Land O'Lakes

-

DATABASE (327)

-

ARTICLES (404)

China Science & Merchants Investment Management Group (CSC)

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Lin Hai majored in Materials Science and Engineering at Tsinghua University and holds an EMBA from China Europe International Business School (CEIBS). He co-founded A8 Digital Music in 2000, which later became one of the largest digital music platforms in China. Lin is currently the secretary-general of CEIBS Alumni Mobile Club’ southern offices and the president of Shenzhen Nanshan Cultural & Creative Industry Association.

Lin Hai majored in Materials Science and Engineering at Tsinghua University and holds an EMBA from China Europe International Business School (CEIBS). He co-founded A8 Digital Music in 2000, which later became one of the largest digital music platforms in China. Lin is currently the secretary-general of CEIBS Alumni Mobile Club’ southern offices and the president of Shenzhen Nanshan Cultural & Creative Industry Association.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

WuXi AppTec is a Chinese company that specializes in the outsourcing of R&D in the pharmaceuticals, biotechnology and medical devices sectors. Listed on the Hong Kong Stock Exchange, WuXi AppTec has invested in drug development and healthcare firms globally. Its portfolio includes Insilico Medicine, which is developing an AI platform for drug development, brain disease research firm Verge Genomics and Indonesian healthcare platform Halodoc.

WuXi AppTec is a Chinese company that specializes in the outsourcing of R&D in the pharmaceuticals, biotechnology and medical devices sectors. Listed on the Hong Kong Stock Exchange, WuXi AppTec has invested in drug development and healthcare firms globally. Its portfolio includes Insilico Medicine, which is developing an AI platform for drug development, brain disease research firm Verge Genomics and Indonesian healthcare platform Halodoc.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

The Oil & Natural Gas Corporation, also known as Maharatna ONGC, is the largest crude oil and natural gas company in India, contributing around 75% of India’s domestic production. It has committed to carbon reduction initiatives and has 15 projects that can potentially reduce total emissions equivalent to 2.1m tons of CO2 annually. String Bio is its first tech startup investment, part of the Series A round in 2019.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Co-Founder of Zhen Robotics

Co-founder of Zhen Robotics. Born in Hong Kong, he has a bachelor’s degree in Computer Science from the Chinese University of Hong Kong and a master’s degree in Innovation, Entrepreneurship & Management from Imperial College London. Prior to founding Zhen Robotics with his schoolmate Liu Zhiyong, he worked for a Fortune 500 technology company in Hong Kong.

Co-founder of Zhen Robotics. Born in Hong Kong, he has a bachelor’s degree in Computer Science from the Chinese University of Hong Kong and a master’s degree in Innovation, Entrepreneurship & Management from Imperial College London. Prior to founding Zhen Robotics with his schoolmate Liu Zhiyong, he worked for a Fortune 500 technology company in Hong Kong.

R&D Manager of AEInnova

Joan Oliver Malagelada is an engineer with a PhD and experience in microsensing and ultra-low power electronics. He is a co-founder of AEInnova and currently serves as its R&D manager and advisor. Since 1990, Oliver has been a physics professor at the Autonomous University of Barcelona.

Joan Oliver Malagelada is an engineer with a PhD and experience in microsensing and ultra-low power electronics. He is a co-founder of AEInnova and currently serves as its R&D manager and advisor. Since 1990, Oliver has been a physics professor at the Autonomous University of Barcelona.

Co-founder and COO of AltStory

Zeng Zhujuan graduated from Franklin & Marshall College in 2012 with a bachelor's degree in Business, Organization, and Society. She earned her MBA from Johns Hopkins University and a master's degree in Design Leadership from the Maryland Institute College of Art, both in 2015. She co-founded AltStory with Gary Kun (Kun Peng) in 2017.

Zeng Zhujuan graduated from Franklin & Marshall College in 2012 with a bachelor's degree in Business, Organization, and Society. She earned her MBA from Johns Hopkins University and a master's degree in Design Leadership from the Maryland Institute College of Art, both in 2015. She co-founded AltStory with Gary Kun (Kun Peng) in 2017.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

Pedro Luis Uriarte Santamarina

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Stanley Ventures / Stanley Black & Decker

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

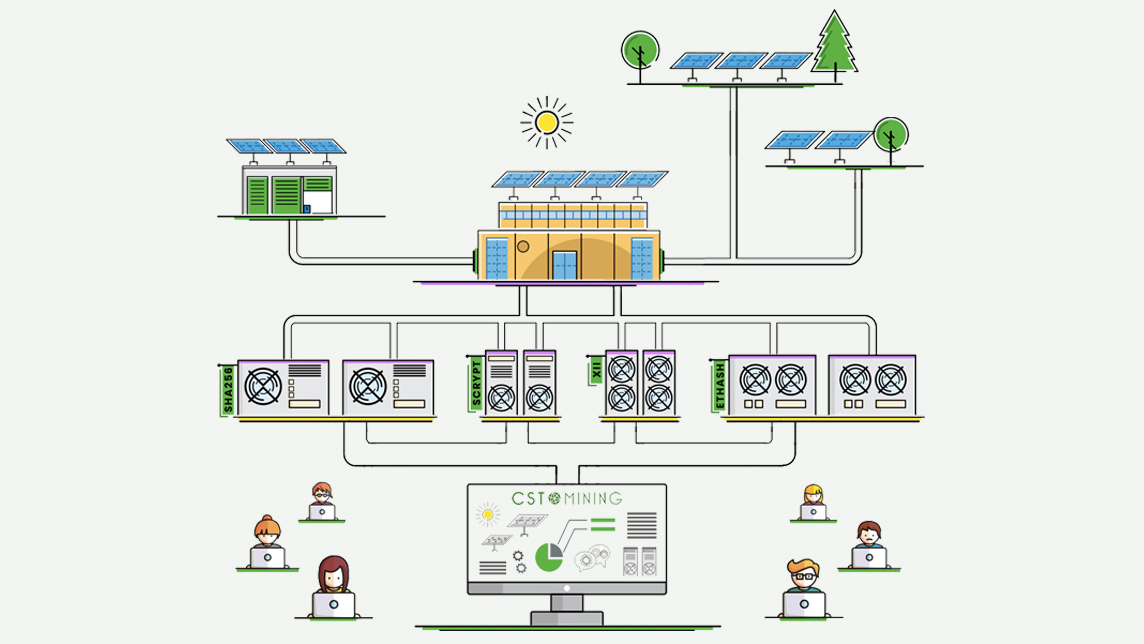

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

As more Chinese opt for cosmetic surgery, startups have emerged to help them make informed decisions

China’s medical aesthetic services platforms face both opportunities and challenges with the rise of Generation Z

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

UTW: Drones and big data to help farmers get the most out of their land

Analytics startup UTW also harvests real-time farming information using satellites and sensors, to offer crop yield predictions

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Sorry, we couldn’t find any matches for“Land O'Lakes”.