Land O'Lakes

-

DATABASE (327)

-

ARTICLES (404)

Asia Africa Investment & Consulting

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Founder and Commissioner of Kumparan

Calvin Lukmantara graduated with a bachelor’s in Mathematics from the University of Indonesia. Besides co-founding Kumparan, Calvin was also a co-founder of Detikcom. He still works as a director at PT Agranet Multicitra Siberkom that owns the online media portal Detikcom. He is known as the key person responsible for M&A projects and external relationships of Detikcom.

Calvin Lukmantara graduated with a bachelor’s in Mathematics from the University of Indonesia. Besides co-founding Kumparan, Calvin was also a co-founder of Detikcom. He still works as a director at PT Agranet Multicitra Siberkom that owns the online media portal Detikcom. He is known as the key person responsible for M&A projects and external relationships of Detikcom.

Founder and President of Clever Home

Chen Yalin used to work on supply chains at China National Electronics Import & Export Corporation (CEIEC) and Shanghai Lonyer Fuels Co Ltd. After 2000, he got into international trading at Vinmar International, Tricon Energy. He joined a Swiss trading company in 2008 as head of its Shanghai office. He founded Clever Home in 2015.

Chen Yalin used to work on supply chains at China National Electronics Import & Export Corporation (CEIEC) and Shanghai Lonyer Fuels Co Ltd. After 2000, he got into international trading at Vinmar International, Tricon Energy. He joined a Swiss trading company in 2008 as head of its Shanghai office. He founded Clever Home in 2015.

Founder and general manager of Xrush

Zhou graduated from Southwest University of Political Science & Law with a bachelors in Law in 2010 and received an MBA degree from The University of Hong Kong in 2019. He worked for a market consultancy firm for seven years, working his way up from project supervisor to general manager of the company. He founded Xrush in 2016.

Zhou graduated from Southwest University of Political Science & Law with a bachelors in Law in 2010 and received an MBA degree from The University of Hong Kong in 2019. He worked for a market consultancy firm for seven years, working his way up from project supervisor to general manager of the company. He founded Xrush in 2016.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

Founded in 2006, AdMaster is a Chinese digital marketing monitoring company. The company offers media auditing, optimization consulting, audience analysis, public opinion monitoring, among other services. Its online ad measurement technology tracks over 5bn impressions every day on computers, smartphones, tablets and smart TVs. AdMaster owns the largest server cluster in the Chinese advertising industry. The company's clients include well-known foreign and domestic brands such as P&G, Coca Cola, Robust and Wahaha.

Founded in 2006, AdMaster is a Chinese digital marketing monitoring company. The company offers media auditing, optimization consulting, audience analysis, public opinion monitoring, among other services. Its online ad measurement technology tracks over 5bn impressions every day on computers, smartphones, tablets and smart TVs. AdMaster owns the largest server cluster in the Chinese advertising industry. The company's clients include well-known foreign and domestic brands such as P&G, Coca Cola, Robust and Wahaha.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founder and CEO of Talkmate

A former investment banker, Wen Ronghui holds an MBA from Peking University. Before founding Talkmate, Wen spent five years in education both as a university lecturer and as a principal of a Beijing language school owned by Nasdaq-listed China Bilingual Technology & Education Group. Prior to that, he was an investment banker for eight years, taking more than 10 companies public.

A former investment banker, Wen Ronghui holds an MBA from Peking University. Before founding Talkmate, Wen spent five years in education both as a university lecturer and as a principal of a Beijing language school owned by Nasdaq-listed China Bilingual Technology & Education Group. Prior to that, he was an investment banker for eight years, taking more than 10 companies public.

Co-founder and CEO of Mobike

Marketing specialist Wang Xiaofeng was Uber’s former General Manager of Shanghai area and a former marketing general manager at Tencent SOSO. He also spent nine years at P&G China, before joining Google as its first staff in the Shanghai office, where he built Google’s advertising channels in East China. He joined Mobike as co-founder and CEO in late 2015.

Marketing specialist Wang Xiaofeng was Uber’s former General Manager of Shanghai area and a former marketing general manager at Tencent SOSO. He also spent nine years at P&G China, before joining Google as its first staff in the Shanghai office, where he built Google’s advertising channels in East China. He joined Mobike as co-founder and CEO in late 2015.

President and Co-founder of Xpeng Motors

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

CPO and Co-founder of Xiaoe Tech

Wang Lianghu graduated from the Chinese University of Hong Kong with a master's degree in 2011. He then joined Tencent and worked as a T3-level engineer. During his four years at Tencent, he focused on the design and R&D of Qzone (a Myspace-like blogging platform). After leaving Tencent, he co-founded Xiaoe Tech in 2016.

Wang Lianghu graduated from the Chinese University of Hong Kong with a master's degree in 2011. He then joined Tencent and worked as a T3-level engineer. During his four years at Tencent, he focused on the design and R&D of Qzone (a Myspace-like blogging platform). After leaving Tencent, he co-founded Xiaoe Tech in 2016.

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

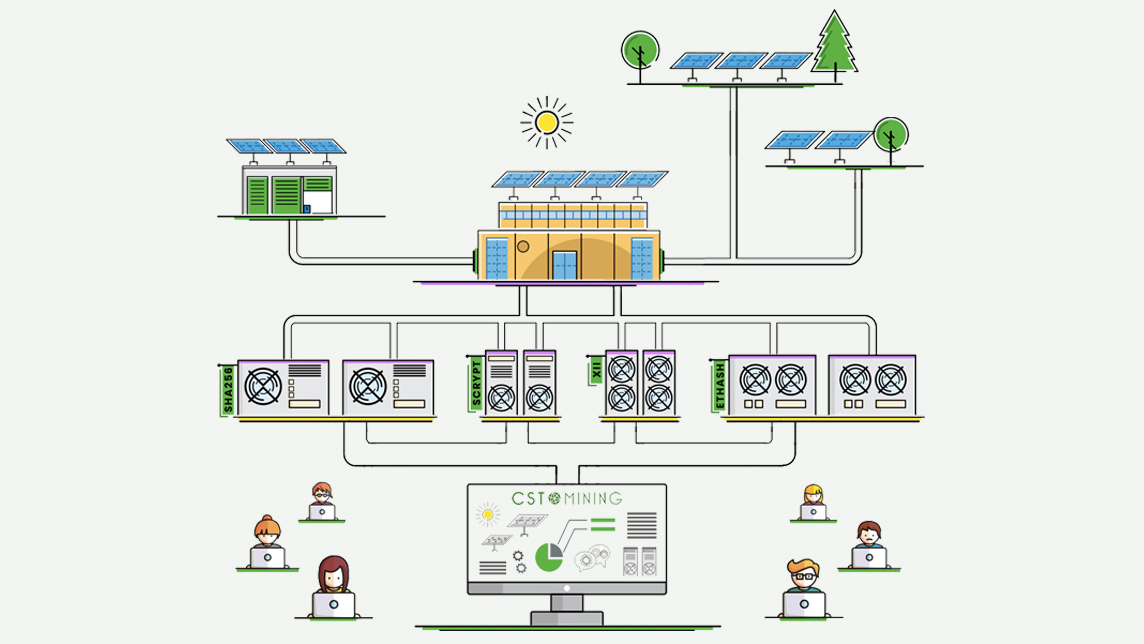

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

As more Chinese opt for cosmetic surgery, startups have emerged to help them make informed decisions

China’s medical aesthetic services platforms face both opportunities and challenges with the rise of Generation Z

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

UTW: Drones and big data to help farmers get the most out of their land

Analytics startup UTW also harvests real-time farming information using satellites and sensors, to offer crop yield predictions

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

TuSimple: When robo-trucks meet the road

After switching focus from adtech to robo-trucks, TuSimple aims to be king of the road in China and the US

Sorry, we couldn’t find any matches for“Land O'Lakes”.