Kale United

-

DATABASE (44)

-

ARTICLES (49)

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

United Fund was founded in 2015 to provide Zhejiang's SME businesses with support in financing, business collaborations, operations and management. It now manages total of assets worth RMB 3bn.

United Fund was founded in 2015 to provide Zhejiang's SME businesses with support in financing, business collaborations, operations and management. It now manages total of assets worth RMB 3bn.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

Co-founder and CFO of Bukalapak

Ex-United Nations employee Muhamad Fajrin Rasyid holds a Bachelor of Engineering in Informatics Engineering from Bandung Institute of Technology. As a student, he and BukaLapak co-founder Achmad Zaky opened a noodle shop near their dorm. Previous to BukaLapak, he had worked at Indosat, the United Nations and The Boston Consulting Group. He also co-founded Suitmedia, a digital agency that develops websites for companies such as HijUp.com and MasukNegeri.com.

Ex-United Nations employee Muhamad Fajrin Rasyid holds a Bachelor of Engineering in Informatics Engineering from Bandung Institute of Technology. As a student, he and BukaLapak co-founder Achmad Zaky opened a noodle shop near their dorm. Previous to BukaLapak, he had worked at Indosat, the United Nations and The Boston Consulting Group. He also co-founded Suitmedia, a digital agency that develops websites for companies such as HijUp.com and MasukNegeri.com.

Founded in 1999, Armilar Venture Partners, previously Espirito Santo Ventures (E.S. Ventures), has made over 40 investments and currently manages five funds valued over €200 million. It covers Europe and the United States.

Founded in 1999, Armilar Venture Partners, previously Espirito Santo Ventures (E.S. Ventures), has made over 40 investments and currently manages five funds valued over €200 million. It covers Europe and the United States.

Backed by Temasek Holdings and United Overseas Bank, InnoVen Capital has offices in Mumbai, Singapore and China. InnoVen Capital is the largest provider of venture debt to venture capital firms in India. The firm’s China office was established in April 2017.

Backed by Temasek Holdings and United Overseas Bank, InnoVen Capital has offices in Mumbai, Singapore and China. InnoVen Capital is the largest provider of venture debt to venture capital firms in India. The firm’s China office was established in April 2017.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

CEO and co-founder of FROGS

After starting his career in Indonesian automotive conglomerate Astra, businessman Kiwi Aliwarga left the country in 1998 to establish United Machinery in Myanmar with business partner Daw Marlar Win. The United Machinery Group (UMG) is now one of Myanmar's biggest conglomerates. Its original core business, ranging from distribution of generators and other heavy machinery, has been transformed and expanded to include media, leisure and F&B.The venture capital arm UMG Idealab seeks and supports innovative business ideas from the region to bring back to Myanmar. Through UMG Idealab, Aliwarga is exploring various new technologies including passenger-carrying drone taxis. He recently co-founded FROGS in Indonesia with former aircraft engineer Asro Nasiri.

After starting his career in Indonesian automotive conglomerate Astra, businessman Kiwi Aliwarga left the country in 1998 to establish United Machinery in Myanmar with business partner Daw Marlar Win. The United Machinery Group (UMG) is now one of Myanmar's biggest conglomerates. Its original core business, ranging from distribution of generators and other heavy machinery, has been transformed and expanded to include media, leisure and F&B.The venture capital arm UMG Idealab seeks and supports innovative business ideas from the region to bring back to Myanmar. Through UMG Idealab, Aliwarga is exploring various new technologies including passenger-carrying drone taxis. He recently co-founded FROGS in Indonesia with former aircraft engineer Asro Nasiri.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Co-Founder of Cermati

US-trained veteran software engineer Oby Sumampouw has worked at LinkedIn, Oracle and Google. He holds a master’s in Computer Science from Stanford University. Oby was living in the United States for 13 years before he decided to return to Indonesia and start Cermati.

US-trained veteran software engineer Oby Sumampouw has worked at LinkedIn, Oracle and Google. He holds a master’s in Computer Science from Stanford University. Oby was living in the United States for 13 years before he decided to return to Indonesia and start Cermati.

Founded by tech entrepreneur and investor Teruhide ("Teru") Sato, Tokyo-headquartered Beenos is a seed accelerator and investor in startups from fast-growing countries such as India, Indonesia and Turkey, as well as Japan and the United States. Beenos typically invests between US$100,000 and US$3 million.

Founded by tech entrepreneur and investor Teruhide ("Teru") Sato, Tokyo-headquartered Beenos is a seed accelerator and investor in startups from fast-growing countries such as India, Indonesia and Turkey, as well as Japan and the United States. Beenos typically invests between US$100,000 and US$3 million.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

Founder and CEO of Ku Ka

Titonius Karto is a former real estate investor who lived in the United States for 15 years. He established Ku Ka, an online marketplace for quality local products, after returning to Indonesia. Titonius holds a Master of Global Management degree from the Thunderbird School of Global Management at Arizona State University.

Titonius Karto is a former real estate investor who lived in the United States for 15 years. He established Ku Ka, an online marketplace for quality local products, after returning to Indonesia. Titonius holds a Master of Global Management degree from the Thunderbird School of Global Management at Arizona State University.

Paint-and-sip startup Bartega pivots online amid Covid-19, spreading the joy of painting to more

The Indonesian startup finds new opportunities for growth in its unexpected shift

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

VitiBot: Using robotics to make winemaking more sustainable

Combining a passion for robotics with his family’s history in winemaking, VitiBot CEO and co-founder Cedric Bache saw an opportunity to help winemakers meet the dual challenges of modernization and sustainable development

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

China’s medical exoskeleton startups take on a promising but challenging market

It was not until 2018 that the first China-made lower limb exoskeleton got regulatory clearance at home, around the same time the first Chinese rehabilitation robot got US FDA approval

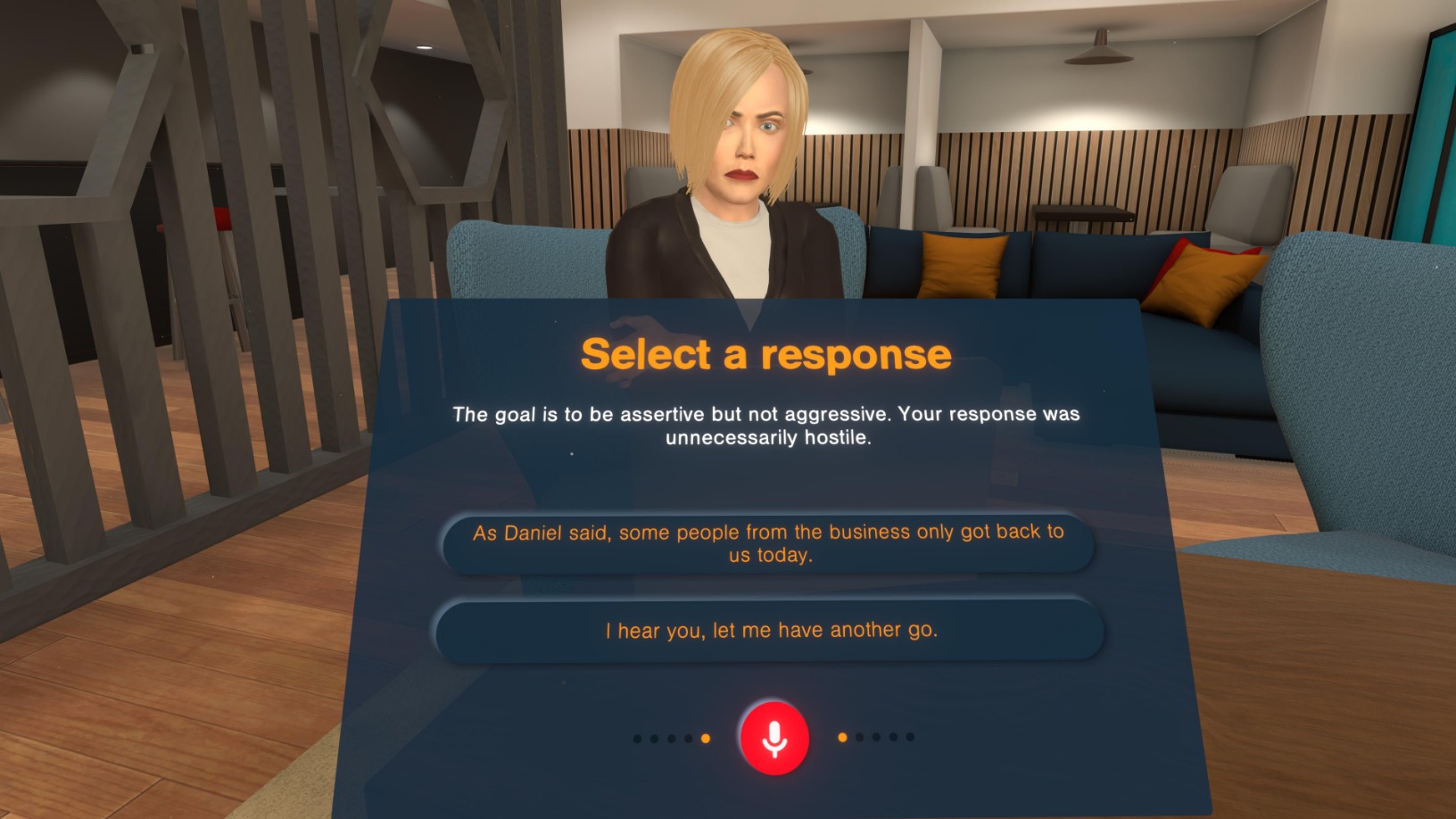

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Visualfy: Tech for autonomy for the hearing-impaired, at home and in public

Visualfy’s app-plus-hardware solution helps the deaf lead fully independent lives

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

Doinn: Impeccable housekeeping for lucrative holiday rentals

With its tech tools, better working conditions and 5-star ratings, the Portuguese startup now wants to expand to Southeast Asia and get Series A funding

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

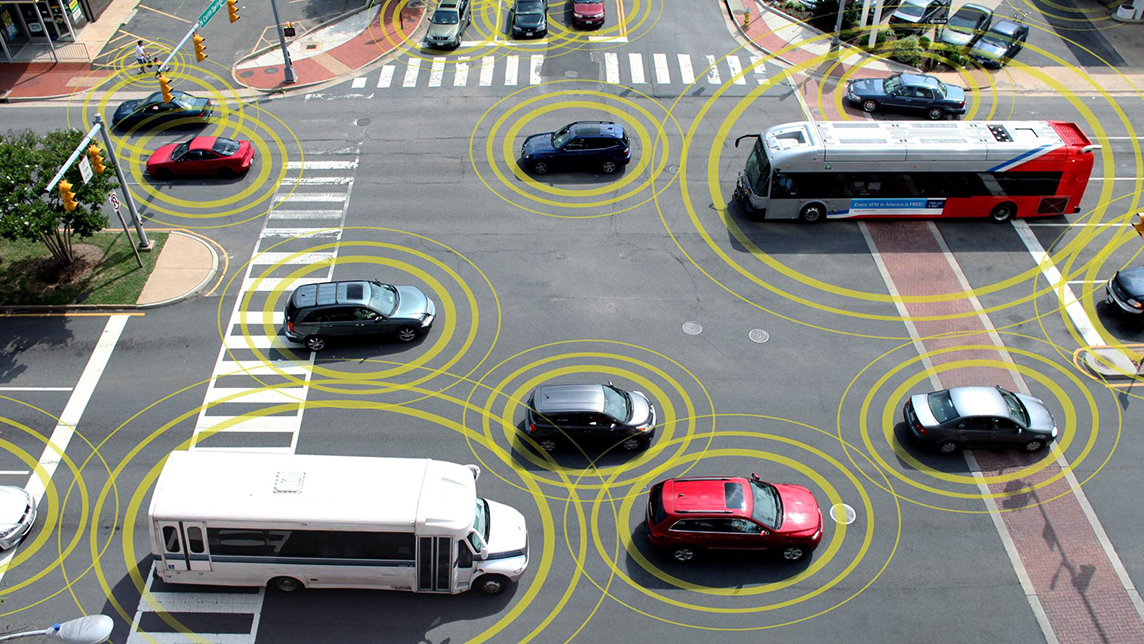

Autodrive Solutions: Making driverless vehicles safer with high-precision positioning tech

A Spanish university's research on sophisticated weapons detection technology is being used to prevent accidents in the mobility and transport sectors

Sorry, we couldn’t find any matches for“Kale United”.