Land O'Lakes

-

DATABASE (327)

-

ARTICLES (404)

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Biotech Bluepha has secured close to $100m Series B funding to boost bioplastics production and R&D to develop greener solutions for industrial manufacturers.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Not enough capital to start your own business? You can own a share of Indonesia's most popular franchises through Bizhare's equity crowdfunding platform.

Not enough capital to start your own business? You can own a share of Indonesia's most popular franchises through Bizhare's equity crowdfunding platform.

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

As more Chinese opt for cosmetic surgery, startups have emerged to help them make informed decisions

China’s medical aesthetic services platforms face both opportunities and challenges with the rise of Generation Z

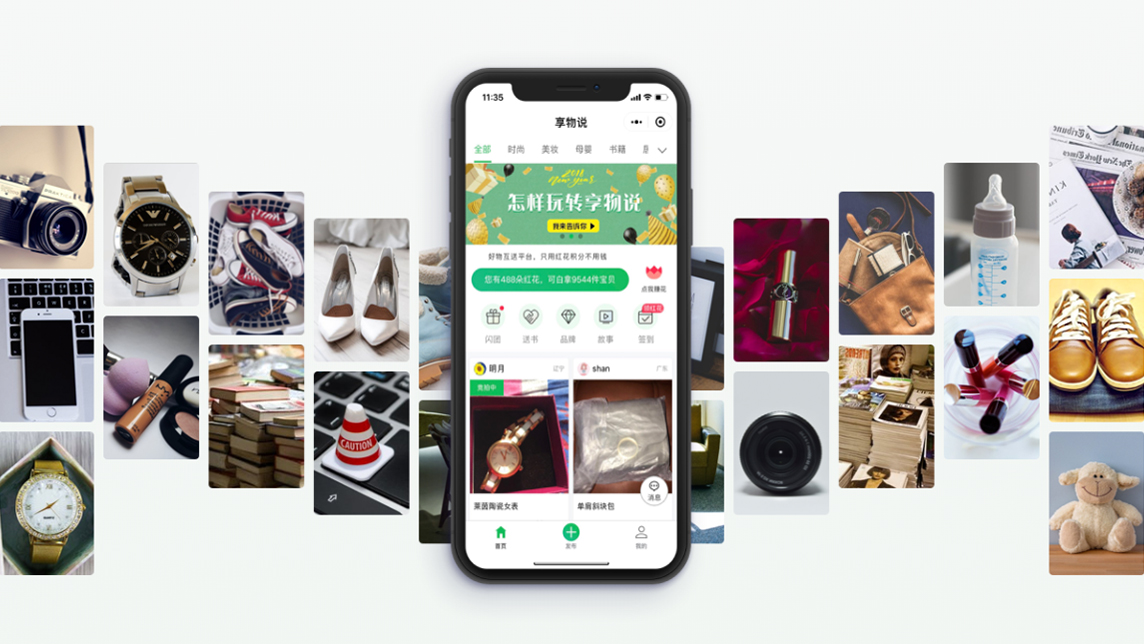

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Sorry, we couldn’t find any matches for“Land O'Lakes”.