and get Series A funding

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

Will Shanghai's new tech board be home to China’s next BAT?

As China’s new Nasdaq-style board speeds to welcome its first IPOs, here’s a look at what’s changed for Chinese tech firms listing in the mainland, and if it could be pivotal in the emerging tech cold war

Future Food Asia: Temasek, Continental Grain on investing in agrifood in Singapore and China

The two heavyweight investors discuss opportunities, needs and how agrifood startups can scale in Asian markets

Sorry, we couldn’t find any matches for“Jungle Ventures”.