Lanai Partners

-

DATABASE (236)

-

ARTICLES (326)

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

European venture capital firm Advent Venture Partners was established in 1981.

European venture capital firm Advent Venture Partners was established in 1981.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Singapore/Japan-based venture capital firm Rebright Partners is backed by publicly listed Japanese internet companies and leading angel investors. The team operates in Tokyo, Singapore and Bangalore.

Singapore/Japan-based venture capital firm Rebright Partners is backed by publicly listed Japanese internet companies and leading angel investors. The team operates in Tokyo, Singapore and Bangalore.

Howzat Partners is mainly an early stage digital business investment fund. Founded in 2006, with headquarters in Luxembourg and an office in London, the firm also invests globally in the digital media, e-commerce and internet sectors.

Howzat Partners is mainly an early stage digital business investment fund. Founded in 2006, with headquarters in Luxembourg and an office in London, the firm also invests globally in the digital media, e-commerce and internet sectors.

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Girls in Tech Indonesia: Inspiring the geek in every girl

Girls in Tech Indonesia aims to put the country's women at the forefront of its tech and startup world

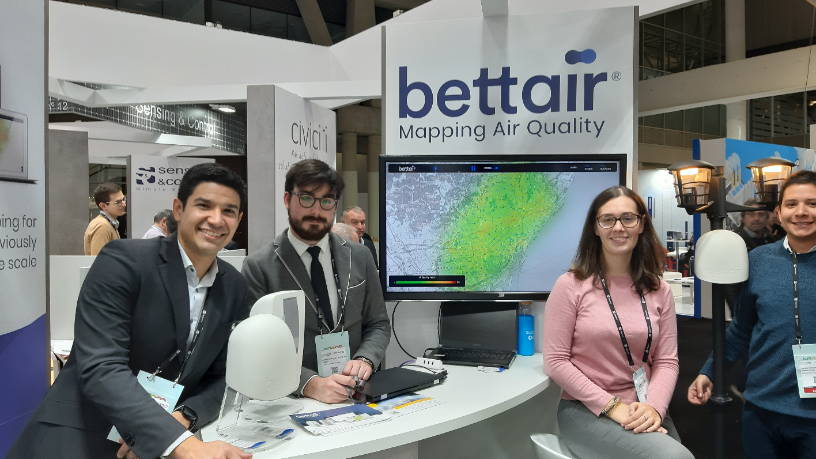

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

BioMind: AI medical diagnostics with over 90% accuracy for 100 diseases

BioMind helps doctors save lives by providing more accurate diagnosis of life-threatening diseases like Covid-19 and brain tumors

Evermos is Indonesia's version of social commerce – and it's Sharia-compliant, too

Evermos targets the resale market, encouraging students and housewives to earn extra income by promoting products on their social media and WhatsApp networks

MENA and Du’Anyam: How two Indonesian social enterprises are tackling Covid-19 challenges

The call to help women in rural communities has become more urgent as social enterprises struggle to survive the current crisis

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Indonesia gaming and esports – Covid-19 brings increased interest but also challenges

Canceled industry events may have curtailed promotion and investment opportunities, but interest in gaming and esports has increased

Pushed by Covid-19, Landing.Jobs repositions itself as IT talent ecosystem

The Portuguese tech jobs portal is pivoting into global talent hub with Future.Works, providing AI-driven recruitment services, training and career management for IT professionals

Sorry, we couldn’t find any matches for“Lanai Partners”.